FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

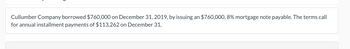

Transcribed Image Text:Cullumber Company borrowed $760,000 on December 31, 2019, by issuing an $760,000, 8% mortgage note payable. The terms call

for annual installment payments of $113,262 on December 31.

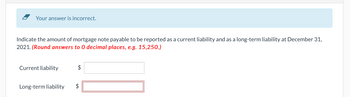

Transcribed Image Text:Your answer is incorrect.

Indicate the amount of mortgage note payable to be reported as a current liability and as a long-term liability at December 31,

2021. (Round answers to O decimal places, e.g. 15,250.)

Current liability

Long-term liability

$

tA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Duval Co. issues four-year bonds with a $108,000 par value on January 1, 2019, at a price of $103,920. The annual contract rate is 6%, and interest is paid semiannually on June 30 and December 31. Prepare a straight-line amortization table for these bonds. (Round your answers to the nearest dollar amount.)arrow_forwardOn January 1,2021, Eagle Company borrows $100,000 cash by signing a four-year, 7% installment note. The note requires four equal payments of $29,523, consisting of accrued interest and principal on December 31 of each year from 2021 through 2024. Prepare an amortization table for this installment note.arrow_forwardOn January 1, 2021, CPS Co. borrowed $340,000 cash from iLend and issued a five-year $340,000, 4% note. Interest was payable annually on December 31. Required: Prepare the journal entries for both firms to record interest at December 31, 2021.arrow_forward

- On July 1, 2020 Walker Inc. signed a $600,000, 15 month, 10% note payable. At due date, the principal and interest will be paid. Calculate the amount of interest expense that Walker Inc. should report on its income statement for the year ended December 31, 2021. (round to the nearest dollar)arrow_forwardSayed Company borrowed $40,000 on August 31, 2020, by issuing an 9-month, 9% interest-bearing note. The company prepares its financial statement annually at the end of December. Maturity date is: April 1, 2020 May 1, 2020 June 1, 2020 July 1, 2020 None of the above The adjusting entry to record the accrued interest on December 31, 2020 is: * Debit Interest Expense and Credit Interest Payable for $1,200 Debit Interest Expense and Credit Interest Payable for $1,500 Debit Interest Expense and Credit Cash for $3,600 Debit Interest Expense and Credit Interest Payable for $2,700 None of the above O Oarrow_forwardCullumber Company borrowed $313,000 on January 1, 2022, by issuing a $313,000, 10% mortgage note payable. The terms call for annual installment payments of $54,000 on December 31. (a) Prepare the journal entries to record the mortgage loan and the first two installment payments. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit ILOR Credarrow_forward

- On January 1, 2018, Paradiso Company issued 1,000 of its 8%, $1,000 bonds at 93. Interest is payable semiannually on June 30 and December 31. The bonds will mature on December 31, 2027. If the company uses straight-line amortization, determine the amount of interest expense for 2018. answer is 87,000 how do you get there?arrow_forwardOn February 10, 2021, after issuance of its financial statements for 2020, Sunland Company entered into a financing agreement with Cleveland Bank, allowing Sunland Company to borrow up to $8060000 at any time through 2023. Amounts borrowed under the agreement bear interest at 3% above the bank's prime interest rate and mature two years from the date of loan. Sunland Company presently has $3100000 of notes payable with Star National Bank maturing March 15, 2021. The company intends to borrow $4910000 under the agreement with Cleveland and liquidate the notes payable to Star National Bank. The agreement with Cleveland also requires Sunland to maintain a working capital level of $12050000 and prohibits the payment of dividends on common stock without prior approval by Cleveland Bank. From the above information only, the total short-term debt of Sunland Company as of the December 31, 2020 balance sheet date is $8060000. $0. $3990000. $3100000.arrow_forwardSunland Company borrowed $760,000 on December 31, 2019, by issuing an $760,000, 9% mortgage note payable. The terms call for annual installment payments of $118,423 on December 31. (a) Your answer is correct. Prepare the journal entries to record the mortgage loan and the first two installment payments. (Round answers to O decimal places, e.g. 15,250. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Dec. 31, 2019 ec. 31, 2020 Account Titles and Explanation Cash Mortgage Payable Interest Expense Mortgage Payable Cash Debit 760,000 68400 50023 Credit 760,000 118423arrow_forward

- On July 1, 2020, Thomas Company, which follows calendar year accounting, issued $240.000 note to be repaid over four years in monthly installments of $5,000. What would be the proper balance sheet presentation of this transaction at December 31, year 2020. Show it: The Current Portion of the Long-Term Debt and the Long-Term Debt.arrow_forwardTolino Company signed a 5-year note payable on January 1, 2020, of $200,000. The note requires annual principal payments each December 31 of $40,000 plus interest of 6%. The entry to record the annual payment on December 31, 2021, includes:arrow_forwardSunland Company borrowed $760,000 on December 31, 2019, by issuing an $760,000, 9% mortgage note payable. The terms call for annual installment payments of $118,423 on December 31. (a) Your answer is correct. Prepare the journal entries to record the mortgage loan and the first two installment payments. (Round answers to 0 decimal places, e.g. 15,250. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Dec. 31, 2019 ec. 31, 2020 Account Titles and Explanation Cash Mortgage Payable Interest Expense Mortgage Payable Cash Debit 760,000 68400 50023 Credit 760,000 118423arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education