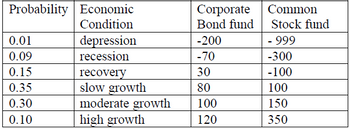

You plan to invest $1,000 in a corporate bond fund or in a common stock fund. The following table represents the annual return (per $1,000) of each of these investments under various economic conditions and the probability that each of those economic conditions will occur.

Compute the expected return for the corporate bond and for the common stock fund. Show your calculations on excel for expected returns.

Compute the standard deviation for the corporate bond fund and for the common stock fund.

Would you invest in the corporate bond fund or the common stock fund? Explain.

If choose to invest in the common stock fund and in (c), what do you think about the possibility of losing $999 of every $1,000 invested if there is depression. Explain.

Step by stepSolved in 1 steps

- Consider the following portfolio choice problem. The investor has initial wealth w and utility u(x) = . There is a safe asset (such as a US government bond) that has net real return of zero. There is also a risky asset with a random net return that has only two possible returns, R₁ with probability 1- q and Ro with probability q. We assume R₁ 0. Let A be the amount invested in the risky asset, so that w - A is invested in the safe asset. 1) Find A as a function of warrow_forwardAssume that you have all your wealth (one million dollars) invested in the Vanguard 500 index fund, and that you expect to earn an annual return of 11%, with a standard deviation in returns of 24%. Since you have become more risk averse, you decide to shift $200,000 from the Vanguard 500 index fund to Treasury bills. The T-bill rate is 5%. Estimate the expected return and standard deviation of your new portfolio.arrow_forwardUsing the Utility Function in Portfolio Management, where the utility function is the constant relative risk aversion utility of wealth function U(W) = W^(gamma)/gamma, set gamma to 0.5 and consider a 50-50 bet on winning 50,000 or getting nothing. What is the certainty equivalent wealth for this bet under these assumptions? Group of answer choices 30,000 10,000 25,000 12,500arrow_forward

- Robin Hood is 23 years old and has accumulated $4,000 in her self-directed defined contribution pension plan. Each year she contributes $2,000 to the plan, and her employer contributes an equal amount. Robin thinks she will retire at age 67 and figures she will live to age 81. The plan allows for two types of investments. One offers a 3.5% risk-free real rate of return. The other offers an expected return of 10% and has a standard deviation of 23%. Robin now has 5% of her money in the risk-free investment and 95% in the risky investment. She plans to continue saving at the same rate and keep the same proportions invested in each of the investments. Her salary will grow at the same rate as inflation. What is the expected value of Robin's risky assets at retirement?arrow_forwardConsider the following portfolio choice problem. The investor has initial wealth w and utility u(x) = . There is a safe asset (such as a US government bond) that has net real return of zero. There is also a risky asset with a random net return that has only two possible returns, R₁ with probability 1-q and Ro with probability q. We assume R₁ 0. Let A be the amount invested in the risky asset, so that w - A is invested in the safe asset. 1) What are risk preferences of this investor, are they risk-averse, risk neutral or risk-loving?arrow_forwardRice farming is risky and generates expected income of $100. The certainty equivalent associated with rice farming will be greater than $100 for a risk averse individual and less than $100 for a risk loving individual. True or Falsearrow_forward

- Hugo has a concave ubility function of U(W)=√W. His only asset is shares in an Internet start-up company. Tomorrow he will learn the stock's value. He belleves that it is worth $225 with probability 80% and $256 with probability 20%. What is his expected utsty? What risk premium would he pay to avoid bearing this risk? The stock's expected utility (EU) is EU = (Enter a numeric response using a real number rounded to two decimal places.) han froarrow_forwardAn investor allocates $30,000 and $50,000 to two assets (A1 and A2). These assets generate 5% and -4.5% rate of returns, respectively. She allocates the remaining 50% of her portfolio to an asset (A3), which provides 4.5% rate of return. Calculate the portfolio's rate of return.arrow_forward10. Which one of the following measures may be used to measure the risk of an investment on its own? a) Expected return of the investment. b) Expected utility of the investment for an investor. c) Standard deviation of the possible outcomes of the investment. d) The Bernoullian utility function's value of a good investment outcome.arrow_forward

- If the risk-free rate is 3 percent and the risk premium is 5 percent, what is the required return?arrow_forwardThe value of a successful project is $420,000; the probabilities of success are 1/2 with good supervision and 1/4 without. The manager is risk neutral, not risk averse as in the text, so his expected utility equals his expected income minus his disutility of effort. He can get other jobs paying $90,000, and his disutility for exerting the extra effort for good supervision on your project is $100,000. (a) Show that inducing high effort would require the firm to offer a compensation scheme with a negative base salary; that is, if the project fails, the manager pays the firm an amount stipulated in the scheme. (b) How might a negative base salary be implemented in reality? (c) Show that if a negative base salary is not feasible, then the firm does better to settle for the low-pay, low-effort situation.arrow_forwardI need help with question darrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education