FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Pl3ase answer in a table form/typewritt3n (not in photo)

Note: The total liabilities on December 31, 2023 is 527,773

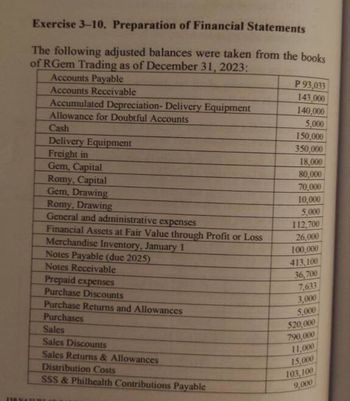

Transcribed Image Text:Exercise 3-10. Preparation of Financial Statements

The following adjusted balances were taken from the books

of RGem Trading as of December 31, 2023;

Accounts Payable

Accounts Receivable

Accumulated Depreciation- Delivery Equipment

Allowance for Doubtful Accounts

Cash

Delivery Equipment

Freight in

Gem, Capital

Romy, Capital

Gem, Drawing

Romy, Drawing

General and administrative expenses

Financial Assets at Fair Value through Profit or Loss

Merchandise Inventory, January 1

Notes Payable (due 2025)

Notes Receivable

Prepaid expenses

Purchase Discounts

Purchase Returns and Allowances

Purchases

Sales

Sales Discounts

Sales Returns & Allowances

Distribution Costs

SSS & Philhealth Contributions Payable

P 93,033

143,000

140,000

5,000

150,000

350,000

18,000

80,000

70,000

10,000

5,000

112,700

26,000

100,000

413,100

36,700

7,633

3,000

5.000

520,000

790,000

11,000

15,000

103,100

9,000

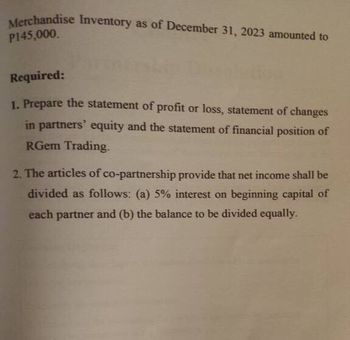

Transcribed Image Text:Merchandise Inventory as of December 31, 2023 amounted to

P145,000.

Required:

1. Prepare the statement of profit or loss, statement of changes

in partners' equity and the statement of financial position of

RGem Trading.

2. The articles of co-partnership provide that net income shall be

divided as follows: (a) 5% interest on beginning capital of

each partner and (b) the balance to be divided equally.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- View Policies Current Attempt in Progress The Bridgeport Company issued $390,000 of 11% bonds on January 1, 2020. The bonds are due January 1, 2025, with interest payable each July 1 and January 1. The bonds are issued at face value. Prepare Bridgeport's journal entries for (a) the January issuance, (b) the July 1 interest payment, and (c) the December 31 adjusting entry. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Date Account Titles and Explanation Debit Credit (a) (b) (c)arrow_forwardDeluxe Suites Hotels includes the following selected accounts in its general ledger at December 31, 2024: (Click the icon to view the accounts.) Prepare the liabilities section of Deluxe Suites' balance sheet at December 31, 2024. Less: Total Liabilities Deluxe Suites Hotels Balance Sheet (Partial) December 31, 2024 Data table ← Note Payable (long-term) Bonds Payable (due 2028) Interest Payable (due next year) Estimated Warranty Payable $ 150,000 250,000 1,200 2,000 Print Accounts Payable Discount on Bonds Payable Salaries Payable Sales Tax Payable Done $ 40,000 7,500 3,300 700arrow_forwardNonearrow_forward

- An accounting example: Otter Products inc issued bonds on January 1, 2019. Interest to be paid semi-annually. Term in years is 2; Face value of bonds issued is $200,000; Issue Price $206,000; Specified Interest Rate each payment period is 6% Question. Calculate a. the amount of interest paid in cash every payment period. b. The amount of amortization to be recorded at each interest payment date (use straight-line method) c. complete amoritzation table by calculating interest expense and beginning and ending bond carrying amounts at the each period over 2 years. The term is for 2 years however 3 years is showing on the workbook. How do I calcuate the 3rd year if the problem only says the term is 2 years?arrow_forwardPlease do not give solution in image format ? And Fast answering please and explain proper steps by Step.arrow_forward4arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education