FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

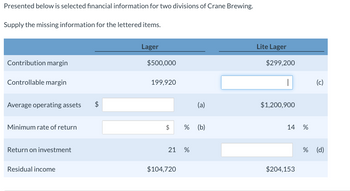

Transcribed Image Text:Presented below is selected financial information for two divisions of Crane Brewing.

Supply the missing information for the lettered items.

Lager

Lite Lager

Contribution margin

$500,000

$299,200

Controllable margin

199,920

(c)

Average operating assets $

(a)

$1,200,900

Minimum rate of return

$ % (b)

14 %

Return on investment

Residual income

21 %

$104,720

% (d)

$204,153

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please answer do not image formatarrow_forwardkai.8arrow_forwardThe following data are available for two divisions of Ryan Enterprises: Alpha Division Beta Division Division operating profit $ 7,360,000 $ 1,240,000 Division investment 32,160,000 3,160,000 The cost of capital for the company is 7 percent. Ignore taxes. Required: a-1. Calculate the ROI for both Alpha and Beta divisions. a-2. If Ryan measures performance using ROI, which division had the better performance? b-1. Calculate the EVA for both Alpha and Beta divisions. (The divisions have no current liabilities.) b-2. If Ryan measures performance using economic value added, which division had the better performance? c. Would your evaluation change if the company’s cost of capital was 10 percent, when evaluated by ROI? when evaluated by EVA?arrow_forward

- Assume a company with two divisions (A and B) prepared the following segmented income statement: A B Total Sales $ 300,000 $ 200,000 $ 500,000 Variable expenses 120,000 140,000 260,000 Contribution margin 180,000 60,000 240,000 Traceable fixed expenses 100,000 80,000 180,000 Segment margin $ 80,000 $ (20,000) 60,000 Common fixed expenses 50,000 Net operating income $ 10,000 The dollar sales required for the company to break even is closest to:arrow_forwardSelected sales and operating data for three divisions of different structural engineering firms are given below: Division C $ 25,450,000 $ 5,090,000 $636,250 12.50% Sales Average operating assets Net operating income Minimum required rate of return Division A $ 12,360,000 $ 3,090,000 $ 494,400 7.00% Required: 1. Compute each division's margin, turnover, and return on investment (ROI). 2. Compute each division's residual income (loss). 3. Assume each division is presented with an investment opportunity yielding a 8% rate of return. a. If performance is being measured by ROI, which division or divisions will accept the opportunity? b. If performance is being measured by residual income, which division or divisions will accept the opportunity? Division B $ 28,360,000 $ 7,090,000 $ 453,760 7.50% Complete this question by entering your answers in the tabs below. Division A Division B Division C Required 1 Required 2 Required 3A Required 3B Assume each division is presented with an…arrow_forwardA family friend has asked your help in analyzing the operations of three anonymous companies operating in the same service sector industry. Supply the missing data in the table below: (Loss amounts should be indicated by a minus sign. Round your percentage answers to nearest whole percent and other amounts to whole dollars.) Sales Net operating income Average operating assets Return on investment (ROI) Minimum required rate of return: Percentage Dollar amount Residual income $ $ A 470,000 160,000 15 % 16 % $ $ $ Company B 680,000 43,000 19 % 57,000 % C $ 560,000 $ 145,000 $ % 10 % 5,000arrow_forward

- Piedmont Company segments its business into two regions-North and South. The company prepared the contribution format segmented income statement as shown: Sales Variable expenses Contribution margin Traceable fixed expenses Segment margin Common fixed expenses Net operating income Total Company $ 937,500 637,500 300,000 142,000 158,000 62,000 $ 96,000 North $ 750,000 600,000 150,000 71,000 $ 79,000 Required: 1. Compute the companywide break-even point in dollar sales. 2. Compute the break-even point in dollar sales for the North region. 3. Compute the break-even point in dollar sales for the South region. South $ 187,500 37,500 150,000 71,000 $ 79,000arrow_forwardResidual Income The Commercial Division of Galena Company has operating income of $264,070 and assets of $549,000. The minimum acceptable return on assets is 13%. What is the residual income for the division?arrow_forwardKnowledge Check East Division of Blue Spruce Anchors provided the following information: Contribution margin Controllable margin Average operating assets Minimum rate of return Return on investment $890,000 $395,900 $2,140,000 Compute the return on investment and the residual income. (Round return on investment answer to two decimal places (e.g., 15.25%).) Residual income 9 % %arrow_forward

- Waffle Fries are Heavenly (WFH) has the following financial information for the previous year of operations: Operating income $128,000 Invested assets $800,000 Sales $296,000 WFH has internally set the minimum acceptable rate of return as 15%. Based on the information provided, what is the residual income? Waffle Fries are Heavenly (WFH) has the following financial information for the previous year of operations: Operating income $128,000 Invested assets $800,000 Sales $296,000 WFH has internally set the minimum acceptable rate of return as 15%. Based on the information provided, what is the residual income? $8,000 $83,600 $176 $128,000arrow_forward(J) Selected sales and operating data for three divisions of different structural engineering firms are given as follows: Division ADivision BDivision CSales$ 12,120,000$ 28,120,000$ 20,120,000Average operating assets$ 3,030,000$ 7,030,000$ 5,030,000Net operating income$ 496,920$ 449,920$ 503,000Minimum required rate of return7.00%7.50%10.00%Required: 1. Compute the margin, turnover, and return on investment (ROI) for each division. 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yield a 8% rate of return. a. If performance is being measured by ROI, which division or divisions will probably accept the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept the opportunityarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education