FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Complete all requirements

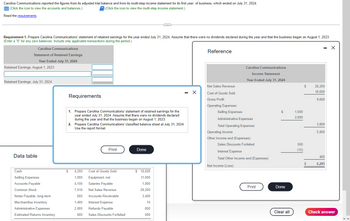

Transcribed Image Text:Carolina Communications reported the figures from its adjusted trial balance and from its multi-step income statement for its first year of business, which ended on July 31, 2024:

(Click the icon to view the accounts and balances.)

(Click the icon to view the multi-step income statement.)

Read the requirements.

Requirement 1. Prepare Carolina Communications' statement of retained earnings for the year ended July 31, 2024. Assume that there were no dividends declared during the year and that the business began on August 1, 2023.

(Enter a "0" for any zero balances. Include only applicable transactions during the period.)

Carolina Communications

- X

Statement of Retained Earnings

Year Ended July 31, 2024

Retained Earnings, August 1, 2023

Retained Earnings, July 31, 2024

Data table

Cash

Selling Expenses

Accounts Payable

Common Stock

Notes Payable, long-term

Merchandise Inventory

Administrative Expenses

Estimated Returns Inventory

Requirements

1. Prepare Carolina Communications' statement of retained earnings for the

year ended July 31, 2024. Assume that there were no dividends declared

during the year and that the business began on August 1, 2023.

Print

(…)

2. Prepare Carolina Communications' classified balance sheet at July 31, 2024.

Use the report format.

$ 4,200 Cost of Goods Sold

Equipment, net

1,000

4,100

Salaries Payable

7,015

Net Sales Revenue

600

Accounts Receivable

1,400

Interest Expense

2,800

Refunds Payable

600

Sales Discounts Forfeited

Done

$ 18,600

11,000

1,800

28,200

3,400

15

800

500

- X

Reference

Net Sales Revenue

Cost of Goods Sold

Gross Profit

Operating Expenses:

Carolina Communications

Income Statement

Year Ended July 31, 2024

Selling Expenses

Administrative Expenses

Total Operating Expenses

Operating Income

Other Income and (Expenses):

Sales Discounts Forfeited

Interest Expense

Total Other Income and (Expenses)

Net Income (Loss)

Print

$

Done

Clear all

1,000

2,800

500

(15)

$

$

28,200

18,600

9,600

3,800

5,800

485

6,285

Check answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education