FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

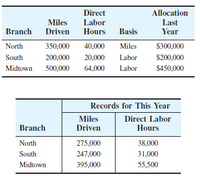

The director of public works needs to distribute the indirect cost allocation of $1.2 million to the three branches around the city. She will use the information from last year to determine the rates for this year. a. Determine this year’s indirect cost rates for each branch. b. Use the rates from last year and records for this year to distribute the allocation for this year. How much of the $1.2 million is actually distributed?

Transcribed Image Text:Direct

Allocation

Miles

Driven

Labor

Hours

Last

Year

Branch

Basis

North

350,000

40,000

Miles

S300,000

South

200,000

20,000

Labor

$200,000

Midtown

500,000

64,000

Labor

S450,000

Records for This Year

Miles

Driven

Direct Labor

Hours

Branch

North

275,000

38,000

South

247,000

31,000

Midtown

395,000

55,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Calculate the property tax rate required to meet the budgetary demands of the community. Note: When calculating budgetary demands, always round up. (Round your answers to two decimal places.) Community Ellingham Total Assessed Property Valuation $56,000,000 Total Taxes Required $2,600,000 Percent X % Property Tax Rate Per $100 (in $) $4.64 X Per $1,000 (in $) $ 46.43 Mills 46.43arrow_forwardFernando Constantia, an engineer at Brandy River Vineyards, has a $100,000 budget for winery improvements. He has identified four investments, all of five years' duration, which have the cash flows shown in the accompanying table. Assuming the four investments are independent, use the IRR method to select which, if any, should be chosen. Use a MARR of 8 percent. 0 - $100,000 - $100,000 2 $24,800 $10,200 $50,000 $0 - $100,000 - $100,000 Give the IRR for each alternative and indicate whether or not it is acceptable. Alternative A Alternative A B C D B с D IRR % % % 1 $24,800 $5,100 $50,000 $0 Acceptable ▼ % (Round to three decimal places as needed.) 3 $24,800 $20,400 $10,000 $0 4 $24,800 $40,800 5 $24,800 $81,600 $0 $0 $0 $1,000,000arrow_forwardIf you receive a grant for a $135,000 project and the grant has a 2:1 match. How much grant money would you receive?arrow_forward

- The city of Bloomington is deciding if they are going to be able to justify an additional street light. The cost of the light to install is $14,000. City officials believe it will reduce the death rate at that intersection from 1.0% to 0.6%. Our guideline for valuing human life is $8M per person. What is the net of this cost benefit proposal? A. 32,000 B. 18,000 C. (18,000) D. (32,000)arrow_forwardCalculate the property tax rate required to meet the budgetary demands of the community. Note: When calculating budgetary demands, always round up. (Round your a two decimal places.) Community Total Assessed Property Valuation Total Taxes Required Ellingham Submit Answer $55,000,000 $2,400,000 43 Property Tax Rate Percent Per $100 (in 5) Per $1,000 (in $) Mills X% $43 x $ 43.64 ✓ 0.000044 xarrow_forwardA community public works project will cost $92,000 and will benefit five different individuals. Individual Individual Benefit ($) Individual Cost ($) 1 4,500 6,000 2 18,500 15,000 3 19,000 17,000 4 30,000 24,000 5 29,000 30,000 Is this project economically feasible? Please show work in an Excel spreadsheet that lists the benefit for each individual. Would this project be approved by a majority at a community referendum?arrow_forward

- The cash flows associated with a public-school building repair project are as follows: costs $550,000 per year; benefits $600,000 per year; disbenefits $90,000 per year. Determine the conventional B/C ratio and say whether the project is viable.arrow_forwardFrom the Case Study"DISTRICT HEADQUARTER HOSPITAL: FINANCIAL FEASIBILITY STUDY" Prepare in as much detail as possible, the projected financial statements, for District Headquarter Hospital for the next six years. The financial statements should comprise projected Balance Sheets, Income Statements and Cash Flow Statements for each of these years.arrow_forwardAssume that, as a part of its economic development program, your governmental agency has committed to provide access to a new regional industrial park. This project must fund the construction of an on/off-interchange from an adjacent highway, a 2-mile length of 4-lane divided roadway, and a bridge that will cross a 500-foot wide river. The entire project is estimated to require 2 years to complete following planning & design.The roadway to be constructed is projected to cost $125,000 per lane mile. It will need to begin construction 12 months prior to the project’s estimated completion date. Your government controls the permitting process for the roadway and has already issued the necessary permits. The total roadway project will be paid for at its completionarrow_forward

- Below are the projected revenues and expenses for a new clinical nurse specialist program being established by a hospital. Nurses would provide education while the patient is in the hospital and home visits after patient discharge on a fee-for-service basis. Should the hospital undertake the program if its required rate of return is 12%? Year 1 Year 2 Year 3 Year 4 Total Revenue costs 100,000 150,000 200,000 250,000 700,000 150,000 150,000 150,000 150,000 600,000 (50,000) 0 50,000 100,000 100,000arrow_forwardAllocated on the basis of program revenues. The head administrator of Jackson County Senior Services, Judith Miyama, considers last year's net operating income of $33,800 to be unsatisfactory; therefore, she is considering the possibility of discontinuing the housekeeping program. The depreciation in housekeeping is for a small van that is used to carry the housekeepers and their equipment from job to job. If the program were discontinued, the van would be donated to a charitable organization. None of the general administrative overhead would be avoided if the housekeeping program were dropped, but the liability insurance and the salary of the program administrator would be avoided. Required: 1-a. What is the financial advantage (disadvantage) of discontinuing the Housekeeping program? 1-b. Based on the financial advantage (disadvantage) of discontinuing the Housekeeping program calculated in requirement Req 1A, should the Housekeeping program be discontinued? 2-a. Prepare a properly…arrow_forwardCity of Oliver is considering automating a process in its accounting department that has been labor-intensive. The equipment currently used in the department can be sold. The new equipment will have a projected useful life of 10 years. The old equipment has a remaining useful life of 10 years. The following data are available to be used in making the decision. Should the city invest in the new equipment? Support your answer with appropriate calculations. Current equipment Current equipment book value $ 30,000 Annual depreciation charges 3,000 Current estimated disposal value 5,000 New equipment Cost $150,000 Annual depreciation charge 12,500 Expected disposal value 25,000 Labor savings each year $ 50,000 Present value factors @ 6% $1…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education