FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

1. Estimate ending inventory for 2022 using the conventional retail method.

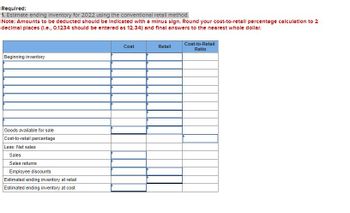

Transcribed Image Text:Required:

1. Estimate ending Inventory for 2022 using the conventional retall method.

Note: Amounts to be deducted should be Indicated with a minus sign. Round your cost-to-retall percentage calculation to 2

decimal places (l.e., 0.1234 should be entered as 12.34) and final answers to the nearest whole dollar.

Beginning inventory

Goods available for sale

Cost-to-retail percentage

Less: Net sales

Sales

Sales returns

Employee discounts

Estimated ending inventory at retail

Estimated ending inventory at cost

Cost

Retail

Cost-to-Retail

Ratio

![!

Required information

[The following information applies to the questions displayed below.]

Raleigh Department Store uses the conventional retail method for the year ended December 31, 2022. Available

information follows:

a. The inventory at January 1, 2022, had a retail value of $50,000 and a cost of $36,200 based on the conventional retail

method.

b. Transactions during 2022 were as follows:

Gross purchases

Purchase returns

Purchase discounts

Sales

Sales returns

Employee discounts

Freight-in

Net markups

Net markdowns

Cost

$ 333,900

6,400

5,500

29,000

Retail

$ 540,000

15,000

500,000

8,000

5,500

30,000

15,000

Sales to employees are recorded net of discounts.

c. The retail value of the December 31, 2023, inventory was $104,325, the cost-to-retail percentage for 2023 under the

LIFO retail method was 70%, and the appropriate price index was 107% of the January 1, 2023, price level.

d. The retail value of the December 31, 2024, inventory was $53,350, the cost-to-retail percentage for 2024 under the

LIFO retail method was 69%, and the appropriate price index was 110% of the January 1, 2023, price level.](https://content.bartleby.com/qna-images/question/969dc51c-cfbc-4a88-8223-4a4d6f7856c4/ac599ee5-fe4b-4856-9480-4fdbb3986f6b/bcxul6_thumbnail.jpeg)

Transcribed Image Text:!

Required information

[The following information applies to the questions displayed below.]

Raleigh Department Store uses the conventional retail method for the year ended December 31, 2022. Available

information follows:

a. The inventory at January 1, 2022, had a retail value of $50,000 and a cost of $36,200 based on the conventional retail

method.

b. Transactions during 2022 were as follows:

Gross purchases

Purchase returns

Purchase discounts

Sales

Sales returns

Employee discounts

Freight-in

Net markups

Net markdowns

Cost

$ 333,900

6,400

5,500

29,000

Retail

$ 540,000

15,000

500,000

8,000

5,500

30,000

15,000

Sales to employees are recorded net of discounts.

c. The retail value of the December 31, 2023, inventory was $104,325, the cost-to-retail percentage for 2023 under the

LIFO retail method was 70%, and the appropriate price index was 107% of the January 1, 2023, price level.

d. The retail value of the December 31, 2024, inventory was $53,350, the cost-to-retail percentage for 2024 under the

LIFO retail method was 69%, and the appropriate price index was 110% of the January 1, 2023, price level.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On the basis of the following data, determine the value of the inventory at the lower of cost or market. Apply lower of cost or market to each inventory item as shown in Exhibit below. Item Inventory Quantity Unit Cost Price ($) Unit Market Price ($) MT22 1642 91 88 4WY09 5278 37 44 1GDS 8898 185 172arrow_forwardinventory as your base numper and adjust the couss amount to the required amount to make the Total Goods Available for Sale to the total of the Value of the ending inventory and the COGS total. Negative value should be indicated with minus sign. Round your intermediate and final answers to 2 decimal places.) \table[[Date,, \table [[Purchases/Transportation - In /], [(PurchaseReturns/Discounts)]], \table [[Cost of Goods Sold/(Returns to], [Inventory)]], Balance in Inventory], [Units, Cost/Unit, Total $, Units, Cost/Unit, Total $, Units, \table[[Avg], [ Cost/Unit]], Total $], [Mar., Brought Forward,,r, 61, $, 93.00, $, 5, 673.00 Telamark Company uses the moving weighted average method for inventory costing. Required: The following incomplete inventory sheet regarding Product W506 is available for the month of March 2023. Complete the inventory sheet. (Use the value of the ending inventory as your base number and adjust the COGS $ amount to the required amount to make the Total Goods…arrow_forwardOn December 31, 2023, Jen & Mink Clothing (J&M) performed the inventory count and determined the year-end ending inventory value to be $77500, it is now January 8, 2024, and you have been asked to double-check the year-end inventory listing. J&M uses a perpetual inventory system Note: Only relevant items are shown on the inventory listing. # 1 2 Jen & Mink Clothing Inventory Listing December 31, 2023 Inventory Number Inventory Description Quantity (units) Blue jackets. Black pants 7649 10824 104 308 Unit Cost ($) Total Value ($) 24 2,496 5,852 19 Total Inventory $77,500 The following situations have been brought to your attention: a. On January 3, 2024, J&M received a shipment of 104 blue jackets, for $2,496 (Item #7649). The inventory was purchased December 23, 2023, FOB destination from Global Threads. This inventory was included in J&M's inventory count and inventory listing. b. On December 29, 2023, J&M sold scarves (Item # 5566) to a customer with a sale price of $740 and cost of…arrow_forward

- You have the following information for Ivanhoe Inc. for the month ended October 31, 2025. Ivanhoe uses a periodic system for inventory. Date Oct. 1 Oct. 9 Oct. 11 Oct. 17 Oct. 22 Oct. 25 Oct. 29 (a1) (a2) Description Beginning inventory 55 Purchase Sale Purchase Sale Purchase Sale Ending inventory Cost of goods sold Gross profit Units Unit Cost or Selling Price $26 $ tA 140 tA 100 1.LIFO. 2. FIFO. 3. Average-cost. (Round answers to O decimal places, e.g. 125.) 100 55 65 110 Calculate ending inventory, cost of goods sold, and gross profit under each of the following methods. LIFO tA $ 28 LA 45 29 50 31 50 FIFO tA tA tA AVERAGE-COSTarrow_forwardApplying the lower-of-cost-or-market approach, what is the correct value that should be reported on the balance sheet for the inventory?arrow_forwardH1.arrow_forward

- 1. If ending inventory on December 31, 2019, is overstated, then, a) cost of goods sold for the year ended December 31, 2020, will be understated. b) gross profit for the year ended December 31, 2019, will be understated. c) gross profit for the year ended December 31, 2020, will be understated. d) cost of goods sold for the year ended December 31, 2019, will be overstated.arrow_forwardIdentify which of the following statement is correct for perpetual inventory system? Under the perpetual Inventory system, on the purchase of Inventory purchase account is debited. When valuing ending Inventory under a perpetual Inventory system, oldest units purchased during the period using FIFO are allocated to the cost of goods sold when units are sold. When valuing ending Inventory under a perpetual Inventory system, weighted average cost method requires that a new weighted average unit cost be calculated after every sale. 09/03/2024 15:01 When valuing ending Inventory under a perpetual inventory system, valuation using weighted average is the same as the valuation using weighted average under the periodic Inventory system.arrow_forwardIdentify which of the following statement is correct for perpetual inventory system? When valuing ending inventory under a perpetual inventory system, weighted average cost method requires that a new weighted average unit cost be calculated after every sale. When valuing ending inventory under a perpetual inventory system, valuation using weighted average is the same as the valuation using weighted average under the periodic inventory system. When valuing ending inventory under a perpetual inventory system, oldest units purchased during the period using FIFO are allocated to the cost of goods sold when units are sold. 5 Under the perpetual inventory system, on the purchase of inventory purchase account is debited. 7arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education