FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

prepare the

Transcribed Image Text:Current Attempt in Progress

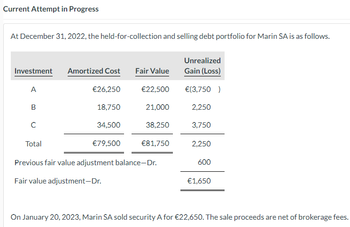

At December 31, 2022, the held-for-collection and selling debt portfolio for Marin SA is as follows.

Investment

A

B

с

Total

Amortized Cost

€26,250

18,750

34,500

€79,500

Fair Value

€22,500

21,000

38,250

€81,750

Previous fair value adjustment balance-Dr.

Fair value adjustment-Dr.

Unrealized

Gain (Loss)

€(3,750 )

2,250

3,750

2,250

600

€1,650

On January 20, 2023, Marin SA sold security A for €22,650. The sale proceeds are net of brokerage fees.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Evaluate the terminal value of the following portfolio: a newly entered-into long forward contract on an asset and a long position in a European put option on the asset with the same maturity as the forward contract and a strike price that is equal to the forward price of the asset at the time the portfolio is set up. Prove that the European put option has the same value as a European call option with the same strike price and maturity. Illustrate your answer with figure.arrow_forwardMatch the words with the term. Question 7 options: 12345 insurance 12345 guarantees 12345 ability to repay loan 12345 status of industry 12345 integrity 1. capacity 2. collateral 3. coverage 4. character 5. conditionsarrow_forwardCould you show a chart to indicate the nearest interest rate and the currency in which it will be paid/received?arrow_forward

- a. Provide the journal entry to adjust the trading security portfolio to fair value on December 31, 2016. b. Assume the market prices of the portfolio were the same on December 31, 2017, as they were on December 31, 2016. What would be the journal entry to adjust the portfolio to fair value?arrow_forwardWhat is a FUTURES CONTRACT and what are its key components? Food Marketingarrow_forwardWhich of the following gives the holder the right to buy the asset at a specified strike price? OA. A future contract OB. A put OC. An ETF OD. A stock OE. A callarrow_forward

- Which of the following gives the holder the right to sell the asset at a specified strike price? OA. A stock OB. A put OC. An ETF OD. A future contract OE. A callarrow_forwarda)analyze and discuss the following factors on a European call option: time to expiration, exercise price, interest rate, volatility, and dividends. b) identify, analyze, and discuss the following characteristics of a European put option: maximum value, intrinsic value, time value, lower bound, and payoff at expiration. c) analyze and discuss the following factors on a European put option: time to expiration, exercise price, interest rate, volatility, and dividends. d) discuss the relationship between American and European option prices. e) derive the put-call parity and discuss its implications. f) discuss the characteristics of a currency option.arrow_forwardExplain how Tvm concepts of present and future value impact 401 planning for retirement.arrow_forward

- c) What is basis risk in futures position. Why it arises? If you are trying to hedge July 2020 oil priceexposure with Aug 2020 oil futures would there be a basis risk in your hedged position?arrow_forwardProvide a review of the most important risk measures available for assessing the risk of a portfolio. Explain what the advantages and disadvantages of each metric are. Give an overview of the latest regulatory guidelines in terms of which measures to use and which one to decommission, and the rationale behind these guidelines.arrow_forwardWhen MUST the Policy Summary for a life insurance policy be delivered? Prior to the sales presentation With or prior to delivery of the policy Within a year after delivery of the policy Only upon delivery of a replacement policy.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education