FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

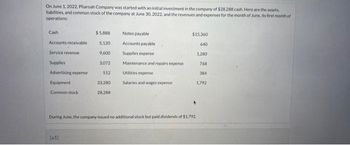

Transcribed Image Text:On June 1, 2022, Pharoah Company was started with an initial investment in the company of $28.288 cash. Here are the assets

liabilities, and common stock of the company at June 30, 2022, and the revenues and expenses for the month of June, its first month of

operations:

Cash

Accounts receivable)

Service revenue

Supplies

Advertising expense

Equipment

Common stock

$5,888

5.120

9,600

3,072

512

(a1)

33,280

28,288

Notes payable

Accounts payable

Supplies expense

Maintenance and repairs expense

Utilities expense

Salaries and wages expense

$15,360

640

1,200

768

384

1,792

During June, the company issued no additional stock but paid dividends of $1,792.

Transcribed Image Text:(a2)

Prepare a retained earnings statement for the month of June. (List items that increase retained earnings first.)

Pharoah Company

Retained Earnings Statement

eTextbook and Media

List of Accounts

Save for Later

Attempts: 0 of 3 used Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please helparrow_forwardClosing Entries The adjusted trial balance prepared as of December 31 contains the following accounts. Use the information provided below to prepare journal entries to close the accounts using the Income Summary account. After these entries are posted, what is the balance in the Retained Earnings account? Debit Credit Service Fees Earned $91,000ccdefrtv Rent Expense $20, 800 Salaries Expense 52, 000 Supplies Expense 6, 000 Depreciation Expense S 11, 300 Retained Earnings $72,000 Dividends $10, 000arrow_forwardI need helparrow_forward

- Selected accounts of Sparkle Electrical, Inc., at June 30, 2018, follow. Begin by closing out the revenue accounts. Close out the expense accounts. Close out the Dividends account What is Sparkle Electrical, Inc.'s Retained earnings balance at June 30, 2018? Sparkle Electrical, Inc.'s Retained earning balance at June 30, 2018 is S Create the journal entrys as stated above and find out the retained earning balance.arrow_forwardShalett Interiors has the following account balances at the end of the year. Use only the appropriate accounts to prepare a balance. sheet. Accounts Equipment Accounts Payable Common Stock Service Revenue Cash Retained Earnings Salaries Expense Notes Payable otal assets Assets Balances $74,200 8,300 24,000 51,900 9,600 7 36,700 27,100 SHALETT INTERIORS Balance Sheet December 31 Total liabilities Liabilities Stockholders' Equity Total stockholders' equity Total liabilities and stockholders' equityarrow_forwardQuestion Content Area A summary of selected transactions in ledger accounts appears below for Alberto’s Plumbing Services for the current calendar year-end. Common Stock 1/1 6,778 Retained Earnings 12/31 9,605 12/31 22,551 Dividends 3/30 2,696 12/31 9,605 9/30 6,909 Net income for the period is a.9,605 b.29,329 c.22,551 d.38,934arrow_forward

- Subject: accountingarrow_forwardThe ledger of Mai Company includes the following accounts with normal balances as of December 31: Retained Earnings $9,000; Dividends $800; Services Revenue $13,000; Wages Expense $8,400; and Rent Expense $1,600. Prepare its December 31 closing entries. 1 Record the entry to close revenue accounts. 2 Record the entry to close expense accounts. 3 Record the entry to close the income summary account. 4 Record the entry to close the dividends account.arrow_forwardUse the May 31 fiscal year-end information from the following ledger accounts (assume that all accounts have normal balances). M. Muncel, Capital Dated May 31 M. Muncel, Withdrawals Date May 31 Services Revenue Date May 31 Depreciation Expense Date May 31 May 31 Date Required A Required B May 31 Date May 31 Date PR G2 May 31 Date PR G2 PR G2 View transaction list PR G2 < A Complete this questions by entering your answers in the tabs below. Prepare closing journal entries from the above ledger accounts. Transaction 1 Debit Debit B Debit Debit 301: M. Muncel, Capital Debit Credit 302: M. Muncel, Withdrawals Debit Credit Debit 403: Services Revenue. Debit Credit 603: Depreciation Expense Credit Journal entry worksheet Note: Enter debits before credits. Account Number 301 Credit Balance 78,000 (a) Prepare closing journal entries from the above ledger accounts. (b) Post the entries from Requirement (a) to the General Ledger accounts below. Use the transaction number from Requirement (a) as…arrow_forward

- ! Required information [The following information applies to the questions displayed below.] Lawson Consulting had the following accounts and amounts on December 31. Cash Accounts receivable Equipment Accounts payable Common stock $14,500 6,400 8,400 Rent expense 4,710 Wages expense 22,190 Dividends Services revenue LAWSON CONSULTING Statement of Retained Earnings $ Use the above information to prepare a December statement of retained earnings for Lawson Consulting. The Retained Earnings account balance at December 1 was $0. Hint. Net income for December is $5,800. 0 $ 3,400 17,700 0 3,900 8,000arrow_forwardBrothers Harry and Herman Hausyerday began operations of their machine shop (H & H Tool, Inc.) on January 1, 2016. The annual reporting period ends December 31. The trial balance on January 1, 2018, follows (the amounts are rounded to thousands of dollars to simplify): Debit Credit $ 3 Account Titles Cash Accounts Receivable Supplies Land 12 Equipment Accumulated Depreciation 52 $ 6 Sof tware 22 Accumulated Amortization 8. Accounts Payable Notes Payable (short-term) Salaries and Wages Payable Interest Payable Income Tax Payable Connon Stock 67 Retained Earnings Service Revenue Salaries and Wages Expense Depreciation Expense Armortization Expense Income Tax Expense Interest Expense Supplies Expense Totals $94 $94 Transactions and events during 2018 (summarized In thousands of dollars) follow: a. Borrowed $12 cash on March 1 using a short-term note. b. Purchased land on March 2 for future bullding site: pald cash, $9. c. Issued additional shares of common stock on April 3 for $32. d.…arrow_forwardThe income statement for the Windsor, Inc. for the month ended July 31 shows Service Revenue $18,760, Salaries and Wages Expense $9,350, Maintenance and Repairs Expense $2,970, and Income Tax Expense $1,360. The statement of retained earnings shows an opening balance for Retained Earnings of $21,890 and Dividends $1,610. Prepare closing journal entries. What is the ending balance in Retained Earnings? Ending balance in Retained Earnings $enter the Ending balance in Retained Earnings in dollarsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education