ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

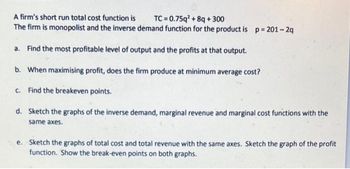

Transcribed Image Text:A firm's short run total cost function is

TC=0.75q² +8q+300

The firm is monopolist and the inverse demand function for the product is p=201-2q

a. Find the most profitable level of output and the profits at that output.

b. When maximising profit, does the firm produce at minimum average cost?

c. Find the breakeven points.

d. Sketch the graphs of the inverse demand, marginal revenue and marginal cost functions with the

same axes.

e. Sketch the graphs of total cost and total revenue with the same axes. Sketch the graph of the profit

function. Show the break-even points on both graphs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Profit-maximization: Non-competitive Market A monopolist in the makeup industry produces two makeup products F and G for which the demand functions, respectively, are:1. Find the profit-maximizing quantity of output for each product.2. Find the profit-maximizing price for each product.3. What is the maximum profit that the firm could earn?arrow_forward1. A firm faces the following inverse demand curve: P = 500 - 0.25Q Where: Q is the monthly production P is price, measured in dollars per unit. The firm also has a total cost (TC) function of: TC = 200Q. Assuming the firm maximizes profits, answer the following: a) Assuming the firm operates as a monopolist, calculate the following: price, quantity, and profit. Graph and show the equilibrium price and quantity. b) Assuming perfect competition, what are price, quantity and profit? Show on the graph from above.arrow_forwardIn the long run a profit maximizing monopolist operates where Long-run ATC is rising Price is equal to MR Long-run MC = MR Long-run MC is constantarrow_forward

- An amusement park has identified its demand functions as follows: Q = 50-3P The marginal operating cost of each unit of quantity is $5 and there are no fixed costs. The park is a monopolist and exercises significant price making power in the market. 1. If the monopolist charges same price for every unit, for what price are his profits maximized? How many units will be sold at that price? What are his total profits?arrow_forwardConsider the following cost and demand information for a monopolist. Demand is Qm = 34 - 1*Qm, Total Cost is TC = 20 + 2*Qm + .5*Qm2. At the profit-maximizing quantity, marginal revenue and marginal cost are equal to $........?arrow_forwardQuestion is in attached image. Thank you! Only answer D,E,Farrow_forward

- Suppose the inverse demand function for a monopolist's product is given by P=100-2Q and the cost function isC(Q)=10+2Q. What is the firm's profit-maximizing maximum profits?A. $1,115B. $1,109C. $1,190.5D. $2,100.5arrow_forwardd. Suppose the government wants to move this market to the efficient quantity by imposing a per-unit subsidy in this market. Find the dollar amount per unit of output for this subsidy.arrow_forward1. A monopolist's marginal cost function is given by: MC = 4q+ 20 where q is the quantity of good the monopolist produces. Fixed costs are 20, and the demand equation for the good produced is p+4q = 40, where p and q are price and quantity, respectively. - Find expressions for total revenue and for profit, as functions of q. Determine the value of q which maximises the profit. 2. Suppose the numbers x, y and z satisfy the following equations, where a is some number: x+y+z= 5-a 2x+y = 7-a x-y-2z = 0. Use a matrix method to determine the values of x, y and z, in terms of a. For what values of a will x, y and z all be positive? 3. Suppose that a is a positive number and that the function f is given by: f(x, y) = y¹ - 8a²y² +1arrow_forward

- In the figure provided, a monopolist faces a market demand represented by Q(P), where is the total quantity demanded, and P is the price of the good. The figure also displays Marginal Cost (MC), Average Total Cost (ATC), Average Variable Cost (AVC), and Marginal Revenue (MR) curves. Additionally, P* and Q* represent the short-run equilibrium price and quantity, respectively. Q DMR MC AT C Avc P(Q) Based on the graphical representation, which of the following statements is true? The monopolist realizes a profit in the short run. The monopolist faces a loss in the short run and decides to shut down. The monopolist incurs a loss in the short run but decides to continue operating.arrow_forwardQUESTION 1 A. The total cost function for a monopolist is given by TC = 44,000 + 180Q + 0.03Q² and the demand function is P = 420 – 0.06Q per unit of output. i. What is the profit maximising level of output? ii. Calculate the profit maximizing price. iii. Calculate total profit at the profit maximising level of output.arrow_forwardSuppose a monopolist is currently producing where its variable costs are $1 million. Its fixed costs are $1.5 million. Its revenues are $1.2 million. Should the firm shut down in the short run? Should it leave the industry in the long run? a no; yes b no; no c yes; yes d yes; noarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education