Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Accounting need help

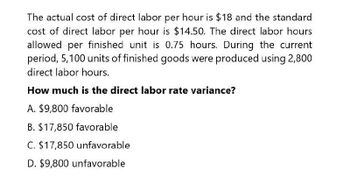

Transcribed Image Text:The actual cost of direct labor per hour is $18 and the standard

cost of direct labor per hour is $14.50. The direct labor hours

allowed per finished unit is 0.75 hours. During the current

period, 5,100 units of finished goods were produced using 2,800

direct labor hours.

How much is the direct labor rate variance?

A. $9,800 favorable

B. $17,850 favorable

C. $17,850 unfavorable

D. $9,800 unfavorable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Marymount Company makes one product. In the month of April, it made 3,500 units. Workers were paid $32 per hour for labor, for a total of $718,848. The standard hours per unit are 6.4, and the standard labor wage rate is $38.40 per hour. A. What are the actual hours worked? B. What are the standard hours for the units made? C. What is the direct labor rate variance for April? D. What Is the direct labor time variance for April? E. What is the total direct labor variance for April?arrow_forwardCase made 24,500 units during June, using 32,000 direct labor hours. They expected to use 31,450 hours per the standard cost card. Their employees were paid $15.75 per hour for the month of June. The standard cost card uses $15.50 as the standard hourly rate. A. Compute the direct labor rate and time variances for the month of June, and also calculate the total direct labor variance. B. If the standard rate per hour was $16.00, what would change?arrow_forwardEagle Inc. uses a standard cost system. During the most recent period, the company manufactured 115,000 units. The standard cost sheet indicates that the standard direct labor cost per unit is $1.50. The performance report for the period includes an unfavorable direct labor rate variance of $3,700 and a favorable direct labor time variance of $10,275. What was the total actual cost of direct labor incurred during the period?arrow_forward

- At the beginning of the year, Lopez Company had the following standard cost sheet for one of its chemical products: Lopez computes its overhead rates using practical volume, which is 80,000 units. The actual results for the year are as follows: (a) Units produced: 79,600; (b) Direct labor: 158,900 hours at 18.10; (c) FOH: 831,000; and (d) VOH: 112,400. Required: 1. Compute the variable overhead spending and efficiency variances. 2. Compute the fixed overhead spending and volume variances.arrow_forwardFitzgerald Company manufactures sewing machines, and they produced 2,500 this past month. The standard variable manufacturing overhead (M0H) rate used by the company is $6.75 per machine hour. Each sewing machine requires 13.5 machine hours. Actual machine hours used last month were 33,500, and the actual variable MOH rate last month was $7.00. Calculate the variable overhead rate variance and the variable overhead efficiency variance.arrow_forwardABC Inc. spent a total of $48,000 on factory overhead. Of this, $28,000 was fixed overhead. ABC Inc. had budgeted $27,000 for fixed overhead. Actual machine hours were 5.000. Standard hours for units made were 4,800. The standard variable overhead rate was $4.10. What is the variable overhead rate variance?arrow_forward

- Queen Industries uses a standard costing system in the manufacturing of its single product. It requires 2 hours of labor to produce 1 unit of final product. In February, Queen Industries produced 12,000 units. The standard cost for labor allowed for the output was $90,000, and there was an unfavorable direct labor time variance of $5,520. A. What was the standard cost per hour? B. How many actual hours were worked? C. If the workers were paid $3.90 per hour, what was the direct labor rate variance?arrow_forwardDirect labor variances Bellingham Company produces a product that requires 4 standard direct labor hours per unit at a standard hourly rate of 20 per hour. If 15,000 units used 61,800 hours at an hourly rate of 1985 per hour, what is the direct labor (A) rate variance, (B) time variance, and (C) cost variance?arrow_forwardA manufacturer planned to use $78 of variable overhead per unit produced, but in the most recent period, it actually used $76 of variable overhead per unit produced. During this same period, the company planned to produce 500 units but actually produced 540 units. What is the variable overhead spending variance?arrow_forward

- Ellis Companys labor information for September is as follows: A. Compute the standard direct labor rate per hour. B. Compute the direct labor time variance. C. Compute the standard direct labor rate if the direct labor rate variance was $2,712.30 (unfavorable).arrow_forwardPower Co.s labor information for June is as follows: A. What was the actual labor rate per hour? B. What was the standard labor rate per hour? C. What was the total standard labor cost for units produced in June? D. What was the direct labor time variance for June?arrow_forwardAssume that the inspection activity has an expected cost of 120,000. Expected direct labor hours are 3,000, and expected number of inspections is 600. The best activity rate for inspection is as follows: a. 40 per inspection b. 40 per hour c. 200 per inspection d. 200 per hourarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning