FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

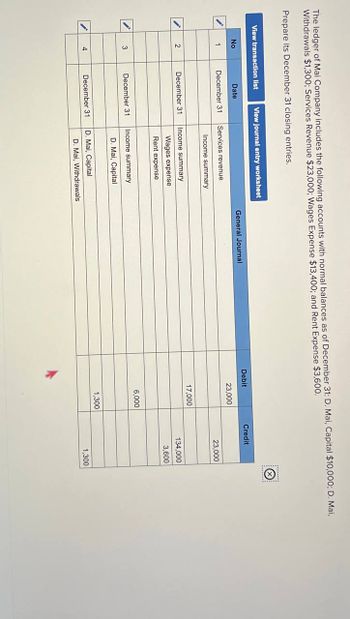

Transcribed Image Text:The ledger of Mai Company includes the following accounts with normal balances as of December 31: D. Mai, Capital $10,000; D. Mai,

Withdrawals $1,300; Services Revenue $23,000; Wages Expense $13,400; and Rent Expense $3,600.

Prepare its December 31 closing entries.

View transaction list

¡

No

1

2

3

4

Date

View journal entry worksheet

December 31

December 31

December 31

December 31

Services revenue

Income summary

Income summary

Wages expense

Rent expense

Income summary

D. Mai, Capital

D. Mai, Capital

D. Mai, Withdrawals

General Journal

Debit

23,000

17,000

6,000

1,300

Credit

23,000

134,000

3,600

*********

Ⓒ

1,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 22 Salaries Payable 55 Insurance Expense 23 Unearmed Fees 59 Miscellaneous Expense The post-dosing trial balance as of April 30, 2019 Required: Journalize each of the May transactions using Kelly Consulling's clhar of accounts. (Do not Insert the account rumbers in the Post. Ref. colt compound transaction, if an amount box does not require an entry, leave it blank, May 3. Receved.cash fromn clients as an advance payrment for servies to be provided and recorded it as unearned fees, s1.500. Post. Ref. 4,500 May 5: Received cash from dlients on account, $2,450. Post. Ref. Debit 2,450 May 9: Paid cash for a newspaper advertisement, $225. Post. Ref. Debit DOOdODS日 May 13: Paid Office Station Co. for part of the debt incurred on April 5, $640. Post. Ref. Debit 640 May 15: Provided services on accournt for the period May 1-15, $9,180. Description Post. Ref. Debit 9,180 9,180 May 16: Paid part-time receptionist for two weeks' salary induding the amount owed on April 30, $750. Description Post.…arrow_forwardxamus - cdn.student.uae.examus.net/?rldbqn=1&sessi... ACCT101_FEX_2021_2_Male A company purchased merchandise on credit with terms Ac Payable if the company pays SR485 cash on this account within ten days? e18 3/15, n/3O. How much will be debited to 33 - 34 abe18ce33 b. Accounts Payable should be credited in а. 485 113:22 9 కోల С. 470.45 95abe18ce 33 d. 500 95abe18ce 95abe18ce33 95aber8ce33 95abe18ce33 95abe18ce33 95abe18ce33 MacBook Pro F3 888 F4 FS E 5 F7 67 7 V T. 8 A 9 Y 6. U 11 9.arrow_forwardeBook Chart of Accounts Payroll Register General Journal Instructions NO. OI Mallal TOLAI HOUIS TOlal Eamings Name Allowances Status Worked Feb. 9-15 Rate Jan. 1-Feb. 8 Barone, William 40 $14.00 $3,360.00 Hastings, Gene 4 M 45 15.00 3,870.00 Nitobe, Isako 3) 46 12.00 3,168.00 Smith, Judy M. 42 13.00 3,276.00 2. Tarshis, Dolores S. 39 14.50 3,480.00 Social Security tax is withheld from the first $128,400 of earnings at the rate of 6.2%, Medicare tax is withheld at the rate of 1.45%, and city earnings tax at the rate of 1%, both applied to gross pay. Hastings and Smith have $35 withheld and Nitobe and Tarshis have $15 withheld for health insurance. Nitobe and Tarshis have $25 withheld to be invested in the bakers' credit union. Hastings has $18.75 withheld and Smith has $43.75 withheld under a savings bond purchase plan. Karen's Cupcakes' payroll is met by drawing checks on its regular bank account. The checks were issued in sequence, beginning with No. 365. Required: 1. Prepare a…arrow_forward

- Nix'It Company's ledger on July 31, its fiscal year-end, includes the following selected accounts that have normal balances. Nix'It uses the perpetual inventory system. Retained earnings Dividends Sales Sales discounts Sales returns and allowances Prepare the company's year-end closing entries. View transaction list Journal entry worksheet 1 2 Date July 31 3 4 Record the entry to close the income statement accounts with credit balances. Note: Enter debits before credits. $ 120,300 Cost of goods sold 7,000 Depreciation expense 175,000 Salaries expense 3,400 Miscellaneous expenses 6,000 Record entry General Journal Clear entry Debit Credit $ 106,500 10,800 35,000 5,000 View general journal >arrow_forwardFrancisco Company has 10 employees, each of whom earns $2,800 per month and is paid on the last day of each month. All 10 have been employed continuously at this amount since January 1. On March 1, the following accounts and balances exist in its general ledger. a. FICA-Social Security Taxes Payable, $3,472; FICA-Medicare Taxes Payable, $812. (The balances of these accounts represent total liabilities for both the employer's and employees' FICA taxes for the February payroll only.) b. Employees' Federal Income Taxes Payable, $7,000 (llability for February only). c. Federal Unemployment Taxes Payable, $336 (liability for January and February together). d. State Unemployment Taxes Payable, $3,024 (lability for January and February together). The company had the following payroll transactions. March 15 Issued check payable to Swift Bank, a federal depository bank authorized to accept employers' payments of FICA taxes and employee income tax withholdings. The $11,284 check is in payment of…arrow_forwardJournal entry worksheet The Krug Company collected $16,200 rent in advance on November 1, debiting Cash and crediting Unearned Rent Revenue. The tenant was paying 12 months’ rent in advance and occupancy began November 1. Note: Enter debits before credits. Transaction General Journal Debit Credit a.arrow_forward

- A. March 1, paid interest due on note, $2,900 B. December 31, interest accrued on note payable, $4,350 Prepare journal entries to record the above transactions. If an amount box does not require an entry, leave it blank. Mar.1 Dec. 31 Create a T-account for Interest Payable, post any entries that affect the account, and tally the ending balance for the account (assume Interest Payable beginning balance of $2,900). Interest Payable Beginning Balance Balancearrow_forwardView transaction list Journal entry worksheet 1 2 3 4 5 6 > Wages of $11,000 are earned by workers but not paid as of December 31. Note: Enter debits before credits. Transaction General Journal Debit Credit а. Record entry Clear entry View general journalarrow_forwardYou are provided with the following information form the accounts of BBS Ltd for the year ending 30 June 2019Cash Sales950 000Cost of Goods Sold35 000Amount received in advance for services to be performed in August 20199 500Rent expenses for year ended 30 June 20199 000Rent Prepaid for two months to 31 August 20191 200Doubtful debts expenses1 200Amount provided in 2019 for employees’ long-service leave entitlements5 000Goodwill impairment expenses7 000Required:Calculate the taxable profit and accounting profit for the year ending 30 June 2019. my confusion : not sure if LSL will be 50%of or not?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education