FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

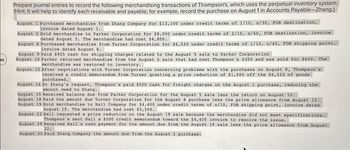

Transcribed Image Text:45

Prepare journal entries to record the following merchandising transactions of Thompson's, which uses the perpetual inventory system.

(Hint: It will help to identify each receivable and payable; for example, record the purchase on August 1 in Accounts Payable-Zhang.)

August 1 Purchased merchandise from Zhang Company for $13,100 under credit terms of 1/10, n/30, FOB destination,

invoice dated August 1.

August 5 Sold merchandise to Parker Corporation for $8,000 under credit terms of 2/10, n/60, FOB destination, invoice

dated August 5. The merchandise had cost $4,800.

August 8 Purchased merchandise from Turner Corporation for $6,520 under credit terms of 1/10, n/45, FOB shipping point,

invoice dated August 8.

August 9 Paid $925 cash for shipping charges related to the August 5 sale to Parker Corporation

August 10 Parker returned merchandise from the August 5 sale that had cost Thompson's $300 and was sold for $600. The

merchandise was restored to inventory.

August 12 After negotiations with Turner Corporation concerning problems with the purchases on August 8, Thompson's

received a credit memorandum from Turner granting a price reduction of $1,000 off the $6,520 of goods

purchased.

August 14 At Zhang's request, Thompson's paid $500 cash for freight charges on the August 1 purchase, reducing the

amount owed to Zhang..

August 15 Received balance due from Parker Corporation for the August 5 sale less the return on August 10.

August 18 Paid the amount due Turner Corporation for the August 8 purchase less the price allowance from August 12.

August 19 Sold merchandise to Hall Company for $4,400 under credit terms of n/10, FOB shipping point, invoice dated

August 19. The merchandise had cost $2,200.

August 22 Hall requested a price reduction on the August 19 sale because the merchandise did not meet specifications.

Thompson's sent Hall a $500 credit memorandum toward the $4,400 invoice to resolve the issue.

August 29 Received Hall's cash payment for the amount due from the August 19 sale less the price allowance from August

22.

August 30 Paid Zhang Company the amount due from the August 1 purchase.

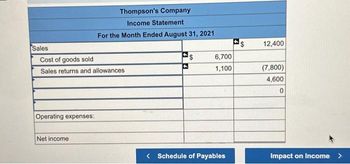

Transcribed Image Text:Sales

Cost of goods sold

Sales returns and allowances

Operating expenses:

Thompson's Company

Income Statement

For the Month Ended August 31, 2021

Net income

$

6,700

1,100

< Schedule of Payables

4

SA

12,400

(7,800)

4,600

0

Impact on Income >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- p. Using the perpetual inventory system, journalize the entries for the following selected transactions: i. Sold merchandise to customers who used MasterCard and VISA, $9,500. The cost of the merchandise sold was $5,300. ii. Paid an invoice from First National Bank for $385, representing a service fee for processing MasterCard and VISA sales. Date Description Post. Debit Credit Ref. 90269-1arrow_forwardRetro Clothes uses a perpetual inventory system. Journalize the following transactions for Retro Clothes. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries. Assume the company uses the gross method to record sales. Round all numbers to the nearest whole dollar.) View the transactions. Aug. 1: Purchased $6,600 of merchandise inventory on account under terms 3/10, n/EOM and FOB shipping point from NYC Clothes. Date Aug. 1 Accounts Debit Credit Transactions Aug. 1 Aug. 5 Aug. 7 Aug. 8 Purchased $6,600 of merchandise inventory on account under terms 3/10, n/EOM and FOB shipping point from NYC Clothes. Returned $400 of defective merchandise purchased on August 1. Paid freight bill of $250 on August 1 purchase. Sold merchandise inventory on account for $2,400 to Youth Outfitters. Payment terms were 2/15, n/30. These goods cost the company $1,100. Aug. 10 Paid amount owed on credit purchase of August 1, less the return and the…arrow_forwardCan you help me explain how does it work? what is $5000 stand for and $2400 stand for? A seller uses a perpetual inventory system and on April 4 it sells $5,000 in merchandise with a cost of $2,400 to a customer on credit terms of 3/10, n/30. Complete the two journal entries to record the sales transaction by selecting the account names from the drop-down menus and entering the dollar amounts in the debit or credit columns. The first journal entry is to record the revenue part of the transaction and the second journal entry is to record the cost part.arrow_forward

- You are to enter up the sale, purchases, return inwards and returns outwards day book" from the following details. then to post the items to the relevant accounts in the sales and purchases ledgern, The total of the day books are then to be transferred to the account in the general Ledger. 2009 in drawing May 1 Credit sales: T 0mpson Tshs 56,000; L Rodriguez Tshs 148,000; K Barton Tshs 145.000. 3 Credit purchase: P Potter 144.000'. H Harris Tshs 25000 Spencer Tshs 76.000. 7 credit sales K Kelly 89.000; N Mendes Toho 78.000; N lee Tshs 237,000. 9 Credit purchases: B Perkins 24,000; H Haris Tshs 58000 H miles Tshs 123000 11 Good return by to: p Potter Tshs 12000 B. Spencer Tshs22.000. 14 Goods returned to by: T. Thompson Tshs 5.000; K Barton Tshs 11,000; K Kelly Tshs 14000. 17 Credit purchases: H Harris Tshs 54,000; B Perkins Tshs 65000L Nixon Tshs 75.000. 20 Goods returned by us to B Spences Tshs 14000 24 credit sales: K Muhammed Tshs 57000 , K Kelly Tshs 65000, O . Green Tshs 112000 28…arrow_forwardCaesar Company uses a sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal. Journalize the following transactions that should be recorded in the sales journal. June 5 Purchased $3,800 of merchandise on credit from Roman Corp. 9 Sold merchandise costing $1,245 to R. Allen for $2,075, terms n/10, Invoice No. 2080. 12 Sold merchandise costing $690 to J. Meyer for $1,150 cash, Invoice No. 2081. 19 Received $2,075 cash from R. Allen to pay for the purchase of June 9. 27 Sold merchandise costing $875 to B. Kraft for Date Account Debited SALES JOURNAL Invoice Number $1,250, terms n/10, Invoice No. 2082. Accounts Receivable Dr. Sales Cr. Cost of Goods Sold Dr. Inventory Cr.arrow_forwardJournalize the following merchandise transactions. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. Mar. 1 Sold merchandise on account, $74,200 with terms 2/10, n/30. The cost of the merchandise sold was $43,300. 9 Received payment less the discount. 13 Issued a $2,500 credit memo for damaged merchandise. The customer agreed to keep the merchandise.arrow_forward

- Instructions In this assignment you will record eight transactions related to the sale and purchase of merchandise. You will record each transaction according to the procedures of a periodic inventory system. You will record each transaction according to the procedures of a perpetual inventory system. Include the date for each transaction. Include a brief explanation for each entry similar to the sample entry example. Please skip a line between each transaction entry. You may use the journals provided or create your own journals. If you create your own journals they must have a date column, description column, a debit column and a credit column. You may hand write the journal entries or type them. Transactions to Record Sample Ace Company issues a $200 Sales Allowance to a customer who received damaged merchandise purchased in Feb from Ace. Mar 1 Ace Company sells merchandise totaling $1,500 on account with terms 2/15, n/30, FOB destination. Cost of goods is…arrow_forwardNow record the cost of the putters sold on the 6th. Date Nov. 6 Accounts and Explanation Cost of Goods Sold Merchandise Inventory To record the cost of goods sold. Debit Creditarrow_forwardThe question is on the photo. Thanks!arrow_forward

- Journalize the following merchandise transactions. The company uses the perpetual inventory system. a. Sold merchandise on account, $14,900 with terms 2/10, net 30. The cost of the goods sold was $9,685. If an amount box does not require an entry, leave it blank. b. Received payment within the discount period. If an amount box does not require an entry, leave it blank.arrow_forwardThe following are the transactions of CARI, INC during 2022: The company follows a periodic inventory system 04.01.2022 Purchases merchandise, in cash SR 100,000.00 01.03.2022 Sales merchandise, on credit SR 180,000.00 06.03.2022 Customer takes discount and pays SR 162,000.00 15.10.2022 Pays downtow's shop rent SR 4,000.00 30.12.2022 Purchases a machinery, in cash SR 35,000.00 31.12.2022 Closes beginning inventory SR 30,000.00 31.12.2022 Records the ending inventory SR 12,000.00 31.12.2022 Revenues & expenses balanced off TBD Record the transactions, prepare the trial balance and show the following financial statements: → Balance sheet (Statement of Financial Position) as of 31.12.2022 → Profit & Loss account (Income Statement) for 2022arrow_forward1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education