FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Prepare schedule to compute the ending inventory at February 28, 2017, under LIFO inventory method. (Round unit costs to 2

decimal places, e.g. 5.25 and final answers to 0 decimal places, e.g. 5,272.)

SUNLAND Company

COMPUTATION OF INVENTORY FOR PRODUCT

XL5500 UNDER LIFO INVENTORY METHOD

Units

Unit Cost

Total Cost

$4

%24

%24

>

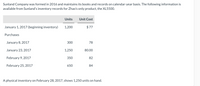

Transcribed Image Text:Sunland Company was formed in 2016 and maintains its books and records on calendar-year basis. The following information is

available from Sunland's inventory records for Zhao's only product, the XL5500.

Units

Unit Cost

January 1, 2017 (beginning inventory)

1,200

$ 77

Purchases

January 8, 2017

300

78

January 23, 2017

1,250

80.00

February 9, 2017

350

82

February 25, 2017

650

84

A physical inventory on February 28, 2017, shows 1,250 units on hand.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Do not give answer in imagearrow_forwardUse data below to calculate the cost of ending inventory using the LIFO periodic inventory system method.January 1 Beginning Inventory 20 units at $20 eachJanuary 10 Purchase 24 units at $25 eachJanuary 31 Purchase 25 units at $28 eachOn January 31, ending Inventory consisted of 32 units. a. $750 b. $680 c. $700 d. $600arrow_forwardOriole Company uses a periodic inventory system and reports the following for the month of June. Date June 1 12 23 30 Explanation Units Inventory Purchase Purchase Inventory Cost of the ending inventory 130 Cost of goods sold 400 210 212 $ Unit Cost $ $5 6 7 Compute the cost of the ending inventory and the cost of goods sold under FIFO, LIFO, and average-cost. (Round per unit cost to 3 decimal places, e.g. 15.647 and final answers to O decimal places, e.g. 5,125.) Total Cost FIFO $650 2,400 1,470 $ $ LIFO $ $ Average-costarrow_forward

- Helparrow_forwardTeal Mountain Inc. uses a periodic inventory system and reports the following for the month of June. Date Explanation Units Unit Cost Total Cost June 1 Inventory 130 $5 $ 650 12 Purchases 370 6 2,220 23 Purchases 200 7 1,400 30 Inventory 240 Calculate weighted-average unit cost. (Round answer to 3 decimal places, e.g. 5.125.) Weighted-average unit cost $enter a weighted-average unit cost in dollars eTextbook and Media Compute the cost of the ending inventory and the cost of goods sold under FIFO, LIFO, and average-cost. (Round answers to 0 decimal places, e.g. 125.) FIFO LIFO Average-cost The cost of the ending inventory $enter a dollar amount $enter a dollar amount $enter a dollar amount The cost of goods sold $enter a dollar amount $enter a dollar amount $enter a dollar amountarrow_forwardView Policies Current Attempt in Progress Whispering Inc. uses LIFO inventory costing. At January 1, 2025, inventory was $211,879 at both cost and market value. At Decembe 31, 2025, the inventory was $287,291 at cost and $270,300 at market value. Prepare the necessary December 31 entry under (a) the cost-of-goods-sold method and (b) the loss method. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) No. Account Titles and Explanation (a) (b) List of Accounts Save for Later O Search Debit co DELL Attempts: 0 of 15 used M Credit 1 Submit Answerarrow_forward

- Required: Determine the cost assigned to ending inventory and to cost of goods sold using FIFO. Date January 01 January 09 January 19 January 25 January 30 Activities Beginning inventory Sales Purchase Sales Purchase Totals Perpetual FIFO Units available 175 units from beginning inventory 130 units purchased on January 19 275 units purchased on January 30 Totals Units Acquired at Cost Units Cost Total cost per unit 175 130 275 580 $10.00 $1,750.00 135 $9.00 $7.00 1,170.00 Cost of Goods Sold - Jan 9 Units Cost per unit Cost of goods sold $1,350.00 135 $10.00 $9.00 $7.00 1,925.00 $4,845.00 $1,350.00 Units Sold at Retail Units Selling Total Sales price per unit 135 140 275 $19.00 0 $19.00 $2,565.00 2,660.00 $5,225.00 Cost of Goods Sold - Jan 25 Units Cost Cost of per unit goods sold $10.00 $9.00 $7.00 $0.00 Ending Inventory Units Cost per unit $10.00 $9.00 $7.00 Inventory $0.00arrow_forward9. Sylvia's Designs Co. had the following inventory activity during April: Unit Units 100 Cost $10 Beginning inventory Purchase (April 3) Sale (April 10) Purchase (April 18) Purchase (April 23) Sale (April 28) 50 12 80 40 14 60 15 120 Assuming Sylvia's uses a periodic LIFO cost flow assumption, ending inventory for April would be a. $2,560 b. $ 750 c. $2,310 d. $ 500arrow_forwardProblem 1 of 2 (note additional problem below): Calculate the cost of goods sold dollar value and the value of ending inventory for En Cee Yo0 Company for the sale on March 11, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for (a) first-in, first-out (FIFO); (b) last-in, first-out (LIF0); and (c) weighted average (AVG). You must show your work and calculations--answers that are correct but do not show calculations are graded as a zero grade. Place your answers in the shaded cells. Number of Units Unit Cost 110 $ Beginning inventory, March 1 Purchased inventory, March 8 86 140 $ 90 Sold inventory for $110 per unit, March 11 95 If you use the FIFO method, the dollar value of COGS is → and the dollar value of ending inventory is- If you use the LIFO method, the dollar value of COGS is - and the dollar value of ending inventory is- If you use the Weighted Average method, the dollar value of…arrow_forward

- Subject: accountingarrow_forwardGiven the following information, determine the cost of the inventory at June 30 using the LIFO perpetual inventory method. Date June 1 June 15 June 29 Activities Beginning inventory Sale Purchase The cost of the ending inventory is: Units Acquired at Cost 15 units @ $29 = $435 8 units @ $34 = $272 Units Sold at Retail 6 units @ $59arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education