ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

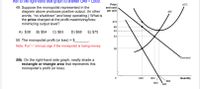

Transcribed Image Text:Ref to the right-hand side graph to answer Q49 – Q50b.

Price

АТС

49. Suppose the monopolist represented in the

diagram above produces positive output. (In other

words, "no shutdown" and keep operating.) What is

the price charged at the profit-maximizing/loss-

minimizing output level?

and cost

per unit

MC

$75

68

63

A) $38

B) $54

C) $63

D) $68

E) $75

54

50. The monopolist profit (or loss) = $_

Note: Put “–" (minus) sign if the monopolist is losing money.

38

'Demand

50b. On the right-hand side graph, neatly shade a

rectangle or triangle area that represents this

monopolist's profit (or loss).

630

800

Quantity

880

850

MR

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- answer quicklyarrow_forwardA monopolist sells output for $4.00 per unit at the current level of production. At this level of output, the marginal cost is $3.00, average variable costs are $3.75, and average total costs are $4.25. The marginal revenue is $3.00. What is the short-run condition for the monopolist and what output changes would you recommend?arrow_forwardProfit-maximization: Non-competitive Market A monopolist in the makeup industry produces two makeup products F and G for which the demand functions, respectively, are:1. Find the profit-maximizing quantity of output for each product.2. Find the profit-maximizing price for each product.3. What is the maximum profit that the firm could earn?arrow_forward

- Exercise 3.3. Suppose a profit-maximizing monopolist is producing 800 units of output and is charging a price of $40 per unit. a. If the elasticity of demand for the product is -2, find the marginal cost of the last unit produced. b. What is the firm's percentage markup of price over marginal cost? c. Suppose that the average cost of the last unit produced is $15 and the firm's fixed cost is $2000. Find the firm's profit.arrow_forward53) A monopolist faces a straight-line demand curve and is currently producing an output level of 2000 units receiving $10 000 in total revenue. At an output of 1000 units the marginal revenue for this firm would be A) 0. B) $2.50. C) $5.00. D) $10.00. E) Impossible to tell with the given information.arrow_forwardTangy Tangerines is a monopolistic firm in the market for tangerines. The following equations describe the demand for, and the cost of producing tangerines, where Q is output measured in thousand pounds, and P is price per pound. Demand: P 59-3Q Marginal Cost: MC = 3 + Q Total Cost: TC = 4 + 3Q+0.50² The monopolist will charge what price and earn what profit? Price $35 and Profit-$220 thousand. Price $19 and Profit $53 thousand. * Price $8 and Profit=$220 thousand. Price $19 and Profit= $14 thousand.arrow_forward

- The table below shows the marginal revenue and costs for a monopolist. Demand, Costs, and Revenues Price (dollars) Quantity Demanded $85 79 73 67 61 55 50 150 250 350 450 550 Marginal Revenue (dollars) $85 76 64 1. 250; -$3,625 2. 250; $3,625 3. 350; -$3,625 4. 350; $4625 52 40 28 Marginal Cost (dollars) $25 85 64 61 67 77 Average Total Cost (dol $139.00 103.30 87.50 80.00 77.00 77.00 The monopolist's profit-maximizing level of output is...................its and the monopolist's profit at the profit maximizing output is....arrow_forwardExercise 3.8. Dayna's Doorstops, Inc. (DD) is a monopolist in the doorstop industry. Its cost is C = 100 - 5Q + Q², and demand is P = 55 - 2Q. a) What price should DD set to maximize profit? What output does the firm produce? How much profit and consumer surplus does DD generate? b) What would output be if DD acted like a perfect competitor and set MC = P? What profit and consumer surplus would then be generated? c) What is the deadweight loss from monopoly power in part (a)? d) Suppose the government, concerned about the high price of doorstops, sets a maximum price at $27. How does this affect price, quantity, consumer surplus, and DD's profit? What is the resulting deadweight loss? e) Now suppose the government sets the maximum price at $23. How does this decision affect price, quantity, consumer surplus, DD's profit, and deadweight loss? f) Finally, consider a maximum price of $12. What will this do to quantity, consumer surplus, profit, and deadweight loss?arrow_forwardRefer to the above table. Given the demand and cost schedules, what is the profit maximizing quantity for this monopolist?arrow_forward

- Give explanation of the correct option and explanation of the incorrect options. Note: Dear expert hand written is not allowed.arrow_forwardPlease answer question d, e and farrow_forwardRefer to the accompanying table, which represents the costs and production for a monopolist. Price Quantity Fixed Cost Variable Cost $20 0 $10 $0 $18 1 $10 $5 $16 2 $10 $8 $14 3 $10 $18 $12 4 $10 $30 $10 5 $10 $44 1) At Q=2, the marginal cost of this firm is $ ____ 2)The profit made by this profit-maximizing firm is $ __arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education