FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:K

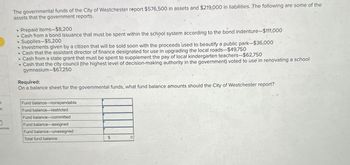

The governmental funds of the City of Westchester report $576,500 in assets and $219,000 in liabilities. The following are some of the

assets that the government reports.

•

Prepaid items-$8,200

Cash from a bond issuance that must be spent within the school system according to the bond indenture-$111,000

.Supplies-$5,200

• Investments given by a citizen that will be sold soon with the proceeds used to beautify a public park-$36,000

Cash that the assistant director of finance designated for use in upgrading the local roads-$49,750

Cash from a state grant that must be spent to supplement the pay of local kindergarten teachers-$62,750

Cash that the city council (the highest level of decision-making authority in the government) voted to use in renovating a school

gymnasium-$67,250

Required:

On a balance sheet for the governmental funds, what fund balance amounts should the City of Westchester report?

Fund balance-nonspendable

ht

Fund balance-restricted

ences

Fund balance-committed

Fund balance assigned

Fund balance-unassigned

Total fund balance

0

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- 2. The following information is available for the preparation of the government-wide financial statements for the City of Southern Springs as of April 30, 2024: Cash and cash equivalents, governmental activities $ 440,000 Cash and cash equivalents, business-type activities 926,000 Receivables, governmental activities 522,000 Receivables, business-type activities 1,542,000 Inventories, business-type activities 604,000 Capital assets, net, governmental activities 15,680,000 Capital assets, net, business-type activities 8,246,000 Accounts payable, governmental activities 754,000 Accounts payable, business-type activities 649,000 General obligation bonds, governmental activities 6,080,000 Revenue bonds, business-type activities 3,726,000 Long-term liability for compensated absences, governmental activities 417,000 Required: From the preceding information, prepare a Statement of Net Position for the City of Southern Springs as of April 30, 2024. Assume that…arrow_forward6arrow_forwardCentral City was awarded two state grants during its fiscal year ending September 30, 20X1: a $2 million block grant that can be used to cover any operating expenses incurred during fiscal 20X2, and a $1 million grant that can be used any time to acquire equipment for its police department. For the year ending September 30, 20X1, Central City should recognize in grant revenue in its fund financial statements (in millions): $0 $1 $2 $3 Assume the same facts as in the previous example. How much should the city recognize in grant revenue in its government‐wide statements? $0 $1 $2 $3 For its fiscal year ending September 30, 20X2, Twin City levied $500 million in property taxes. It collected taxes applicable to fiscal 20X2 as follows (in millions): June 1, 20X1, through September 30, 20X1 $ 20 October 1, 20X1, through September 30, 20X2 $440 October 1, 20X2, through November 30, 20X2 $ 15 December 20X2 $ 4 The city estimates that $10 million of the outstanding balance…arrow_forward

- The City of St. John operates an investment trust fund for neighboring governments, including St. John County and the independent school district. Assume the investment trust fund began the year 2024 with investments in U.S. government securities totaling $1,324,000, no liabilities, and Restricted Net Position of $1,324,000. The County and school district deposited $3,155,000 in the investment pool. The investment trust fund invested $726,000 in corporate bonds and $2,429,000 in U.S. government securities. Interest received by the investment trust fund totaled $128,000 for the year. At year-end, the fair value of the corporate bonds had increased by $1,600. The earnings of the fund (there are no expenses) are allocated among the accounts of the participating governments. Throughout the year, the participating governments withdrew $3,251,000 of funds from the investment trust fund. Assume that an equal amount of short-term investments were converted to cash as they matured. Required:…arrow_forwardIndicate (i) how each of the following transactions impacts the fund balance of the general fund, and its classifications, for fund financial statements and (ii) what impact each transaction has on the net position balance of the Government Activities on the government-wide financial statements.a. Issue a five-year bond for $6 million to finance general operations.b. Pay cash of $149,000 for a truck to be used by the police department.c. The fire department pays $17,000 to a government motor pool that services the vehicles of only the police and fire departments. Work was done on several department vehicles. d. Levy property taxes of $75,000 for the current year that will not be collected until four months into the subsequent year.e. Receive a grant for $7,000 that must be returned unless the money is spent according to the stipulations of the conveyance. That is expected to happen in the future.f. Businesses make sales of $20 million during the current year. The…arrow_forward2. Arsenal City applied for and received a grant of $50,000 from the Federal government to purchase computersfor the public library. Record this transaction in the city's journals from the perspective of government - wide governmental activities and the perspective of the General Fund. For governmental activities: Date Account Name Debit Credit For the General Fund: Date Account Name Debit Creditarrow_forward

- Revenue bonds to fund improvements to the town-owned electric utility $50 million,Conduit bonds issued to assist a fast‐food franchisee to construct a restaurant for $7 million, The amount that the city should report as an obligation in its government‐wide statement of net position and its proprietary funds balance sheet is A.) Government‐Wide $57 million, Proprietary Fund $57 million B.) Government‐Wide $50 million, Proprietary Fund $50 million C.) Government‐Wide $ 0, Proprietary Fund $ 0 D.) Government‐Wide $57 million , Proprietary Fund $arrow_forwardValaarrow_forwardThe governmental funds of the City of Westchester report $541,000 in assets and $156,000 in liabilities. The following are some of the assets that the government reports. Prepaid items—$10,900. Cash from a bond issuance that must be spent within the school system according to the bond indenture—$89,500. Supplies—$8,800. Investments given by a citizen that will be sold soon with the proceeds used to beautify a public park—$36,750. Cash that the assistant director of finance designated for use in upgrading the local roads—$60,750. Cash from a state grant that must be spent to supplement the pay of local kindergarten teachers—$55,750. Cash that the city council (the highest level of decision-making authority in the government) voted to use in renovating a school gymnasium—$86,000. On a balance sheet for the governmental funds, what fund balance amounts should the City of Westchester report?arrow_forward

- The governmental funds of the City of Westchester report $601,500 in assets and $214,000 in liabilities. The following are some of the assets that the government reports. • Prepaid items-$16,900. • Cash from a bond issuance that must be spent within the school system according to the bond indenture-$120,000. • Supplies-$5,750. • Investments given by a citizen that will be sold soon with the proceeds used to beautify a public park-$34,500. • Cash that the assistant director of finance designated for use in upgrading the local roads-$43,750. • Cash from a state grant that must be spent to supplement the pay of local kindergarten teachers-$59,000. • Cash that the city council (the highest level of decision-making authority in the government) voted to use in renovating a school gymnasium-$80,750. On a balance sheet for the governmental funds, what fund balance amounts should the City of Westchester report? Answer is complete but not entirely correct. Fund balance-nonspendable Fund…arrow_forwardPrepare journal entries for the City of Pudding's governmental funds to record the following transactions, first for fund financial statements and then for government-wide financial statements. A new truck for the sanitation department was ordered at a cost of $107,250. The city print shop did $3,600 worth of work for the school system (but has not yet been paid). A(n) $14 million bond was issued at face value to build a new road. The city transfers cash of $185,000 from its general fund to provide permanent financing for a municipal swimming pool that will be maintained as an enterprise fund. The truck ordered in (a) is received but at an actual cost of $109,650. Payment is not made at this time. The city transfers cash of $33,600 from its general fund to a capital projects fund. The city receives a state grant of $30,000 that must be spent to promote recycling by the citizens. The first $5,650 of the state grant received in (g) is expended as intended.arrow_forwardActivities of a county recreation center are reported in an enterprise fund. During 2019, $5,000,000 is spent on equipment and bonds are issued for $3,000,000. How are these two transactions reported on the enterprise fund’s operating statement? a. No effect b. Revenues, $3,000,000; expenditures, $5,000,000 c. Other financing sources, $3,000,000 d. Other financing sources, $3,000,000; expenditures, $5,000,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education