EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Solve the problem. Show work and do not use AI

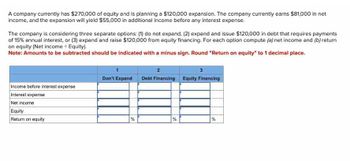

Transcribed Image Text:A company currently has $270,000 of equity and is planning a $120,000 expansion. The company currently earns $81,000 in net

income, and the expansion will yield $55,000 in additional income before any interest expense.

The company is considering three separate options: (1) do not expand, (2) expand and issue $120,000 in debt that requires payments

of 15% annual interest, or (3) expand and raise $120,000 from equity financing. For each option compute (a) net income and (b) return

on equity (Net income + Equity).

Note: Amounts to be subtracted should be indicated with a minus sign. Round "Return on equity" to 1 decimal place.

Dan't Expand Debt Financing Equity Financing

Income before interest expense

Interest expense

Net income

Equity

Return on equity

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You own debt with face amount of $150 Million that you lent to a firm managed by its sole shareholder, whose firm is expected to generate next year either a cash flow of $200 Million with probability .6, or $100 Million with probability .4. This is a one-time, one year project and then the firm will be shut down. In addition there is a project P that will generate $40 Million in either state next year. This new project requires funding of $30 million which the firm does not have, and so say he would have to issue junior debt to obtain the capital to undertake the project. Assume that all cash flows are discounted at 0%. a. Do you expect the manager to undertake the new project P? Explain how he would acquire the capital – in other words, what is the face value for the new junior debt. (The existing debt has a pari passu covenant it turns out that disallows senior debt)? b. The manager asks you to forgive $40 million in debt down to a new face value of $110 million. Again…arrow_forwardA start-up company Amazonian.com is considering expanding into new product markets. The expansion will require an initial investment of $160 million and is expected to generate perpetual EBIT of $40 million per year. After the initial investment, future capital expenditures are expected to equal depreciation, and no further additions to net working capital is anticipated. Amazonian.com’s existing capital structure is composed of equity with a market value of $500 million and debt with a market value of $300 million, and has 10 million shares outstanding. The unlevered cost of capital for Amazonian.com is 10%, and Amazonian.com’s debt is risk free with an interest of 4%. The expansion into the new product market will have the same business risk as Amazonian.com’s existing assets. The corporate tax rate is 35%, there are no personal taxes or costs of financial distress. a) Amazonian.com initially proposes to fund the expansion by issuing equity. If investors were not expecting this…arrow_forwardNeed help to solve thisarrow_forward

- Rentz Corporation is investigating the optimallevel of current assets for the coming year. Management expects sales to increase toapproximately $2 million as a result of an asset expansion presently being undertaken.Fixed assets total $1 million, and the firm plans to maintain a 60% debt-to-assets ratio.Rentz’s interest rate is currently 8% on both short- and long-term debt (which the firmuses in its permanent structure). Three alternatives regarding the projected currentassets level are under consideration: (1) a restricted policy where current assets wouldbe only 45% of projected sales, (2) a moderate policy where current assets would be 50%of sales, and (3) a relaxed policy where current assets would be 60% of sales. Earningsbefore interest and taxes should be 12% of total sales, and the federal-plus-state taxrate is 40%.a. What is the expected return on equity under each current assets level?b. In this problem, we assume that expected sales are independent of the current…arrow_forwardDynamo Corp. produces annual cash flows of $150 and is expected to exist forever. The company is currently financed with 75 percent equity and 25 percent debt. Your analysis tells you that the appropriate discount rates are 10 percent for the cash flows, and 7 percent for the debt. You currently own 10 percent of the stock. If Dynamo wishes to change its capital structure from 75 percent to 60 percent equity, what transaction do you need to take in order to undo the restructuring according to M&M Proposition 1? O Sell $22.50 of stock O Sell $10.80 worth of stock O Buy $22.50 worth of debt O Buy $10.80 worth of debtarrow_forwardRentz Corporation is investigating the optimal level of current assets for the coming year. Management expects sales to increase to approximately $4 million as a result of an asset expansion presently being undertaken. Fixed assets total $1 million, and the firm plans to maintain a 55% debt-to - assets ratio. Rentz's interest rate is currently 10% on both short-term and long-term debt (which the firm uses in its permanent structure). Three alternatives regarding the projected current assets level are under consideration: (1) a restricted policy where current assets would be only 45% of projected sales, (2) a moderate policy where current assets would be 50% of sales, and (3) a relaxed policy where current assets would be 60% of sales. Earnings before interest and taxes should be 12% of total sales, and the federal-plus-state tax rate is 40%. What is the expected return on equity under each current assets level? Round your answers to two decimal places. Restricted policy % Moderate…arrow_forward

- Rentz Corporation is investigating the optimal level of current assets for the coming year. Management expects sales to increase to approximately $4 million as a result of an asset expansion presently being undertaken. Fixed assets total $1 million, and the firm plans to maintain a 60% debt-to-assets ratio. Rentz's interest rate is currently 10% on both short- term and long-term debt (which the firm uses in its permanent structure). Three alternatives regarding the projected current assets level are under consideration: (1) a restricted policy where current assets would be only 45% of projected sales, (2) a moderate policy where current assets would be 50% of sales, and (3) a relaxed policy where current assets would be 60% of sales. Earnings before interest and taxes should be 13% of total sales, and the federal-plus-state tax rate is 40%. a. What is the expected return on equity under each current assets level? Round your answers to two decimal places. Restricted policy Moderate…arrow_forwardPlease help with correct answers asap.arrow_forwardRentz Corporation is investigating the optimal level of current assets for the coming year. Management expects sales to increase to approximately $2 million as a result of an asset expansion presently being undertaken. Fixed assets total $3 million, and the firm plans to maintain a 60% debt-to-assets ratio. Rentz's interest rate is currently 10% on both short-term and long-term debt (which the firm uses in its permanent structure). Three alternatives regarding the projected current assets level are under consideration: (1) a restricted policy where current assets would be only 45% of projected sales, (2) a moderate policy where current assets would be 50% of sales, and (3) a relaxed policy where current assets would be 60% of sales. Earnings before interest and taxes should be 11% of total sales, and the federal-plus- state tax rate is 40%. a. What is the expected return on equity under each current assets level? Round your answers to two decimal places. Restricted policy Moderate…arrow_forward

- The second image is the data table in the question, thank youarrow_forwardDyrdek Enterprises has equity with a market value of $1.8 million and the market value of debt is $3.55 million. The company is evaluating a new project that has more risk than the firm. As a result, the company will apply a risk adjustment factor of 1.6 percent. The new project will cost $2.20 million today and provide annual cash flows of $576,000 for the next 6 years. The company's cost of equity is 11.07 percent and the pretax cost of debt is 4.88 percent. The tax rate is 21 percent. What is the project's NPV?arrow_forwardDubai Corporation manufactures construction equipment. It is currently at its target debt– equity ratio of .70. It’s considering building a new $45 million manufacturing facility. This new plant is expected to generate after-tax cash flows of $6.2 million a year in perpetuity. The company raises all equity from outside financing. There are three financing options: A new issue of common stock: The flotation costs of the new common stock would be 8 percent of the amount raised. The required return on the company’s new equity is 14 percent. A new issue of 20-year bonds: The flotation costs of the new bonds would be 4 percent of the proceeds. If the company issues these new bonds at an annual coupon rate of 8 percent, they will sell at par. Increased use of accounts payable financing: Because this financing is part of the company’s ongoing daily business, it has no flotation costs, and the company assigns it a cost that is the same as the overall firm WACC. Management has a target ratio…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT