ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

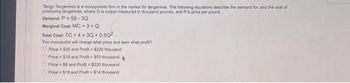

Transcribed Image Text:Tangy Tangerines is a monopolistic firm in the market for tangerines. The following equations describe the demand for, and the cost of

producing tangerines, where Q is output measured in thousand pounds, and P is price per pound.

Demand: P 59-3Q

Marginal Cost: MC = 3 + Q

Total Cost: TC = 4 + 3Q+0.50²

The monopolist will charge what price and earn what profit?

Price $35 and Profit-$220 thousand.

Price

$19 and Profit $53 thousand. *

Price $8 and Profit=$220 thousand.

Price $19 and Profit= $14 thousand.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 7 images

Knowledge Booster

Similar questions

- Monopoly - End of Chapter Problem Download Records decides to release an album by the group Mary and the Little Lamb. It produces the album with no fixed cost, but the total cost of creating a digital album and paying Mary her royalty is $6 per album. Download Records can act as a single-price monopolist. Its marketing division finds that the demand schedule for the album is as shown in the accompanying table. a. Calculate the total revenue and marginal revenue per album for P = $16, $14, and $12. TRP $16: $ TRP $14: $ Price of album $22 20 18 16 14 12 10 8 Quantity of albums demanded 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000arrow_forward. Profit maximization and loss minimization BYOB is a monopolist in beer production and distribution in the imaginary economy of Hopsville. Suppose that BYOB cannot price discriminate; that is, it sells its beer at the same price per can to all customers. The following graph shows the marginal cost (MC), marginal revenue (MR), average total cost (ATC), and demand (D) for beer in this market. Place the black point (plus symbol) on the graph to indicate the profit-maximizing price and quantity for BYOB. If BYOB is making a profit, use the green rectangle (triangle symbols) to shade in the area representing its profit. On the other hand, if BYOB is suffering a loss, use the purple rectangle (diamond symbols) to shade in the area representing its loss. Suppose that BYOB charges $2.50 per can. Your friend Clancy says that since BYOB is a monopoly with market power, it should charge a higher price of $3.00 per can because this will increase BYOB’s profit. Complete the…arrow_forwardExplains it correctlyarrow_forward

- If the price is greater than Actual total cost, does the monopolistic firm makes a profit, loss, or break-even?arrow_forwardPRICE 1 2 10. Study Questions and Problems #10 The following graph represents a natural monopolist. Suppose that regulators have set the fair-return price at $3. Use the black point (cross symbol) to indicate the equilibrium under unregulated monopoly. Then use the grey point (star symbol) to indicate the equilibrium for the monopoly regulated by marginal cost pricing. Finally, use the purple point (diamond symbol) to indicate the equilibrium for the monopoly regulated by fair-return pricing. 5 • + MC Pricing Monopoly Pricing LRAC Fair-Return Pricing LRMC MR D 0 0 1 2 3 4 5 6 7 8 QUANTITY Use the graph to complete the following table. Pricing Price (Dollars) Quantity (Units) Stays in Business? Unregulated monopoly $ Marginal cost pricing $ Under which of the following pricing regulations will the monopolist stay in business? Check all that apply. Fair-return pricing Marginal cost pricing Monopoly pricingarrow_forwardif a monopolistic firm takes over a perfectly competaive market we would expect to see market price of the goof to fall because demand is perfectly eleastic rise and quantity is sold fall as the monopolist tries to increase sales rise and the quantity sold to increasearrow_forward

- Exercise 3.8. Dayna's Doorstops, Inc. (DD) is a monopolist in the doorstop industry. Its cost is C = 100 - 5Q + Q², and demand is P = 55 - 2Q. a) What price should DD set to maximize profit? What output does the firm produce? How much profit and consumer surplus does DD generate? b) What would output be if DD acted like a perfect competitor and set MC = P? What profit and consumer surplus would then be generated? c) What is the deadweight loss from monopoly power in part (a)? d) Suppose the government, concerned about the high price of doorstops, sets a maximum price at $27. How does this affect price, quantity, consumer surplus, and DD's profit? What is the resulting deadweight loss? e) Now suppose the government sets the maximum price at $23. How does this decision affect price, quantity, consumer surplus, DD's profit, and deadweight loss? f) Finally, consider a maximum price of $12. What will this do to quantity, consumer surplus, profit, and deadweight loss?arrow_forwardA monopolist serves a market with five potential buyers, each of whom would buy at most one piece of the monopolist's good. Anna would be willing to pay up to £80 for it, Bob up to £90, Chloe up to £100, Dave up to £110 and Elizabeth up to £120. The monopolist's variable cost function is given in below table. Quantity Variable Costs 1 3. 4. 40 90 150 220 300 Price Marg. Revenue a) Indicate in the table which price the monopolist would want to charge for each given quantity. b) Find the marginal revenue for each quantity. c) Find the monopolist's profit maximising price under the assumption that he wants to produce anything at all. d) How large can the monopolist's fixed costs be such that he still wants to start producing at 1. D Focus 9°C Sunarrow_forwardReferring to the given graph of a monopoly firm, which statement states a correct outcome in case of single price for good is charged by a monopolist: D MR -MC-ATC D Quantity Area A represents the consumer surplus, Area C represents the producer surplus and deadweight loss is represented by area B+D+E. Area B represents the consumer surplus, Area C+D represents the producer surplus and deadweight loss is represented by area D+E. Area A+B represents the consumer surplus; Area C+D represents the producer surplus and deadweight loss is represented by area E. Area A+B represents the consumer surplus; Area C represents the producer surplus and deadweight loss is represented by area E+F.arrow_forward

- Given the following demand schedule for a monopolist in the diamond industry, assume the marginal cost of producing diamonds is constant and equal to 200 and that there are no fixed costs. Quantity 1 2 3 4 5 Price $500 400 300 200 100 Suppose that rival producers enter the market and the market becomes perfectly competitive. How large is the deadweight loss associated with monopoly in this case? Explain the excess capacity problem. (Note: I am not asking for a definition. I want an explanation of the problem.) Explain what is meant when we say that monopolistic competition is a "second-best" outcome. (Note: I am not asking for a definition. I want an explanation of the problem.)arrow_forwardA monopolistically competitive firm faces the following demand curve for its product: Price ($) 10 6. 8. 17. 6. 3 2 1 Quantity 4 6. 8. 10 12 14 16 18 20 Refer to the Table. The firm has total fixed costs of $20 and a constant marginal cost of $9 per unit. How many units will the firm produce? "Don't leave spaces before, after or in between your number.arrow_forwardLagatt Green is a monopoly beer producer and distributor operating in the hypothetical economy of Lightington. Assume that Lagatt Green is not able price discriminate, and so it sells its beer to all customers at the same price per bottle. The following graph gives the marginal cost (MC), marginal revenue (MR), average total cost (ATC), and demand (D) curves that Lagatt Green faces for beer in Lightington. Place the black point (plus symbol) on the graph to indicate the profit-maximizing price and quantity for Lagatt Green. If Lagatt Green is making a profit, use the green rectangle (triangle symbols) to shade in the area representing its profit. On the other hand, if Lagatt Green is suffering a loss, use the purple rectangle (diamond symbols) to shade in the area representing its loss. PRICE (Dollars per bottle) 4.00 3.50 3.00 2.50 2.00 1.50 1.00 0.50 D MC D 15 20 25 30 3.5 QUANTITY (Thousands of bottles of beer) 45 ATC MR Price (Dollars per bottle) 2.00 2.25 40 Monopoly Outcome…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education