FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Transcribed Image Text:Total Assets

$944,500

$596,400

Accounts payable

$130,000

$87,500

Mortgage payable

65,000

97,400

Common stock

266,500

238,000

Retained earnings

483,000

173,500

Total Liabilities & Shareholders' Equity

$944,500

$596,400

Required:

Prepare the cash flows from investing and financing activities sections of the 2020 statement of cash flows. For those boxes in which you must enter subtractive or negative numbers use a minus sign.

Caraba's Company

Statement of Cash Flows (Partial)

For the Year Ended December 31, 2020

Investing Activities:

Net cash used for investing activities

Financing Activities:

Net cash used for financing activities

%24

%24

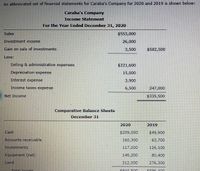

Transcribed Image Text:An abbreviated set of financial statements for Caraba's Company for 2020 and 2019 is shown below:

Caraba's Company

Income Statement

For the Year Ended December 31, 2020

Sales

$553,000

Investment income

26,000

Gain on sale of investments

3,500

$582,500

Less:

Selling & administrative expenses

$221,600

Depreciation expense

15,000

Interest expense

3,900

Income taxes expense

6,500

247,000

Net Income

$335,500

Comparative Balance Sheets

December31

2020

2019

Cash

$209,000

$49,900

Accounts receivable

160,300

63,700

InvestmentS

117,000

126,100

Equipment (net)

146,200

80,400

Land

312,000

276,300

T-kal ^sssts

E044 500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Below are the Income Statement and Balance Sheet for Longborg Corporation for the years ended 2020 and 2021. Calculate the leverage ratios in the table to the right for the year ended 2021. Longborg Corporation Comparative Income Statement For the Years Ended December 31, 2021 and 2020 2021 2020 Amount Amount Sales $60,200,300 $52,410,500 Cost of goods sold 44,850,700 39,050,800 Gross profit 15,349,600 13,359,700 Selling expenses 2,725,500 2,860,600 Administrative expenses 2,850,300 2,575,400 Total operating expenses 5,575,800 5,436,000 Income from operations 9,773,800 7,923,700 Interest Expense 385,200 425,600 Other income 125,000 105,000 Income before income tax 9,513,600 7,603,100 Income tax expense 3,329,800 2,661,000 Net income $6,183,800 $4,942,100…arrow_forwardCondensed financial data of Bridgsport Company for 2020 and 2019 are presented below. BRIDGEPORT COMPANY COMPARATIVE BALANCE SHEET AS OF DECEMBER 31, 2020 AND 2019 2020 2019 Cash $1,820 $1,150 Receivables 1,780 1,310 Inventory 1,600 1,930 Plant assets 1,930 1,710 Accumulated depreciation (1,200 ) [1,160 } Long-term investments (held-to-maturity) 1,320 1,400 $7,250 $6,340 Accounts payable $1190 SB80 Accrued liabilities 190 270 Bonds payable 1,430 1,520 Common stock 1,900 1,730 Retained carnings 2,540 1,940 $7,250 $6,340 BRIDGEPORT COMPANY INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $6,860 Cost of goods sold 4,620 Gross margin 2,240 Selling and administrative expenses 920 Income from operations 1,320 Other revenuss and gains Gain on sale of investments B0 Income before tax 1,400 Income tax expense 540 Net income B60 Cash dividends 260 Income ratained in business $600 Additional information: During the year, $70 of common stock was issued in exchanga for plant…arrow_forwardBelow are the Income Statement and Balance Sheet for Palmer Corporation for the years ended 2020 and 2021. Calculate the liquidity ratios in the table to the right for the year ended 2021. Palmer Corporation Comparative Income Statement For the Years Ended December 31, 2021 and 2020 2021 2020 Amount Amount Sales $5,750,900 $4,894,800 Cost of goods sold 3,646,700 3,195,600 Gross profit 2,104,200 1,699,200 Selling expenses 775,500 688,700 Administrative expenses 863,900 815,200 Total operating expenses 1,639,400 1,503,900 Income from operations 464,800 195,300 Other income 102,500 84,600 Income before income tax 567,300 279,900 Income tax expense 200,600 101,200 Net income $366,700 $178,700 Palmer Corporation…arrow_forward

- Prepare a 2020 income statement for Crane Corporation based on the following information: Cost of goods sold Operating expenses Other expenses and losses Sales revenue Tax rate Sales Revenue $460,000 Cost of Goods Sold 104,000 32,500 725,000 30% CRANE CORPORATION Income Statement For the Year Ended December 31, 2020 725000 460,000 iarrow_forwardThe 2024 Income statement of Adrian Express reports sales of $18,957,000, cost of goods sold of $11,971,500, and net Income of $1,690,000. Balance sheet Information is provided in the following table. Assets Current assets: Cash Accounts receivable Inventory Long-term assets Total assets Liabilities and stockholders' Equity Current liabilities Long-term debt Common stock Retained earnings Total liabilities and stockholders' equity Industry averages for the following four ratios are as follows: 25 days 60 days 2 to 1 35% ADRIAN EXPRESS Balance Sheets December 31, 2024 and 2023 Req 1 Req 2 and 3 Complete this question by entering your answers in the tabs below. Ratios 2024 Average collection period Average days in inventory Current ratio Debt to equity ratio $ 690,000 1,580,000 1,980,000 4,890,000 $ 9,140,000 Average collection period Average days in inventory Current ratio Debt to equity ratio Required: 1. Calculate the four ratios listed above for Adrian Express In 2024 assuming all…arrow_forwardThe 2021 income statement of Adrian Express reports sales of $18,957,000, cost of goods sold of $11,971,500, and net income of $1,690,000. Balance sheet information is provided in the following table. Assets Current assets: Cash Accounts receivable Inventory Long-term assets. Total assets Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and stockholders' equity ADRIAN EXPRESS Balance Sheets December 31, 2021 and 2020 Average collection period Average days in inventory Current ratio Debt to equity ratio Industry averages for the following four risk ratios are as follows: Risk Ratios Average collection period Average days in inventory Current ratio Debt to equity ratio 25 days 60 days. 2 to 1 50% 2021 $ 690,000 1,580,000 1,980,000 4,890,000 $9, 140,000 365.0 days days to 1 % 2020 $ 850,000 1,090,000 1,490,000 4,330,000 $7,760,000 Required: 1. Calculate the four risk ratios listed above for Adrian Express in…arrow_forward

- Carla Company’s income statement for the year ended December 31, 2020, contained the following condensed information. Service revenue $843,000 Operating expenses (excluding depreciation) $622,000 Depreciation expense 60,000 Loss on sale of equipment 26,000 708,000 Income before income taxes 135,000 Income tax expense 40,000 Net income $95,000 Carla’s balance sheet contained the following comparative data at December 31. 2020 2019 Accounts receivable $36,000 $55,000 Accounts payable 43,000 33,000 Income taxes payable 4,200 8,200 (Accounts payable pertains to operating expenses.)Prepare the operating activities section of the statement of cash flows using the indirect method.arrow_forwardCondensed financial data of Waterway Company for 2020 and 2019 are presented below. WATERWAY COMPANYCOMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 2020 2019 Cash $1,790 $1,150 Receivables 1,780 1,330 Inventory 1,620 1,890 Plant assets 1,930 1,700 Accumulated depreciation (1,200 ) (1,180 ) Long-term investments (held-to-maturity) 1,310 1,420 $7,230 $6,310 Accounts payable $1,210 $920 Accrued liabilities 210 240 Bonds payable 1,370 1,530 Common stock 1,860 1,670 Retained earnings 2,580 1,950 $7,230 $6,310 WATERWAY COMPANYINCOME STATEMENTFOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $6,970 Cost of goods sold 4,680 Gross margin 2,290 Selling and administrative expenses 940 Income from…arrow_forwardHere are the comparative condensed income statements of Cheyenne Corporation. CHEYENNE CORPORATIONCondensed Income StatementsFor the Years Ended December 31 2022 2021 Net sales $588,000 $490,000 Cost of goods sold 474,516 416,010 Gross profit 113,484 73,990 Operating expenses 80,556 44,100 Net income $ 32,928 $ 29,890 (a)Prepare a horizontal analysis of the income statement data for Cheyenne Corporation, using 2021 as a base. (If amount and percentage are a decrease show the numbers as negative, e.g. -55,000, -20% or (55,000), (20%). Round percentages to 1 decimal place, e.g. 12.1%.) CHEYENNE CORPORATIONCondensed Income Statementschoose the accounting period Increase or (Decrease) During 2022 2022 2021 Amount Percentage Net sales $588,000 $490,000 $enter a dollar amount enter…arrow_forward

- Partial income statements for Sherwood Company summarized for a four-year period show the following: 2018 2019 2020 2021 $ 2,900,000 1,508,000 $ 3,300,000 1,683,000 $ 3,400,000 1,802,000 $ 1,598,000 $ 3,900,000 2,028,000 $ 1,872,000 Net Sales Cost of Goods Sold Gross Profit $ 1,392,000 $ 1,617,000 An audit revealed that in determining these amounts, the ending inventory for 2019 was overstated by $23,600. The inventory balance on December 31, 2020, was accurately stated. The company uses a periodic inventory system. Required: 1. Restate the partial income statements to reflect the correct amounts, after fixing the inventory error. 2-a. Compute the gross profit percentage for each year (a) before the correction and (b) after the correction. 2-b. Do the results lend confidence to your corrected amounts? Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B Restate the partial income statements to reflect the correct amounts, after fixing the inventory…arrow_forwardSelected financial statement information for 2018, 2019, and 2023 for End Run Corporation is presented below (amounts in millions of dollars): Accounts receivable Current assets Property, plant, and equipment (net) Total assets Current liabilities Long-term debt Sales Cost of goods sold Selling and administrative expenses Income from continuing operations Cash flow from operations Depreciation expense 2020 A. 2020 SAI B. 2020 LVGI C. 2020 TATA D. 2020 Y E. 2020 earnings manipulation probability 10508 30945 11284 68787 29417 8776 101573 92207 3931 946 4837 518 2019 3905 7438 10744 31289 6595 7223 47860 32090 3315 1063 1127 550 2018 2985 5743 10493 26213 6048 7223 33906 27772 2582 739 1863 550 For 2019 and 2020, compute the following amounts relative to Beneish's eight-factor earnings manipulation model:arrow_forwardThe following table shows an abbreviated income statement and balance sheet for Quick Burger Corporation for 2019. INCOME STATEMENT OF QUICK BURGER CORP., 2019 (Figures in $ millions) $ 27,583 17,585 1,418 Net sales Costs Depreciation Earnings before interest and taxes Interest expense (ЕBIT) $ 8,580 533 Pretax income 8,047 Federal taxes (@ 21%) 1,690 Net income $ 6,357 BALANCE SHEET OF QUICK BURGER CORP., 2019 (Figures in $ millions) Assets 2019 2018 Liabilities and Shareholders Equity 2019 2018 Current assets Current liabilities $ 2,352 1,351 Debt due for repayment Accounts payable Cash and marketable securities $ 2,352 $ $ 3,419 $ 3,419 415 3,159 $ 3,574 Receivables 1,391 Inventories 138 133 Total current liabilities 1,105 $ 4,986 Other current assets 632 Total current assets $ 4,468 Long-term debt Other long-term liabilities $12,150 2,973 $18,697 14,406 Fixed assets $13,649 Property, plant, and equipment Intangible assets (goodwill) Other long-term assets 3,073 $20,141 15,357…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education