FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Saved

Prepare journal entries to record the following merchandising transactions of Lowe's, which uses the perpetual inventory system and

the gross method. Hint: It will help to identify each receivable and payable; for example, record the purchase on August 1 in Accounts

Payable-Aron.

1 Purchased merchandise from Aron Company for $7,000 under credit terms of l/10, n/30, FOB destination, invoice

dated August 1.

5 Sold merchandise to Baird Corp. for $4,900 under credit terms of 2/10, n/60, FOB destination, invoice dated

August 5. The merchandise had cost $3,000.

8 Purchased merchandise from Waters Corporation for $6, 000 under credit terms of 1/10, n/45, FOB shipping point,

invoice dated August 8.

9 Paid $100 cash for shipping charges related to the August 5 sale to Baird Corp.

10 Baird returned merchandise from the August 5 sale that had cost Lowe's $500 and was sold for $1,000. The

merchandise was restored to inventory.

12 After negotiations with Waters Corporation concerning problems with the purchases on August 8, Lowe's received a

price reduction from Waters of $600 off the $6,000 of goods purchased. Lowe's debited accounts payable for $600.

14 At Aron's request, Lowe's paid $230 cash for freight charges on the August1 purchase, reducing the amount owed

(accounts payable) to Aron.

15 Received balance due from Baird Corp. for the August 5 sale less the return on August 10.

18 Paid the amount due Waters Corporatic

19 Sold merchandise to Tux Co. for $4,200 under credit terms of n/l0, FOB shipping point, invoice dated August 19.

The merchandise had cost $2,100.

22 Tux requested a price reduction on the August 19 sale because the merchandise did not meet specifications.

Lowe's gave a price reduction (allowance) of $700 to Tux, and credited Tux's accounts receivable for that

amount.

Aug.

for the August 8 purchase less the price allowance from August 12.

29 Received Tux's cash payment for the amount due from the August 19 sale less the price allowance from August 22.

30 Paid Aron Company the amount due from the August 1 purchase.

View transaction list

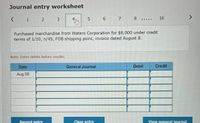

Transcribed Image Text:Journal entry worksheet

1

6.

7

8

16

..N .

Purchased merchandise from Waters Corporation for $6,000 under credit

terms of 1/10, n/45, FOB shipping point, invoice dated August 8.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Aug 08

Record entry

Clear entry

View general journal

Expert Solution

arrow_forward

Step 1

As student mentioned the specific date entry as on "Aug 08" i am providing the respective date journal entry alone. If you need complete entry just posted it,

Journal entry: Journal entry is a set of economic events that can be measured in monetary terms. These are recorded chronologically and systematically.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Transactions for buyer and seller Shore Co. sold merchandise to Blue Star Co. on account, $110,800, terms FOB shipping point, n/30. The cost of the goods sold is $66,480. Shore paid freight of $1,900. Shore Co, issued a credit memo for $7,900 to Blue Star Co. for merchandise that was returned. The cost of the merchandise returned was $4,000. Journalize Shore Co.'s entry for the sale, credit memo, and payment of amount due. If an amount box does not require an entry, leave it blank. Sale Credit Memo Payment Carrow_forwardan invoice dated oct 15 shows list price of $82 for the merchandise plus $30 shipping and handling. the terms are : trade discount of 20/10 and cash discount 2/10,1/20,n/30. invoice is paid Oct 24 calculate the amount needed to pay the invoice in fullarrow_forwardQ.22.arrow_forward

- Pierce Company sold merchandise to Stanton Company on account FOB shipping point, 1/10, net 30, for $9,500. Pierce prepaid the $285 shipping charge. Which of the following entries does Pierce make to record this sale? a.Accounts Receivable—Stanton, debit $9,785; Sales, credit $9,785 b.Accounts Receivable—Stanton, debit $9,500; Sales, credit $9,500 c.Accounts Receivable—Stanton, debit $9,500; Sales, credit $9,500, and Delivery Expense, debit $285; Cash, credit $285 d.Accounts Receivable—Stanton, debit $9,405; Sales, credit $9,405, and Accounts Receivable—Stanton, debit $285; Cash, credit $285arrow_forwardRecord the following transactions in general journal form for Ford Education Outfitters and Romero Textbooks, Inc. Ford Educational Outfitters bought merchandise on account from Romero Textbooks, Inc., invoice no. 10594, $1,888.13; terms net 30 days; FOB destination. Romero Textbooks, Inc., paid $90.31 for shipping. Ford Education Outfitters received credit memo no. 513A from Romero Textbooks, Inc., for merchandise returned, $149.93. Required: 1. For Ford Education Outfitters. Round your answers to the nearest cent. GENERAL JOURNAL PAGE DATE DESCRIPTION DOC. NO. POST. REF. DEBIT CREDIT (a) Purchased merchandise from Romero Textbooks, Inc., invoice no. 10594, terms n/30. (b) Credit memo no. 513A for return of merchandise. 2. For Romero Textbooks, Inc. Round your answers to the nearest cent.…arrow_forwardAn invoice is dated for June 28 for $8657 with terms of 8/10 EOM,ROG . The merchandise was received on July 3 , how much should be paid on or before August 1?arrow_forward

- Presented below are transactions related to Crane, Inc. May 10 (a) Purchased goods billed at $15,800 subject to cash discount terms of 2/10, r/60. Purchased goods billed at $13,800 subject to terms of 1/15, n/30. Paid invoice of May 10. Purchased goods billed at $10,300 subject to cash discount terms of 2/10, r/30. Your answer is partially correct. Prepare general journal entries for the transactions above under the assumption that purchases are to be recorded at net amounts after cash discounts and that discounts lost are to be treated as financial expense. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.) Date Account Titles and Explanation Accounts Payable Inventory Accounts Payable Debit 15800 13800 Credit 10arrow_forward1. Merchandise with a list price of $7,425 is purchased on account, terms FOB shipping point, n/30. The seller prepaid transportation costs of $300. Prior to payment, $1,000 of the merchandise is returned. The correct amount is paid within the discount period.(net method) Record the foregoing transactions of the buyer in the sequence indicated below. a) Purchased the merchandise b) Recorded receipt of the credit memorandum for merchandise returned. c) Paid the amount owed.arrow_forwardPurchases Transactions Barans Company purchased merchandise on account from Springhill Company for $12,400, terms 1/10, n/30. Barans returned merchandise with an invoice amount of $1,900 and received full credit. a. If Barans Company pays the invoice within the discount period, what is the amount of cash required for the payment? If required, round the answer to the nearest dollar.arrow_forward

- Entity J sold merchandise to Entity X on account, P23,000, terms 3/15, net 45. The cost of the merchandise sold is P18,500. Entity J issued a credit memorandum for P2,500 for merchandise returned that originally cost P1,900. Entity X paid the invoice within the discount period. What is the amount of net sales from the above transaction? A. 20,090 B. 20,467 О с. 19,885 O D. 16,102arrow_forwardJournalize the following merchandise transactions:c. Issued a credit memo to Wilson Company for returned merchandise that was sold for $4,000, terms n/30. The cost of the merchandise returned was $2,275arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education