FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Statement of Financial Position

|

||||||

|

Cash |

10,000 |

Accounts payable |

$15,000 |

|||

|

|

70,548 |

Notes payable |

35,548 |

|||

|

Inventory |

20,000 |

Current liabilities |

$50,548 |

|||

|

Current assets |

$100,548 |

Long-term debt |

200,000 |

|||

|

Fixed assets |

500,000 |

Equity |

$350,000 |

|||

|

Total assets |

$600,548 |

|

$600,548 |

- Construct the Pro-forma Statement of Comprehensive Income and Statement of Financial Position based on the current credit policy and the two proposed credit policies.

- Calculate the average collection period, net profit margin, return on assets, and return on equity for both the current and the proposed policies.

- How does the company compare with the industry average in terms of its average collection period, profitability, and returns on assets and equity under the current and proposed policies?

4-Which credit policy should the Samuelsons choose? Provide reasons for your recommendation.

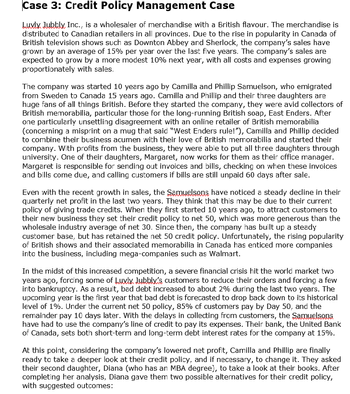

Transcribed Image Text:Case 3: Credit Policy Management Case

Luvly Jubbly Inc., is a wholesaler of merchandise with a British flavour. The merchandise is

distributed to Canadian retailers in all provinces. Due to the rise in popularity in Canada of

British television shows such as Downton Abbey and Sherlock, the company's sales have

grown by an average of 15% per year over the last five years. The company's sales are

expected to grow by a more modest 10% next year, with all costs and expenses growing

proportionately with sales.

The company was started 10 years ago by Camilla and Phillip Samuelson, who emigrated

from Sweden to Canada 15 years ago. Camilla and Phillip and their three daughters are

huge fans of all things British. Before they started the company, they were avid collectors of

British memorabilia, particular those for the long-running British soap, East Enders. After

one particularly unsettling disagreement with an online retailer of British memorabilia

(concerning a misprint on a mug that said "West Enders rule!"), Camilla and Phillip decided

to combine their business acumen with their love of British memorabilia and started their

company. With profits from the business, they were able to put all three daughters through

university. One of their daughters, Margaret, now works for them as their office manager.

Margaret is responsible for sending out invoices and bills, checking on when these invoices

and bills come due, and calling customers if bills are still unpaid 60 days after sale.

Even with the recent growth in sales, the Samuelsons have noticed a steady decline in their

quarterly net profit in the last two years. They think that this may be due to their current

policy of giving trade credits. When they first started 10 years ago, to attract customers to

their new business they set their credit policy to net 50, which was more generous than the

wholesale industry average of net 30. Since then, the company has built up a steady

customer base, but has retained the net 50 credit policy. Unfortunately, the rising popularity

of British shows and their associated memorabilia in Canada has enticed more companies

into the business, including mega-companies such as Walmart.

In the midst of this increased competition, a severe financial crisis hit the world market two

years ago, forcing some of Luvly. Jubbly's customers to reduce their orders and forcing a few

into bankruptcy. As a result, bad debt increased to about 2% during the last two years. The

upcoming year is the first year that bad debt is forecasted to drop back down to its historical

level of 1%. Under the current net 50 policy, 85% of customers pay by Day 50, and the

remainder pay 10 days later. With the delays in collecting from customers, the Samuelsons

have had to use the company's line of credit to pay its expenses. Their bank, the United Bank

of Canada, sets both short-term and long-term debt interest rates for the company at 15%.

At this point, considering the company's lowered net profit, Camilla and Phillip are finally

ready to take a deeper look at their credit policy, and if necessary, to change it. They asked

their second daughter, Diana (who has an MBA degree), to take a look at their books. After

completing her analysis, Diana gave them two possible alternatives for their credit policy,

with suggested outcomes:

Transcribed Image Text:Alternative #1: 2/20 net 30

Lose 5% sales

50% of customers will pay at Day 20

40% of customers will pay at Day 30

10% of customers will pay at Day 60

Cash, inventory, fixed assets, accounts payable, long-term debt, and equity will

remain unchanged

Alternative #2: 2/25 net 45

No lost sales

60% of customers will pay at Day 25

35% of customers will pay at Day 45

5% customers will pay at Day 60

Cash, inventory, fixed assets, accounts payable, long-term debt, and equity will

remain unchanged

Industry average: 2/20 net 30

Average collection period

Net profit margin = 5%

Return on assets = 5.2%

Return on equity = 13%

The company's most recent statement of comprehensive income and statement of financial

position are presented below.

The Samuelsons will have to make a decision on the company's credit policy based on the

available information.

Cost of goods sold

Statement of Comprehensive Income

Sales

$500,000

300,000

$200,000

100,000

$100,000

Gross profit

Operating expenses

Earnings before interest

and taxes

Interest expense

=

Earnings before taxes

28 days

Income taxes (35%)

Net income

35,332

$64,668

22,634

$42,034

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Statement of Financial Position Cash 10,000 Accounts payable $15,000 Accounts receivable 70,548 Notes payable 35,548 Inventory 20,000 Current liabilities $50,548 Current assets $100,548 Long-term debt 200,000 Fixed assets 500,000 Equity $350,000 Total assets $600,548 Total liabilities & equity $600,548 Questions: What are the three components of a credit policy? Does the company’s current credit policy satisfy these three components? What are the effective annual costs for the two proposed credit policy alternatives? If the average borrowing rate for the company’s customers is 15%, will these credit policies be attractive to these customers?arrow_forwardUse the following information to answer the questions: Assets Liabilities and Equity Cash 14,000 Accounts payable 16,000 Marketable securities 2,000 Notes payable 6,000 Accounts receivable 4,000 Current liabilities 22,000 Inventory 24,000 Long-term debt 95,000 Current assets 44,000 Total liabilities 117,000 Machines 34,000 Paid-in capital 20,000 Real estate 80,000 Retained earnings 21,000 Net fixed assets 114,000 Equity 41,000 Total assets 158,000 Total liab. & equity 158,000 Line item Value Sales 80,000 - Costs 65,600 - Depreciation 2,000 = EBIT 12,400 - Interest 800 = Taxable income 11,600 - Taxes 3,828 = Net income 7,772 What is the total debt ratio (including all liabilities)?arrow_forwardExamine the balance sheet of commercial banks in the following table. $ Billion % Total 201.2 28.9 230.1 Assets Real assets Equipment and premises Other real estate Total real assets Financial assets Cash Investment securities Loans and leases Other financial assets Total financial assets Other assets Intangible assets Other Total other assets Total $ Ratio of real assets to total assets $ $ 876.3 2,032.1 6,627.3 1,201.2 $10,736.9 $ 416.4 780.7 $ 1,197.1 $12,164.1 1.7% 0.2 1.9% 7.2% 16.7 54.5 9.9 88.3% 3.4% 6.4 9.8% 100.0% Liabilities Deposits Liabilities and Net Worth Debt and other borrowed funds Federal funds and repurchase agreements Other Total liabilities Net worth Balance sheet of FDIC-insured commercial banks and savings institutions Note: Column sums may differ from total because of rounding error. Source: Federal Deposit Insurance Corporation, www.fdic.gov, October 2018. a. What is the ratio of real assets to total assets? (Round your answer to 4 decimal places.) $ Billion %…arrow_forward

- San Antonio Corporation’s current assets and current liabilities section of the statement of financial position as of December 31, 20x1 appear as follows: Current assets Cash Accounts receivable P5,340,000 P2,400,000 Less: Allowance for doubtful accounts 420,000 4,920,000 Inventories 10,260,000 Prepaid expenses 540,000 Total current assets P18,120,000 Current liabilities Accounts payable P3,660,000 Notes payable 4,020,000 Total current liabilities P7,680,000 The following errors in the corporation’s accounting have been discovered: January 20x2 cash disbursements entered as of December 20x1 included payment of accounts payable amounting to P2,340,000, on which a cash discount of 2%…arrow_forwardWhat is the financial performance summary for this balance sheet? BALANCE SHEET INCOME STATEMENT ($ in millions) ($ in millions) ASSETS LIABILITIES Revenue 28,681.10 Cash & Marketable Securities 449.90 Accounts Payable 1,611.20 Cost Of Goods Sold 20,768.80 Accounts Receivable 954.80 Salaries Payable 225.20 Gross Profit 7,912.30 Inventories 3,645.20 Other Current Liabilities 1,118.80 Other Current Assets 116.60 Total Current Liabilities 2,955.20 Operating Expenses: Total Current Assets 5,166.50 Selling, General & Admin. 5,980.80 Other Liabilities 693.40 Depreciation 307.30 Machinery & Equipment 1,688.90 Operating income 1,624.20 Land 1,129.70 Total Liabilities 3,648.60 Buildings 2,348.40 Interest - Depreciation (575.60) SHAREHOLDER'S EQUITY Other Expense (Income) (13.10) Property, Plant & Equip. - Net…arrow_forwardConsider this simplified balance sheet for Geomorph Trading: Current assets $ 120 Current liabilities $ 70 Long-term assets 520 Long-term debt 270 Other liabilities 90 Equity 210 $ 640 $ 640 Required: What is the company’s debt-equity ratio? Note: Round your answer to 2 decimal places.arrow_forward

- Compute for the Current Assets.arrow_forwardCompute and Interpret Liquidity, Solvency and Coverage Ratios Selected balance sheet and income statement information for Calpine Corporation for 2004 and 2006 follows. ($ millions) Cash 2004 2006 $1,376.73 $1,503.36 Accounts receivable Current assets Current liabilities Long-term debt Short-term debt Total liabilities Interest expense Capital expenditures Equity Cash from operations 1,097.16 735.30 3,563.56 3,168.33 3,285.39 6,057.95 16,940.81 3,351.63 1,033.96 4,568.83 22,628.42 25,743.17 1,516.90 1,288.29 1,545.48 211.50 4,587.67 (7,152.90) 9.89 Earnings before interest and taxes 1,589.84 155.98 1,877.84 (a) Compute the following liquidity, solvency and coverage ratios for both years. (Round your answers to two decimal places.) 2006 current ratio = 2004 current ratio= 2006 quick ratio= 2004 quick ratio= 2006 liabilities-to-equity= 2004 liabilities-to-equity= 2006 total debt-to-equity= 2004 total debt-to-equity= 2006 times interest earned = 2004 times interest earned = 2006 cash from…arrow_forwardHuluduey Corporation's comparative balance sheet for current assets and liabilities was as follows: Line Item Description Dec. 31, 20Y2 Dec. 31, 20Y1 Accounts receivable $17,500 $12,500 Inventory 51,650 44,200 Accounts payable 8,480 5,100 Dividends payable 9,480 6,100 Adjust net income of $75,800 for changes in operating assets and liabilities to arrive at net cash flows from operating activities.arrow_forward

- Find the below: Cash ratio Inventory turnover EPS Total asset turnover Debt ratio Debt-to-equity ratio Times interest earned ROI Net profit margin ROE Market price/Book value P/E BALANCE SHEET ASSETS LIABILITIES & STOCKHOLDERS EQUITY Cash $ 1,500 Accounts payable $12,500 Marketable securities 2,500 Notes payable 12,500 Accounts receivable 15,000 Total current liabilities $25,000 Inventory 33,000 Long-term debt 22,000 Total current assets…arrow_forwardAssets Line Item Description Amount Cash and short-term investments $42,572 Accounts receivable (net) 33,774 Inventory 37,691 Property, plant, and equipment 215,705 Total assets $329,742 Liabilities and Stockholders’ Equity Line Item Description Amount Current liabilities $68,960 Long-term liabilities 98,919 Common stock, $10 par 64,740 Retained earnings 97,123 Total liabilities and stockholders’ equity $329,742 Income Statement Line Item Description Amount Sales $91,805 Cost of goods sold (41,312) Gross profit $50,493 Operating expenses (28,002) Net income $22,491 Number of shares of common stock 6,474 Market price of common stock $28 What is the current ratio?arrow_forwardK. Jackson Corporation Assets Cash Accounts receivable Inventory Net fixed assets Total assets Liabilities and owners' equity. Accounts payable ST Notes payable Long-term debt Owners' Equity Total liabilities and owner's equity Balance Sheet $250,000 450.000 500,000 2.100,000 $3,300.000 $100.000 450.000 1,050,000 1,700.000 $3,300,000 Income Statement Sales (all credit) Cost of goods sold Operating expense Interest expense Income taxes Net income $8,000,000 (4.000.000) (2,900,000) (150,000) (380,000) $570,000 Based on the information for K. Jackson Corporation, the current and acid-test ratios are, respectively. OA2.37 and 1.39. OB2 37 and 1.27 OC2 18 and 1.39 OD.2 18 and 1.27 OE None of the above.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education