FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

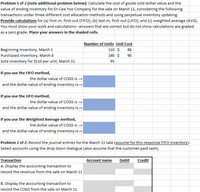

Transcribed Image Text:Problem 1 of 2 (note additional problem below): Calculate the cost of goods sold dollar value and the

value of ending inventory for En Cee Yo0 Company for the sale on March 11, considering the following

transactions under three different cost allocation methods and using perpetual inventory updating.

Provide calculations for (a) first-in, first-out (FIFO); (b) last-in, first-out (LIF0); and (c) weighted average (AVG).

You must show your work and calculations--answers that are correct but do not show calculations are graded

as a zero grade. Place your answers in the shaded cells.

Number of Units Unit Cost

110 $

Beginning inventory, March 1

Purchased inventory, March 8

86

140 $

90

Sold inventory for $110 per unit, March 11

95

If you use the FIFO method,

the dollar value of COGS is →

and the dollar value of ending inventory is-

If you use the LIFO method,

the dollar value of COGS is -

and the dollar value of ending inventory is-

If you use the Weighted Average method,

the dollar value of COGS is -

and the dollar value of ending inventory is→

Problem 2 of 2: Record the journal entries for the March 11 sale (assume for this response FIFO inventory):

Select accounts using the drop down dialogue (also assume that the customer paid cash).

Transaction

Account name

Debit

Credit

A. Display the accounting transaction to

record the revenue from the sale on March 11

B. Display the accounting transaction to

record the COGS from the sale on March 11

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required:Hemming uses a periodic inventory system. (a) Determine the costs assigned to ending inventory and to cost of goods sold using FIFO.arrow_forwardinventory as your base numper and adjust the couss amount to the required amount to make the Total Goods Available for Sale to the total of the Value of the ending inventory and the COGS total. Negative value should be indicated with minus sign. Round your intermediate and final answers to 2 decimal places.) \table[[Date,, \table [[Purchases/Transportation - In /], [(PurchaseReturns/Discounts)]], \table [[Cost of Goods Sold/(Returns to], [Inventory)]], Balance in Inventory], [Units, Cost/Unit, Total $, Units, Cost/Unit, Total $, Units, \table[[Avg], [ Cost/Unit]], Total $], [Mar., Brought Forward,,r, 61, $, 93.00, $, 5, 673.00 Telamark Company uses the moving weighted average method for inventory costing. Required: The following incomplete inventory sheet regarding Product W506 is available for the month of March 2023. Complete the inventory sheet. (Use the value of the ending inventory as your base number and adjust the COGS $ amount to the required amount to make the Total Goods…arrow_forwardCalculate a) cost of goods sold, b) ending inventory, and c) gross margin for A76 Company, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for first-in, first-out (FIFO). Numberof Units Unit Cost Sales Beginning Inventory 260 $140 Sold 160 $180 Purchased 510 143 Sold 400 182 Purchased 420 150 Sold 370 184 Ending Inventory 260 FIFO (perpetual) Inventory Cost of Goods Purchased Cost of Goods Sold Cost of Inventory Remaining Numberof Units Unit Cost Total Cost Numberof Units Unit Cost Total Cost Numberof Units Unit Cost Total Cost Beginning fill in the blank 1 $fill in the blank 2 $fill in the blank 3 Sale fill in the blank 4 $fill in the blank 5 $fill in the blank 6 fill in the blank 7 fill in the blank 8 fill in the blank 9 Purchase fill in the blank 10 $fill in the…arrow_forward

- Inventory Costing Methods and the Periodic MethodKay & Company experienced the following events in March: Date Event Units Unit Cost Total Cost Mar. 1 Purchased inventory 100 @ $16 $1,600 Mar. 3 Sold inventory 60 Mar. 15 Purchased inventory 100 @ 18 $1,800 Mar. 20 Sold inventory 40 If Kay & Company uses the weighted-average cost method, calculate the company’s cost of goods sold and ending inventory as of March 31 assuming the periodic method.(Round answer to two decimal places, if needed.)arrow_forwardPlease see imagearrow_forwardUMET's Stores had the following inventory transactions in 2020: Transaction Units Cost per unit 1/1 Balance 50 $6 2/14 Sale 25 5/23 Purchase 100 8 8/21 Sale 50 11/5 Purchase 25 12 11/18 Sale 95 Required: Compute tge cost of goods sold and the ending inventory using the periodic inventory system for each of the following cost flow assumptions: a. FIFO b. LIFO c. Weighted averagearrow_forward

- Please help me. Thankyou.arrow_forwardd The records of Cordova Corp. showed the following transactions, in the order given, relating to the major inventory item: Required: Complete the following schedule for each independent assumption. (Round unit costs to the nearest cent.) a. 1. Inventory 2. Purchase 3. Sale (at $15.20) 4. Purchase 5. Sale (at $15.20) 6. Purchase 7. Sale (at $18.20) 8. Purchase Independent Assumptions FIFO Weighted average, periodic inventory system Moving average, perpetual inventory system b. Unit Units Cost 5,600 $7.00 11,200 7.30 7,900 10,200 7.60 16,800 18,800 7.76 16,800 11,200 7.90 C. $ Ending Inventory 121,848 121,675 X 121,676 Units and Amounts Cost of Goods Sold $ 311,000 311,064 311,328 $ Gross Margin 370,200 370,136 X 369,872arrow_forwardReyarrow_forward

- Please do not give image formatarrow_forwardIdentify which of the following statement is correct for perpetual inventory system? Under the perpetual Inventory system, on the purchase of Inventory purchase account is debited. When valuing ending Inventory under a perpetual Inventory system, oldest units purchased during the period using FIFO are allocated to the cost of goods sold when units are sold. When valuing ending Inventory under a perpetual Inventory system, weighted average cost method requires that a new weighted average unit cost be calculated after every sale. 09/03/2024 15:01 When valuing ending Inventory under a perpetual inventory system, valuation using weighted average is the same as the valuation using weighted average under the periodic Inventory system.arrow_forwardThe following information is taken from a company’s records. Costper Unit Market valueper Unit Inventory Item 1 (10 units) $39 $38 Inventory Item 2 (22 units) 19 19 Inventory Item 3 (12 units) 9 11 Applying the lower-of-cost-or-market approach, what is the correct value that should be reported on the balance sheet for the inventory? $fill in the blank 1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education