FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

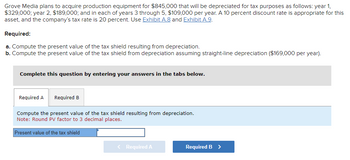

Transcribed Image Text:Grove Media plans to acquire production equipment for $845,000 that will be depreciated for tax purposes as follows: year 1,

$329,000; year 2, $189,000; and in each of years 3 through 5, $109,000 per year. A 10 percent discount rate is appropriate for this

asset, and the company's tax rate is 20 percent. Use Exhibit A.8 and Exhibit A.9.

Required:

a. Compute the present value of the tax shield resulting from depreciation.

b. Compute the present value of the tax shield from depreciation assuming straight-line depreciation ($169,000 per year).

Complete this question by entering your answers in the tabs below.

Required A Required B

Compute the present value of the tax shield resulting from depreciation.

Note: Round PV factor to 3 decimal places.

Present value of the tax shield

< Required A

Required B >

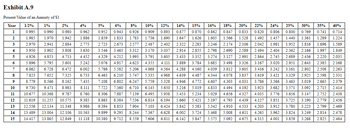

Transcribed Image Text:Exhibit A.9

Present Value of an Annuity of $1

Year 1/2%

1

2

0.995

1.985 1.970

2.970

3.950

4.926

5.896

6.862

7.823

8.779

10

9.730

11 10.677

12

13

14

15

3

4

5

25%

30% 35% 40%

1% 2%

0.990 0.980

1.942

2.941 2.884

3.902 3.808

4.853 4.713

5.795 5.601

6.728 6.472

4% 5% 6% 8% 10% 12% 14% 15% 16% 18% 20% 22%

24%

0.962 0.952

0.943

0.926 0.909 0.893 0.877 0.870 0.862 0.847 0.833 0.820

0.806 0.800 0.769 0.741 0.714

1.886 1.859 1.833 1.783 1.736 1.690 1.647 1.626 1.605 1.566 1.528 1.492 1.457 1.440 1.361 1.289 1.224

2.775 2.723 2.673 2.577 2.487 2.402 2.322 2.283 2.246 2.174 2.106 2.042 1.981 1.952 1.816 1.696 1.589

3.630 3.546 3.465 3.312 3.170 3.037 2.914 2.855 2.798 2.690 2.589 2.494 2.404 2.362 2.166 1.997 1.849

4.452 4.329 4.212 3.993 3.791 3.605 3.433 3.352 3.274 3.127 2.991 2.864 2.745 2.689 2.436 2.220 2.035

5.242 5.076 4.917 4.623 4.355 4.111 3.889 3.784 3.685 3.498 3.326 3.167 3.020 2.951 2.643 2.385 2.168

6.002 5.786 5.582 5.206 4.868 4.564 4.288 4.160 4.039 3.812 3.605 3.416 3.242 3.161 2.802 2.508 2.263

6.733 6.463 6.210 5.747 5.335 4.968 4.639 4.487 4.344 4.078 3.837 3.619 3.421 3.329 2.925 2.598 2.331

7.435 7.108 6.802 6.247 5.759 5.328 4.946 4.772 4.607 4.303 4.031 3.786 3.566 3.463 3.019 2.665 2.379

7.722

6.145 5.650 5.216 5.019 4.833 4.494 4.192 3.923 3.682 3.571 3.092 2.715 2.414

8.306

6.495

5.938 5.453 5.234 5.029 4.656

4.327 4.035 3.776 3.656 3.147 2.752 2.438

9.385 8.863 8.384

6.814 6.194 5.660 5.421 5.197 4.793 4.439 4.127 3.851 3.725 3.190 2.779 2.456

7.103 6.424 5.842 5.583 5.342 4.910 4.533 4.203

3.780 3.223

6.002

6.811 6.142

7.652

7.325

8.566

8.162

9.471

8.983

8.111

10.368 9.787

8.760

7.360 6.710

7.887 7.139

7.536

11.619 11.255 10.575

12.556 12.134 11.348 9.986

9.394 8.853

7.904

3.912

2.799

2.469

9.899 9.295

8.244

7.367

6.628

5.724 5.468 5.008

3.962

3.824 3.249

2.814

2.478

13.489 13.004 12.106 10.563

14.417 13.865 12.849 11.118 10.380 9.712 8.559

4.611 4.265

4.675 4.315 4.001 3.859

7.606

5.847 5.575 5.092

3.268

2.825

2.484

6

7

8

9

ان اسلالوار امامات

ahal

Jud

.....

ala-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Summit Petroleum Corporation will purchase an asset that qualifies for three-year MACRS depreciation. The cost is $450,000 and the asset will provide the following stream of earnings before depreciation and taxes for the next four years: Use Table 12-12. Year 1 $200,000 Year 2 263,000 90,000 80,000 Year 3 Year 4 The firm is in a 30 percent tax bracket and has a cost of capital of 12 percent. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. Calculate the net present value. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places.) Net present valuearrow_forwardA firm buys a piece of equipment for $115,866.00 and will straight-line depreciate it to zero over five years. If the tax rate is 39.00%, what is the present value of the depreciation tax shield if the cost of capital is 10.00%? Submit Answer format: Currency: Round to: 2 decimal places. Show Hintarrow_forwardAssume the following: . A firm acquires an asset for $120.000 with a 5 year useful life and no salvage . The asset will generate $50,000 of cash flow for all five years . The tax rate is 20% . The firm will depreciate the asset over four years on a straight-line (SL) basis for tax purposes and over five years on a SL basis for financial reporting purposes. Taxable income in year 1 is: $26.000 $20.000 © $4.000arrow_forward

- Use the spreadsheet to determine the after-tax internal rate of return. For this problem, assumea a 10 year analysis period, straight-line depreciation is used, 21% corporate tax rate , an initial cost of $ 200,000, an annual benefit of $60,000 and no salvage value but instead you must pay a disposal fee of $20,000 that your corporate accountant determined is tax deductible.arrow_forwardMf1. Consider an asset that costs $492,800 and is depreciated straight-line to zero over its 6-year tax life. The asset is to be used in a 2-year project; at the end of the project, the asset can be sold for $61,600. If the relevant tax rate is 22 percent, what is the aftertax cash flow from the sale of this asset?arrow_forwardGrove Media plans to acquire production equipment for $845,000 that will be depreciated for tax purposes as follows: year 1, $329,000; year 2, $189,000; and in each of years 3 through 5, $109,000 per year. A 10 percent discount rate is appropriate for this asset, and the company’s tax rate is 20 percent. Required: Compute the present value of the tax shield resulting from depreciation. 2. Compute the present value of the tax shield from depreciation assuming straight-line depreciation ($169,000 per year).arrow_forward

- Thank you!!arrow_forward12arrow_forwardA Company is considering a proposal of installing a drying equipment. The equipment would involve a Cash outlay of 6,00,000 and net Working Capital of 80,000. The expected life of the project is 5 years without any salvage value. Assume that the company is allowed to charge depreciation on straight-line basis for Income-tax purpose. The estimated before-tax cash inflows are given below: Year Before-tax Cash inflows ('000) 1 2 3 4 5 240 275 210 180 160 The applicable Income-tax rate to the Company is 35%. If the Company's opportunity Cost of Capital is 12%, calculate the equipment's discounted payback period, payback period, net present value and internal rate of return. The PV factors at 12%, 14% and 15% are: Year 1 2 3 4 5 PV factor at 12% 0.8929 0.7972 0.7118 0.6355 0.5674 PV factor at 14% 0.8772 0.7695 0.6750 0.5921 0.5194 PV factor at 15% 0.8696 0.7561 0.6575 0.5718 0.4972 10-22arrow_forward

- An asset used in a 4-year project falls in the 5-year MACRS class (MACRS Table) for tax purposes. The asset has an acquisition cost of $18,720,000 and will be sold for $4,160,000 at the end of the project. If the tax rate is 22 percent, what is the aftertax salvage value of the asset?arrow_forward3. Solar Solutions has purchased new manufacturing equipment that cost $400,000. Calculate the yearly tax savings from the CCA tax shield for the next three years. Assume that the income tax rate is 30%, the CCA rate is 30%, and the weighted-average cost of capital (WACC) is 12%. Assume that CCA in the first year is subject to the accelerated depreciation method for the year of acquisition. (Hint. Use Microsoft Excel to calculate the discount factor(s).) (Do not round your intermediate calculations. Round your final answers to 2 decimal places.) X Answer is complete but not entirely correct. Year 1 2 3 $ $ $ PV of Tax Savings 91,071.43 x 56,919.64 X 35,574.78 Xarrow_forwardAn asset used in a four-year project falls in the five-year MACRS class for tax purposes. The asset has an acquisition cost of $6,000,000 and will be sold for $1,200,000 at the end of the project. If the tax rate is 34 percent, what is the aftertax salvage value of the asset? Refer to the MACRS schedule. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) Aftertax salvage value Sarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education