FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

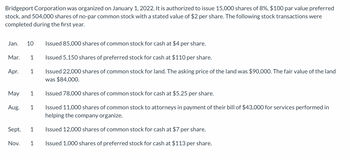

Transcribed Image Text:Bridgeport Corporation was organized on January 1, 2022. It is authorized to issue 15,000 shares of 8%, $100 par value preferred

stock, and 504,000 shares of no-par common stock with a stated value of $2 per share. The following stock transactions were

completed during the first year.

Jan. 10 Issued 85,000 shares of common stock for cash at $4 per share.

Issued 5,150 shares of preferred stock for cash at $110 per share.

Issued 22,000 shares of common stock for land. The asking price of the land was $90,000. The fair value of the land

was $84,000.

Mar. 1

Apr.

May

Aug.

Sept.

Nov.

1

Issued 78,000 shares of common stock for cash at $5.25 per share.

Issued 11,000 shares of common stock to attorneys in payment of their bill of $43,000 for services performed in

helping the company organize.

Issued 12,000 shares of common stock for cash at $7 per share.

1 Issued 1,000 shares of preferred stock for cash at $113 per share.

1

1

1

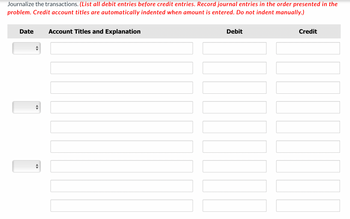

Transcribed Image Text:Journalize the transactions. (List all debit entries before credit entries. Record journal entries in the order presented in the

problem. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Date Account Titles and Explanation

|||||||

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- CURCord Corporation was organized on January 1, 2022. It is authorized to issue 14,000 shares of 8%, $100 par value preferred stock, and 511,000 shares of no-par common stock with a stated value of $3 per share. The following stock transactions were completed during the first year. Jan. 10 Mar. Apr May Aug. (a) (b) 1 (c) 1 Sept. 1 Nov. 1 1 1 Issued 82,000 shares of common stock for cash at $6 per share. Issued 4,850 shares of preferred stock for cash at $105 per share. Issued 25,000 shares of common stock for land. The asking price of the land was $93,000. The fair value of the land was $82,000. Issued 76.500 shares of common stock for cash at $4.50 per share. Issued 11,000 shares of common stock to attorneys in payment of their bill of $41.500 for services performed in helping the company organize. Issued 12,000 shares of common stock for cash at $7 pershare. Issued 2.500 shares of preferred stock for cash at $112 pershare. Prepare the paid-in capital section of stockholders' equity…arrow_forwardPaydirt Limestone, Incorporated was organized several years ago and was authorized to issue 3,750,000 shares of $2 par value common stock. In its fifth year, the corporation has the following transactions: Mar. 1 Purchased 2,000 shares of its own common stock at $15 per share Apr. 10 Reissued 1,000 shares of its common stock held in the treasury for $18 per share. Jun. 12 Reissued 1,000 shares of common stock at $12 per share Journalize the above transactions.arrow_forwardWhen Wisconsin Corporation was formed on January 1, the corporate charter provided for 95,400 shares of $10 par value common stock. During its first month of operation, the corporation issued 8,990 shares of stock at a price of $21 per share. The journal entry for this transaction would include a a. debit to Common Stock for $95,400 b. debit to Cash for $89,900 c. credit to Paid-In Capital in Excess of Par—Common Stock for $98,890 d. credit to Common Stock for $188,790arrow_forward

- Eastport Incorporated was organized on June 5, Year 1. It was authorized to issue 430,000 shares of $11 par common stock and 40,000 shares of 5 percent cumulative class A preferred stock. The class A stock had a stated value of $25 per share. The following stock transactions pertain to Eastport Incorporated: a. Issued 17,000 shares of common stock for $16 per share. b. Issued 10,000 shares of the class A preferred stock for $30 per share. c. Issued 54,000 shares of common stock for $19 per share. Required Prepare the stockholders' equity section of the balance sheet immediately after these transactions. EASTPORT INCORPORATED Balance Sheet (partial) For the Year Ended Year 1 Stockholders' Equity Total Paid-In Capital Total stockholders' equityarrow_forwardTolkin Corporation was organized on January 1, 2019, with an authorization of 5,000,000 shares of $1 par value common stock. During 2019,Tolkin had the following common stock transactions: Jan. 4 Issued 300,000 shares @ $8 per share. Apr. 8: Issued 100,000 shares @ $6 per share. July 29: Purchased 90,000 shares (treasury) @ $7 per share. Oct. 18: Sold 60,000 shares held in treasury @ $9 per share. Dec. 31: Sold 30,000 shares held in treasury @ $6 per share. Tolkin had no other transactions affecting paid-in capital. At December 31, 2019, what is the total amount of paid-in capital? Select one: a. $3,120,000 b. $3,090,000 c. $2,660,000 d. $2,720,000 e. None of the abovearrow_forwardFeeney Corporation is authorized to issue 200,000 shares of $1 par value common stock and 50,000 shares of $10 par value preferred stock. During the year the company issued the following shares: Feb 2 Issued 20,000 shares of common stock, $1 par value, for cash of $40,000. Mar 17 Issued 2,000 shares of preferred stock, $10 par value, for cash of $25,000. May 24 Issued 10,000 shares of common stock, $1 par value, for cash of $30,000. Aug 15 Purchased 2,000 shares of common stock for $28,000 to put into the treasury. Oct 12 Sold 1,000 shares of treasury stock for $16 per share. a. How many common shares have been issued? b. How many common shares are outstanding? c. How many preferred shares…arrow_forward

- Eastport Incorporated was organized on June 5, Year 1. It was authorized to issue 300,000 shares of $10 par common stock and 50,000 shares of 5 percent cumulative class A preferred stock. The class A stock had a stated value of $50 per share. The following stock transactions pertain to Eastport Incorporated during Year 1: 1.Issued 15,000 shares of common stock for $12 per share. 2.Issued 5,000 shares of the class A preferred stock for $51 per share. Repurchased as treasury stock 500 shares of common stock for $8 per share. Sold 100 shares of treasury stock for $14 per share. Declared a $130,000 total dividend. Paid the dividend, with appropriate amounts going to preferred stock and common stock investors. Eastport reported a $479,000 net income for the year. Required Prepare general journal entries for these transactions. What amount of dividends went to common stock shareholders & preferred stock shareholders? Prepare the stockholders’ equity section of the balance sheet…arrow_forwardOn January 1, Vermont Corporation had 46,400 shares of $9 par value common stock issued and outstanding. All 46,400 shares had been issued in a prior period at $22 per share. On February 1, Vermont purchased 1,010 shares of treasury stock for $24 per share and later sold the treasury shares for $22 per share on March 1. The journal entry to record the purchase of the treasury shares on February 1 would include aarrow_forwardEastport Incorporated was organized on June 5, Year 1. It was authorized to issue 370,000 shares of $9 par common stock and 60,000 shares of 4 percent cumulative class A preferred stock. The class A stock had a stated value of $25 per share. The following stock transactions pertain to Eastport Incorporated: Issued 25,000 shares of common stock for $14 per share. Issued 14,000 shares of the class A preferred stock for $30 per share. Issued 49,000 shares of common stock for $17 per share. Requireda. Prepare general journal entries for these transactions.b. Prepare the stockholders’ equity section of the balance sheet immediately after these transactions.arrow_forward

- Moon Corporation received a charter that authorized the issuance of 119,000 shares of $7 par common stock and 19,000 shares of $75 par, 8 percent cumulative preferred stock. Moon Corporation completed the following transactions during its first two years of operation. Year 1 January 5 Sold 17,850 shares of the $7 par common stock for $9 per share. January 12 Sold 1,900 shares of the 8 percent preferred stock for $85 per share. April 5 Sold 23,800 shares of the $7 par common stock for $11 per share. December 31 During the year, earned $302,000 in cash revenue and paid $240,100 for cash operating expenses. December 31 Declared the cash dividend on the outstanding shares of preferred stock for Year 1. The dividend will be paid on February 15 to stockholders of record on January 10, Year 2. December 31 Closed the revenue, expense, and dividend accounts to the retained earnings account. Year 2 February 15 Paid the cash dividend declared on December 31, Year 1. March 3…arrow_forwardWhen Wisconsin Corporation was formed on January 1, the corporate charter provided for 115,800 shares of $15 par value common stock. During its first month of operation, the corporation issued 7,940 shares of stock at a price of $25 per share. The journal entry for this transaction would include a a.credit to Common Stock for $198,500 b.debit to Cash for $119,100 c.credit to Paid-In Capital in Excess of Par—Common Stock for $79,400 d.debit to Common Stock for $115,800arrow_forwardBridgeport Corporation is authorized to issue both preferred and common stock. The par value of the preferred is $50. During the first year of operations, the company had the following events and transactions pertaining to its preferred stock. Feb. 1 Issued 22,500 shares for cash at $56 per share. July 1 Issued 14,000 shares for cash at $60 per share. Journalize the transactions. (List all debit entries before credit entries. Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Feb. 1 く Cash Preferred Stock Paid-in Capital in Excess of Par-Preferred Stock July 1 く Cash Preferred Stock Paid-in Capital in Excess of Par-Preferred Stock eTextbook and Media List of Accounts Debit 1260000 840000 Credit 11250C 1350C 7000C 1400C Assistance Used Assistance Used Post to the stockholders' equity accounts. (Post entries in the order of journal entries…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education