Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

prepare the journal entries and state the impact each transaction had on net income

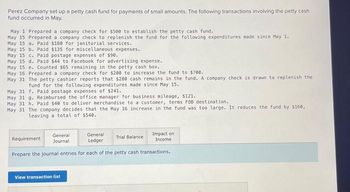

Transcribed Image Text:Perez Company set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash

fund occurred in May.

May 1 Prepared a company check for $500 to establish the petty cash fund.

May 15 Prepared a company check to replenish the fund for the following expenditures made since May 1.

May 15 a. Paid $180 for janitorial services.

May 15 b. Paid $135 for miscellaneous expenses.

May 15 c. Paid postage expenses of $90.

May 15 d. Paid $44 to Facebook for advertising expense.

May 15 e. Counted $65 remaining in the petty cash box..

May 16 Prepared a company check for $200 to increase the fund to $700.

May 31 The petty cashier reports that $280 cash remains in the fund. A company check is drawn to replenish the

fund for the following expenditures made since May 15.

May 31 f. Paid postage expenses of $241.

May 31 g. Reimbursed the office manager for business mileage, $121.

May 31 h. Paid $40 to deliver merchandise to a customer, terms FOB destination.

May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by $160,

leaving a total of $540.

General

Journal

General

Ledger

Prepare the journal entries for each of the petty cash transactions.

Requirement

View transaction list

Impact on

Income

Trial Balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On September 1, French company has decided to initiate a petty cash fund in the amount of $800. Prepare journal entries for the following transactions: A. On September 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $37, Supplies $124, Postage Expense $270, Repairs and Maintenance Expense $168, Miscellaneous Expense $149. The cash on hand at this time was $48. B. On September 14, the petty cash fund needed replenishment and the following are the receipts: Auto Expense $18, Supplies $175, Postage Expense $50, Repairs and Maintenance Expense $269, Miscellaneous Expense $59. The cash on hand at this time was $210. C. On September 23, the petty cash fund needed replenishment and the following are the receipts: Auto Expense $251, Supplies $88, Postage Expense $63, Repairs and Maintenance Expense $182, Miscellaneous Expense $203. The cash on hand at this time was $20. D. On September 29, the company determined that the petty cash fund needed to be increased to $1,000. E. On September 30, the petty cash fund needed replenishment as it was month end. The following are the receipts: Auto Expense $18, Supplies $15, Postage Expense $57, Repairs and Maintenance Expense $49, Miscellaneous Expense $29. The cash on hand at this time was $837.arrow_forwardOn June 1 French company has decided to initiate a petty cash fund in the amount of $800. Prepare journal entries for the following transactions: A. On June 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $37, Supplies $124, Postage Expense $270, Repairs and Maintenance Expense $168, Miscellaneous Expense $149. The cash on hand at this time was $48. B. On June 14, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $18, Supplies $175, Postage Expense $50, Repairs and Maintenance Expense $269, Miscellaneous Expense $59. The cash on hand at this time was $220. C. On June 23, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $251, Supplies $88, Postage Expense $63, Repairs and Maintenance Expense $182, Miscellaneous Expense $203. The cash on hand at this time was $20. D. On June 29, the company determined that the petty cash fund needed to be increased to $1,000. E. On June 30, the petty cash fund needed replenishment, as it was month end. The following are the receipts: Auto Expense $18, Supplies $175, Postage Expense $50, Repairs and Maintenance Expense $269, Miscellaneous Expense $59. The cash on hand at this time was $437.arrow_forwardOn July 2 Kellie Company has decided to initiate a petty cash fund in the amount of $1,200. Prepare journal entries for the following transactions: A. On July 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $125, Supplies $368, Postage Expense $325, Repairs and Maintenance Expense $99, Miscellaneous Expense $259. The cash on hand at this time was $38. B. On June 14, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $425, Supplies $95, Postage Expense $240, Repairs and Maintenance Expense $299, Miscellaneous Expense $77. The cash on hand at this time was $110. C. On June 23, the petty cash fund needed replenishment and the following are the receipts: Auto Expense $251, Supplies $188, Postage Expense $263, Repairs and Maintenance Expense $182, Miscellaneous Expense $203. The cash on hand at this time was $93. D. On June 29, the company determined that the petty cash fund needed to be decreased to $1,000. E. On June 30, the petty cash fund needed replenishment, as it was month end. The following are the receipts: Auto Expense $14, Supplies $75, Postage Expense $150, Repairs and Maintenance Expense $121, Miscellaneous Expense $39. The cash on hand at this time was $603.arrow_forward

- Catherines Cookies has a beginning balance in the Accounts Payable control total account of $8,200. In the cash disbursements journal, the Accounts Payable column has total debits of $6,800 for November. The Accounts Payable credit column in the purchases journal reveals a total of $10,500 for the current month. Based on this information, what is the ending balance in the Accounts Payable account in the general ledger?arrow_forwardMitchell Co. set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May. May 1 Prepared a company check for $550 to establish the petty cash fund. May 15 Prepared a company check to replenish the fund for the following expenditures made since May 1. a. Paid $194 for janitorial services. b. Paid $145 for miscellaneous expenses. c. Paid postage expenses of $97. d. Paid $48 to The County Gazette (the local newspaper) for an advertisement. e. Counted $77 remaining in the petty cash box. May 16 Prepared a company check for $250 to increase the fund to $800. May 31 The petty cashier reports that $320 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. f. Paid postage expenses of $280. g. Reimbursed the office manager for business mileage, $140. h.…arrow_forwardKiona Company set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May (the last month of the company's fiscal year). May 1 Prepared a company check for $250 to establish the petty cash fund. May 15 Prepared a company check to replenish the fund for the following expenditures nade since May 1. May 15 a. Paid $78.00 for janitorial expenses. May 15 b. Paid $63.68 for miscellaneous expenses. May 15 c. Paid postage expenses of $43.50. May 15 d. Paid $57.15 to Facebook for advertising expense. May 15 e. Counted $19.17 remaining in the petty cashbox. May 16 Prepared a company check for $200 to increase the fund to $450. May 31 The petty cashier reports that $303.39 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. May 31 f. Paid postage expenses of $48.36. May 31 g. Reimbursed the office manager for mileage expense, $38.50. May 31 h. Paid $39.75 in…arrow_forward

- Kiona Company set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May (the last month of the company's fiscal year). May 1 Prepared a company check for $400 to establish the petty cash fund. May 15 Prepared a company check to replenish the fund for the following expenditures made since May 1. May 15 a. Paid $124.80 for janitorial expenses. May 15 b. Paid $101.88 for miscellaneous expenses. May 15 c. Paid postage expenses of $69.60. May 15 d. Paid $91.44 to Facebook for advertising expense. May 15 e. Counted $30.68 remaining in the petty cashbox. May 16 Prepared a company check for $200 to increase the fund to $600. May 31 The petty cashier reports that $401.19 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. May 31 f. Paid postage expenses of $64.48. May 31 g. Reimbursed the office manager for mileage expense, $51.33.…arrow_forwardKiona Company set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May (the last month of the company's fiscal year). May 1 Prepared a company check for $300 to establish the petty cash fund. May 15 Prepared a company check to replenish the fund for the following expenditures made since May 1. May 15 a. Paid $88 for janitorial expenses. May 15 b. Paid $53.68 for miscellaneous expenses. May 15 c. Paid postage expenses of $53.50. May 15 d. Paid $47.15 to Facebook for advertising expense. May 15 e. Counted $62.15 remaining in the petty cashbox. May 16 Prepared a company check for $200 to increase the fund to $500. May 31 The petty cashier reports that $288.20 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. May 31 f. Paid postage expenses of $147.36. May 31 g. Reimbursed the office manager for mileage expense, $23.50. May 31 h. Paid $34.75 in…arrow_forwardKiona Company set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May (the last month of the company’s fiscal year). May 1 Prepared a company check for $300 to establish the petty cash fund. May 15 Prepared a company check to replenish the fund for the following expenditures made since May 1. May 15 a. Paid $88 for janitorial expenses. May 15 b. Paid $53.68 for miscellaneous expenses. May 15 c. Paid postage expenses of $53.50. May 15 d. Paid $47.15 to Facebook for advertising expense. May 15 e. Counted $62.15 remaining in the petty cashbox. May 16 Prepared a company check for $200 to increase the fund to $500. May 31 The petty cashier reports that $288.20 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. May 31 f. Paid postage expenses of $147.36. May 31 g. Reimbursed the office manager for mileage expense, $23.50.…arrow_forward

- Kiona Company set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May (the last month of the company's fiscal year). May 1 Prepared a company check for $300 to establish the petty cash fund. May 15 Prepared a company check to replenish the fund for the following expenditures made since May 1. May 15 a. Paid $93.60 for janitorial expenses. May 15 b. Paid $76.41 for miscellaneous expenses. May 15 c. Paid postage expenses of $52.20. May 15 d. Paid $68.58 to Facebook for advertising expense. May 15 e. Counted $23.01 remaining in the petty cashbox. May 16 Prepared a company check for $200 to increase the fund to $500. May 31 The petty cashier reports that $349.32 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. May 31 f. Paid postage expenses of $53.73. May 31 g. Reimbursed the office manager for mileage expense, $42.78.…arrow_forwardKiona Company set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May (the last month of the company's fiscal year). May 1 Prepared a company check for $300 to establish the petty cash fund. May 15 Prepared a company check to replenish the fund for the following expenditures made since May 1. May 15 a. Paid $93.60 for janitorial expenses. May 15 b. Paid $76.41 for miscellaneous expenses. May 15 c. Paid postage expenses of $52.20. May 15 d. Paid $68.58 to Facebook for advertising expense. May 15 e. Counted $23.01 remaining in the petty cashbox. May 16 Prepared a company check for $200 to increase the fund to $500. May 31 The petty cashier reports that $319.32 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. May 31 f. Paid postage expenses of $53.73. May 31 g. Reimbursed the office manager for mileage expense, $42.78. May 31 h. Paid $44.17 in…arrow_forwardHansabenarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,  Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage