College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

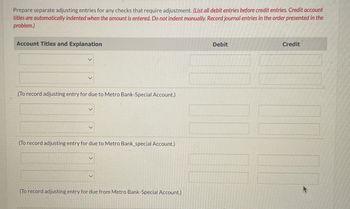

Transcribed Image Text:Prepare separate adjusting entries for any checks that require adjustment. (List all debit entries before credit entries. Credit account

titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the

problem.)

Account Titles and Explanation

(To record adjusting entry for due to Metro Bank-Special Account.)

(To record adjusting entry for due to Metro Bank_special Account.)

(To record adjusting entry for due from Metro Bank-Special Account.)

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- I need help.arrow_forwardWhich of the following transactions will require a journal entry? Indicate if it will be a debit or a credit and to what account the entry will be recorded. Select "NA" if not applicable. No Journal Journal Entry Entry Transaction Needed Needed Debit Credit Outstanding check Interest income NES check Wire transfer by customer Deposit in transit Bank chargesarrow_forwardplease and thank youarrow_forward

- Need asap. Please see below.arrow_forwardPlease journalize the info below. I need this asap please.arrow_forwardBridgeport Corporation was organized on January 1, 2022. It is authorized to issue 15,000 shares of 8%, $100 par value preferred stock, and 504,000 shares of no-par common stock with a stated value of $2 per share. The following stock transactions were completed during the first year. Jan. 10 Issued 85,000 shares of common stock for cash at $4 per share. Issued 5,150 shares of preferred stock for cash at $110 per share. Issued 22,000 shares of common stock for land. The asking price of the land was $90,000. The fair value of the land was $84,000. Mar. 1 Apr. May Aug. Sept. Nov. 1 Issued 78,000 shares of common stock for cash at $5.25 per share. Issued 11,000 shares of common stock to attorneys in payment of their bill of $43,000 for services performed in helping the company organize. Issued 12,000 shares of common stock for cash at $7 per share. 1 Issued 1,000 shares of preferred stock for cash at $113 per share. 1 1 1arrow_forward

- View Policies Current Attempt in Progress Carla Vista Company manufactures pizza sauce through two production departments: cooking and canning. In each process, materials and conversion costs are incurred evenly throughout the process. For the month of April, the work in process inventory accounts show the following debits: Beginning work in process inventory Direct materials Direct labour Manufacturing overhead Costs transferred in Cooking $-0- 26,900 7,350 32,800 Canning $3,750 7,620 7,490 26,000 52,200 I dit ontries Credit account titles are automatically indented when the anarrow_forwardWildhorse Corporation sells rock-climbing products and also operates an indoor climbing facility for climbing enthusiasts. During the last part of 2025. Wildhorse had the following transactions related to notes payable Sept. 1 Sept. 30 Oct. 1 Oct. 31 Nov. 1 Nov. 30 Dec. 1 Dec. 31 Issued a $13,200 note to Pippen to purchase inventory. The 3-month note payable bears interest of 9% and is due December 1. (Wildhorse uses a perpetual inventory system) Recorded accrued interest for the Pippen note. Issued a $22,800, 9%, 4-month note to Prime Bank to finance the purchase of a new climbing wall for advanced climbers. The note is due February 1. Recorded accrued interest for the Pippen note and the Prime Bank note. Issued a $24,000 note and paid $7,600 cash to purchase a vehicle to transport clients to nearby climbing sites as part of a new series of climbing classes. This note bears interest of 6% and matures in 12 months. Recorded accrued interest for the Pippen note, the Prime Bank note, and…arrow_forwardPrepare journal entries for the selected transactions above. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record entries in the order displayed in the problem statement. List all debit entries before credit entries.) (b) Account Titles and Explanation (c) purchases accounts payable Date December 31 Accounts Payable Notes Payable December 31 cash eTextbook and Medial Discount on Notes Payable List of Accounts Your Answer Correct Answer Solution notes payable Your answer is partially correct. Account Titles and Explanation Interest Expense Interest Payable (To record interest on the note) Interest Expense Prepare adjusting entries at December 31. (if no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Round…arrow_forward

- Please answer question completely and correctly. Fill out every single box with the right information pleasearrow_forwardVaughn Limited, which uses a perpetual inventory system, purchased inventory costing $22,000 on February 1 by issuing a 3-month note payable bearing interest at 6%, with interest and principal due on May 1. The company's year end is on March 31 and the company records adjusting entries only at that time. Your answer is correct. Prepare the journal entry to record the purchase of inventory on February 1. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Date Account Titles Feb. 1 (b) Inventory Notes Payable eTextbook and Media List of Accounts Your answer is correct. Mar. 31 Date Account Titles Interest Expense Debit Interest Payable Prepare the journal entry to record the accrual of interest expense on March 31. (Credit account titles are automatically indented when the amount is entered. Do not indent…arrow_forwardThe adjusting entry to record an NSF check includes a credit to accounts payable a debit to vash a debit to accounts receivable a debit to miscellaneous expensearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College