ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

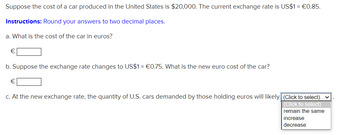

Transcribed Image Text:Suppose the cost of a car produced in the United States is $20,000. The current exchange rate is US$1 = €0.85.

Instructions: Round your answers to two decimal places.

a. What is the cost of the car in euros?

b. Suppose the exchange rate changes to US$1= €0.75. What is the new euro cost of the car?

€

c. At the new exchange rate, the quantity of U.S. cars demanded by those holding euros will likely (Click to select) ✓

(Click to select)

remain the same

increase

decrease

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Figure 2.3: S$i£ 2.20 2.00 1.90 The Market for British Pounds D E Q5 Q4 Q₁ B Q₂ S₁(£) D₂(£) D₁ (£) D3(£) Q3 Quantities of pound Refer to Figure 2.3. Suppose that the spot exchange rate of British pound is $2.00 per pound. Suppose that the U.S. decreases its taste for imports from the Under a flexible exchange rate system, the Bank of England will: Let the British pound appreciate Let the British pound depreciate Sell pounds and buy dollars in foreign exchange market Sell dollars and buy pounds in foreign exchange marketarrow_forward7) Suppose that as a policy maker you increased money supply to increase in-vestment to decrease unemployment level in the country. However, at the end of the period it is revealed that the policy increased the unemployment level in the country. Explain this unexpected outcome by considering policy's implications in the foreign exchange market?arrow_forwardOptions are gain or loss. Note : don't use chat gp8arrow_forward

- (a). Consider the diagram. Analyze the effects of a temporary increase in the European money supply on the dollar/euro exchange rate. (b). What is the interest parity condition? Explain why the interest parity condition must hold if the foreign exchange market is in equilibrium.arrow_forwardIf the exchange rate moves from $1 for one Euro to $1.50 for one Euro, then Select one: a. it becomes more expensive for a European to buy a European product. b. it becomes more expensive for an American investor to save at an American bank. c. it becomes more expensive for an American to buy a Mexican product. d. it becomes more expensive for an American to buy a European product.arrow_forwardOolong tea is produced in China and sold in many countries. In the province of Fujian, per 100 grams of Oolong tea sells for 50 yuan. In Kuala Lumpur, per 100 grams of the same Oolong tea sells for RM20. Suppose that the exchange rate is RM0.45 1 yuan. Please do the following calculations based on the above information: 1. How much would it cost in Malaysian currency to buy the tea in Fujian? 2. How much would it cost in China currency to buy the tea in Kuala Lumpur?arrow_forward

- Let us imagine that the income for all Australians increased and therefore created an increase in demand for British cars in Australia. How will this affect the exchange rate in the above figure from P1 and why?arrow_forwardAnswer correctly and explain within 30 mins will give you positive feedback. URGENTarrow_forwardSuppose the implied exchange rate between euro and USD is $1.17 per euro based on PPP and the Hamburger standard. The actual exchange rate is $1.22. Therefore, euro is misvalued by ______%.arrow_forward

- Price per euro P₂ P₁ Po Qo Q₁ Q₂ Q3 1) the excess demand of euro equal to Q3 - Q1. In the above figure, suppose the value of the European euro is P₁ and U.S. demand for French wine declines. The effect on the franc can be shown by S 3) the decrease in the value of the euro to Po. Quantity of euros 2) a shift in the demand for euros from D₁ to Do, but no change in the value of the euro. 4) an increase in the value of the euro to P2.arrow_forwardLet's suppose you have $1 million to invest. You are considering to invest in UK first, then convert the British Pound back to US$ in the future. You know following information: Annual Interest rate on investment in US: 2% Annual Interest rate on investment in UK: 1% Investment period: 1 year Current exchange rate: 1.52 $/BP Forward exchange rate which you can apply when converting BP to US$: 1.53 $/BP What will be profit or loss if you apply the covered-interest arbitrage? (step by step answer please)arrow_forwardIn the foreign exchange market, what could be a possible consequence of an increased preference by U.S. residents for Japanese vehicles? A) Demand for the dollar will increase B) Yen will depreciate C) The dollar will depreciate D) The supply curve for the dollar will shift to the leftarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education