FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

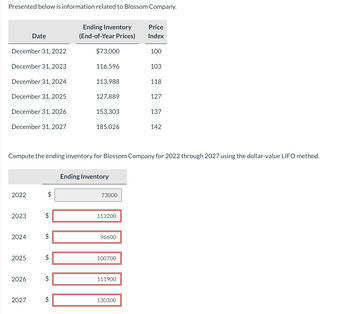

Transcribed Image Text:Presented below is information related to Blossom Company.

December 31, 2022

December 31, 2023

December 31, 2024

December 31, 2025

December 31, 2026

December 31, 2027

2022

2023

2024

2025

Date

2026

2027

$

$

$

$

$

Ending Inventory

(End-of-Year Prices)

$

$73,000

116,596

Compute the ending inventory for Blossom Company for 2022 through 2027 using the dollar-value LIFO method.

113,988

127,889

153,303

185,026

Ending Inventory

73000

113200

96600

100700

111900

Price

Index

130300

100

103

118

127

137

142

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Perpetual Inventory Using Weighted Average Beginning inventory, purchases, and sales for J101 are as follows: Oct. 1 Inventory 480 units at $14 13 Sale 280 units 22 Purchase 600 units at $16 29 Sale 450 units a. Assuming a perpetual inventory system and using the weighted average method, determine the weighted average unit cost after the October 22 purchase. Round your answer to two decimal places. per unit b. Assuming a perpetual inventory system and using the weighted average method, determine the cost of the merchandise sold on October 29. Round your "average unit cost" to two decimal places. c. Assuming a perpetual inventory system and using the weighted average method, determine the inventory on October 31. Round your "average unit cost" to two decimal places.arrow_forward6. MNO Company is preparing the annual financial statements dated December 31, 2022. Information about inventory stocked for regular sale follows: Item A B C D Quantity on Hand 80 35 40 75 Unit Cost When Acquired €50 €20 €50 €40 Market Value at year end €30 €25 €80 €20 a) Compute the valuation for the December 31, 2022, inventory using the lower-of-cost-or-net realizable value basis and make necessary adjusting journal entries. b) Sold 15 units of A for €20 in cash, 3 units of B for €30 and 10 units of C for €75 cach in cash and written-off 5 units of D. Make necessary journal entries. 7. Improvements were made to the leased warehouse on June 01, 2021 at a cost of $ 22,000. The estimated life of the improvement is ten years. Lease contract terminates on December 31, 2025. Make necessary entries as of 31.12.2021 and 31.12.2022.arrow_forwardNonearrow_forward

- Inventory, 12/31/25 Purchases Purchase returns Purchase discounts Gross sales (before employee discounts) Sales returns Markups Markup cancellations Markdowns Markdown cancellations Freight in Employee discounts granted Loss from breakage (normal) Cost $158,500 752,100 42,300 11,400 37400 Retail $265.000 1,357,000 75,400 1,243,000 53,600 67,200 15,200 82,200 21,500 10.500 8.800arrow_forwardmuabhaiarrow_forwardUsing Perpetual Inventory, identify cost of goods sold expense for Oct 2021 # Units Cost Sale price 01-Oct Opening Inventory 500 $10,000.00 04-Oct Sales 100 $4,000.00 07-Oct Purchase 300 $6,300.00 11-Oct Sales 225 $9,225.00 15-Oct Purchase 350 $6,650.00 17-Oct Sales 175 $6,650.00 18-Oct Sales 275 $10,725.00 Using FIFO, provide Closing Inventory Question 5 options: 7565.23 7415.65 7433.44 7395.58arrow_forward

- UMET's Stores had the following inventory transactions in 2020: Transaction Units Cost per unit 1/1 Balance 50 $6 2/14 Sale 25 5/23 Purchase 100 8 8/21 Sale 50 11/5 Purchase 25 12 11/18 Sale 95 Required: Compute tge cost of goods sold and the ending inventory using the periodic inventory system for each of the following cost flow assumptions: a. FIFO b. LIFO c. Weighted averagearrow_forwardManjiarrow_forwardView Policies Current Attempt in Progress Whispering Inc. uses LIFO inventory costing. At January 1, 2025, inventory was $211,879 at both cost and market value. At Decembe 31, 2025, the inventory was $287,291 at cost and $270,300 at market value. Prepare the necessary December 31 entry under (a) the cost-of-goods-sold method and (b) the loss method. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) No. Account Titles and Explanation (a) (b) List of Accounts Save for Later O Search Debit co DELL Attempts: 0 of 15 used M Credit 1 Submit Answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education