FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please answer the first picture. The second picture is the formula. Hope you can answer correctly, thankyou in advance!

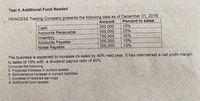

Transcribed Image Text:Test II. Additional Fund Needed

PRINCESS Trading Company presents the following data as of December 31, 2018.

Percent to sales

Amount

200,000

500,000

700,000

200,000

300,000

10%

25%

Cash

Accounts Receivable

35%

Inventory

Accounts Payable

Notes Payable

10%

15%

The business is expected to increase its sales by 40% next year. It has maintained a net profit margin

to sales of 10% with a dividend payout ratio of 40%.

Compute the following:

5. Projected increase in current assets

6. Spontaneous increase in current liabilities

7. Increase in retained earnings

8. Additional fund needed.

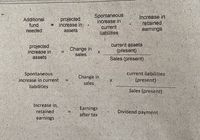

Transcribed Image Text:projected

increase iny

assets

Spontaneous

increase in

current

liabilities

Increase in

retained

earnings

Additional

fund

%3D

needed

projected

increase in

assets

Change in

sales

current assets

(present)

Sales (present)

%3D

Spontaneous

increase in current

Change in

sales

current liabilities

(present)

X.

liabilities

Sales (present)

Increase in.

Earnings

after tax

Dividend payment

retained

earnings

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Hi, Could you please show me how to solve this with formulas? not excel, I should have clarified. Thanksarrow_forwardis there a way to do this question with formulas and a calculator instead of excel? if so please upload the solution this wayarrow_forwardFurther info is in the attached images For the Excel part of the question give the solutions in the form of the Excel equations. Please and thank you! :) Download the Applying Excel form and enter formulas in all cells that contain question marks. For example, in cell B34 enter the formula "= B9". After entering formulas in all of the cells that contained question marks, verify that the dollar amounts match the example in the text. Check your worksheet by changing the beginning work in process inventory to 100 units, the units started into production during the period to 2,500 units, and the units in ending work in process inventory to 200 units, keeping all of the other data the same as in the original example. If your worksheet is operating properly, the cost per equivalent unit for materials should now be $152.50 and the cost per equivalent unit for conversion should be $145.50. Thank you!arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education