FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:View Policies

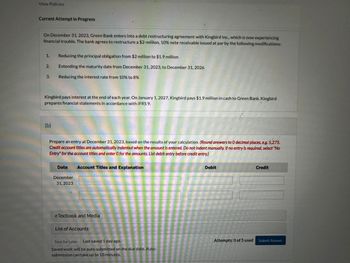

Current Attempt in Progress

On December 31, 2023, Green Bank enters into a debt restructuring agreement with Kingbird Inc., which is now experiencing

financial trouble. The bank agrees to restructure a $2-million, 10% note receivable issued at par by the following modifications:

1. Reducing the principal obligation from $2 million to $1.9 million

Extending the maturity date from December 31, 2023, to December 31, 2026

Reducing the interest rate from 10% to 8%

2₁

3.

Kingbird pays interest at the end of each year. On January 1, 2027, Kingbird pays $1.9 million in cash to Green Bank. Kingbird

prepares financial statements in accordance with IFRS 9.

(b)

Prepare an entry at December 31, 2023, based on the results of your calculation. (Round answers to 0 decimal places, e.g. 5,275.

Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No

Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.)

Date

December

31, 2023

Account Titles and Explanation

eTextbook and Media

List of Accounts

Save for Later Last saved 1 day ago.

Saved work will be auto-submitted on the due date. Auto-

submission can take up to 10 minutes.

Debit

Attempts: 0 of 5 used

Credit

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject: accountingarrow_forwardDomesticarrow_forwardThese financial statement items are for Wildhorse Co. at year-end, July 31, 2017. $ 3,880 Salaries and wages payable Salaries and wages expense 59,200 Supplies expense 17,000 Equipment 20,300 Accounts payable 4,100 Service revenue 67,800 Rent revenue 9,900 Notes payable (due in 2020) 2,900 Common stock 16,000 Cash 30,900 Accounts receivable 10,880 Accumulated depreciation-equipment 7,600 Dividends 4,000 Depreciation expense 5,600 Retained earnings (beginning of the year) 35,700arrow_forward

- Prepare all necessary journal entries for 2024.arrow_forwardRecorded an adjusting journal entry for the portion of insurance coveragearrow_forwardWhispering Steel Company, as lessee, signed a lease agreement for equipment for 5 years, beginning December 31, 2020. Annual rental payments of $54,000 are to be made at the beginning of each lease year (December 31). The interest rate used by the lessor in setting the payment schedule is 6%; Whispering's incremental borrowing rate is 8%. Whispering is unaware of the rate being used by the lessor. At the end of the lease, Whispering has the option to buy the equipment for $5,000, considerably below its estimated fair value at that time. The equipment has an estimated useful life of 7 years, with no salvage value. Whispering uses the straight-line method of depreciation on similar owned equipment. Click here to view factor tables.arrow_forward

- Prepare journal entries to record the following transactions entered into by the Ivanhoe Company. Omit cost of goods sold entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) 2024 June Nov. 1 1 Received a $10,800, 9%, 1-year note from Luke Bryan as full payment on his account. Sold merchandise on account to Ace, Inc., for $17,000, terms 2/10, n/30. Nov. 5 Ace, Inc., returned merchandise worth $1,500. Received payment in full from Ace, Inc. Accrued interest on Bryan's note. Nov. 9 Dec. 31 2025 June 1 Luke Bryan honored his promissory note by sending the face amount plus interest.arrow_forwardNeed a worksheet in excel form add interest expense - of 167.00 please.arrow_forwardPrepare the journal entries, with appropriate journal entry descriptions, for 2020, including any required year-end adjusting entries.The company prepares annual adjusting entries.arrow_forward

- For 2019 and 2020, what is the ceiling for a person under the age of 70 and 1/2 to contribute to an Individual Retirement Account? a. $6,000 (or the $12,00 for spousal IRAs) or 100% of compensation. b. $1,000 annually. c. $3,000 annually. d. all of the above.arrow_forwardam.101.arrow_forwardGive the entry in January 2026, when the 37,500-gallon shipment is received, assuming that the situation given in (b2) above existed at December 31, 2025, and that the market price in January 2026 was $3.35 per gallon. Prepare the journal entry for when the materials are received in January 2026. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Jan. 2026 Inventory Estimated Liability on Purchase Commitments Accounts Payable Debit 125625 13125 Credit 138750arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education