FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

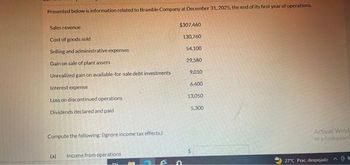

Transcribed Image Text:Presented below is information related to Bramble Company at December 31, 2025, the end of its first year of operations.

Sales revenue

Cost of goods sold

Selling and administrative expenses

Gain on sale of plant assets

Unrealized gain on available-for-sale debt investments

Interest expense

Loss on discontinued operations.

Dividends declared and paid

Compute the following: (Ignore income tax effects.)

(a)

Income from operations

$307,460

130,760

54,100

29,580

9,010

6,400

13,050

5.300

*

Activar Wind

Ve a Configuraci

27°C Prac. despejado

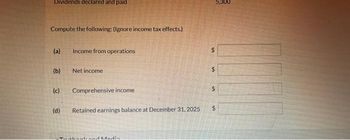

Transcribed Image Text:Dividends declared and paid

Compute the following: (Ignore income tax effects.)

(a)

(b)

(c)

(d)

Income from operations

Net income

Comprehensive income

Retained earnings balance at December 31, 2025

and Media

S

SA

5,300

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- View Policies Current Attempt in Progress For its fiscal year ending October 31, 2025, Cullumber Corporation reports the following partial data. Income before income taxes Income tax expense (20% × $390,600) Income from continuing operations Loss on discontinued operations Net income $502,200 78,120 424,080 111,600 $312,480 The loss on discontinued operations was comprised of a $46,500 loss from operations and a $65,100 loss from disposal. The income tax rate is 20% on all items. (a) Prepare a correct partial income statement, beginning with income before income taxes. CULLUMBER CORPORATION Income Statement (Partial)arrow_forwardThe following is information for Novak Corp. for the year ended December 31, 2020: Sales revenue $1,420,000 Loss on inventory due to decline in net realizable value $70,000 Unrealized gain on FV-OCI equity investments 46,000 Loss on disposal of equipment 45,000 Interest income 9,000 Depreciation expense related to buildings omitted by mistake in 2019 56,000 Cost of goods sold 852,000 Retained earnings at December 31, 2019 950,000 Selling expenses 71,000 Loss from expropriation of land 57,000 Administrative expenses 52,000 Dividends declared 46,000 Dividend revenue 15,000 The effective tax rate is 25% on all items. Novak prepares financial statements in accordance with IFRS. The FV-OCI equity investments trade on the stock exchange. Gains/losses on FV-OCI investments are not recycled through net income. a)Prepare the retained earnings section of the statement of changes in equity for 2020. (List…arrow_forwardWB Inc. reported profits of P 100,000 in its March 31, 2022 interim financial statements. Additional information is shown below (amounts are net of tax): • AP 10,000 cumulative-effect gain resulting from a change in inventory cost flow formula was recognized in profit or loss during the 1 quarter. • In March 2022, a component of an entity was classified as held for sale. Of the total loss on discontinued operations of P 12,000, only P 3,000 has been recognized in the 1" quarter. WB Inc. intends to allocate the remaining P 9,000 loss to the other quarters in 2022. REQUIRED: Compute for the restated profit after tax for the 1" quarter of 2022.arrow_forward

- Current Attempt in Progress In its income statement for the year ended December 31, 2027, Ivanhoe Inc. reported the following condensed data. Operating expenses $623,500 Interest revenue $28,380 Cost of goods sold 1,080,160 Loss on disposal of plant assets 14,620 Interest expense 60,200 Net sales 1,892,000 Income tax expense 40,420 Prepare an income statement. (List other revenues before other expenses.) IVANHOE INC. Income Statement > > +Aarrow_forwardCompute NOPATThe income statement for TJX Companies follows. THE TJX COMPANIES, INC.Consolidated Statements of Income Fiscal Year Ended ($ thousands) February 2, 2019 Net sales $38,972,934 Cost of sales, including buying and occupancy costs 27,831,177 Selling, general and administrative expenses 6,923,564 Pension settlement charge 36,122 Interest expense, net 8,860 Income before provision for income taxes 4,173,211 Provision for income taxes 1,113,413 Net income $ 3,059,798 Assume that the combined federal and state statutory tax rate is 22%. a. Compute NOPAT using the formula: NOPAT = Net income + NNE. Round to the nearest whole number. b. Compute NOPAT using the formula: NOPAT = NOPBT − Tax on operating profit. Round to the nearest whole number.arrow_forwardIn its income statement for the year ended December 31, 2025, Cullumber Company reported the following condensed data Salaries and wages expenses $492,900 Cost of goods sold 808,930 Interest expense Interest revenue Depreciation expense (a) - 75,260 68,900 334,800 Your answer is partially correct. Loss on disposal of plant assets Sales revenue Income tax expense Sales discounts Utilities expense $68,900 2,142,600 Prepare a multiple-step income statement. (List other revenues before other expenses.) 26,250 169,600 116,600arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education