FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

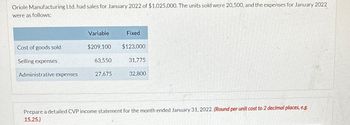

Transcribed Image Text:Oriole Manufacturing Ltd. had sales for January 2022 of $1,025,000. The units sold were 20,500, and the expenses for January 2022

were as follows:

Variable

Fixed

Cost of goods sold

$209,100

$123,000

Selling expenses

63,550

31,775

Administrative expenses

27,675

32,800

Prepare a detailed CVP income statement for the month ended January 31, 2022. (Round per unit cost to 2 decimal places, e.g.

15.25.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the following selected data from Business Solutions's income statement for the three months ended March 31, 2022, and from its March 31, 2022, balance sheet to complete the requirements. Computer services revenue Net sales (of goods) Total sales and revenue Cost of goods sold Net income Quick assets Current assets Total assets Current liabilities Total liabilities Total equity Required: 1. Compute the gross margin ratio (both with and without services revenue) and net profit margin ratio. 2. Compute the current ratio and acid-test ratio. 3. Compute the debt ratio and equity ratio. 4. What percent of its assets are current? What percent are long term? Required 1 Required 2 Complete this question by entering your answers in the tabs below. $ 27,275 19,083 46,358 12,572 18,807 89,252 97,520 123,464 Gross margin ratio Net profit main ratio 885 885 122,579 Required 3 Required 4 Compute the gross margin ratio (both with and without services revenue) and net profit margin ratio. Note:…arrow_forwardHere are the abbreviated financial statements for Planner’s Peanuts: INCOME STATEMENT, 2019 Sales $ 5,000 Cost 3,900 Net income $ 1,100 BALANCE SHEET, YEAR-END 2018 2019 2018 2019 Assets $ 7,500 $ 12,100 Debt $ 833 $ 1,000 Equity 6,667 11,100 Total $ 7,500 $ 12,100 Total $ 7,500 $ 12,100 a. If sales increase by 10% in 2020 and the company uses a strict percentage of sales planning model (meaning that all items on the income and balance sheet also increase by 10%), what must be the balancing item? b. What will be the value of this balancing item?arrow_forwardHere are the abbreviated financial statements for Planner’s Peanuts: INCOME STATEMENT, 2022 Sales $ 5,000 Cost 3,900 Net income $ 1,100 BALANCE SHEET, YEAR-END 2021 2022 2021 2022 Assets $ 7,500 $ 12,100 Debt $ 833 $ 1,000 Equity 6,667 11,100 Total $ 7,500 $ 12,100 Total $ 7,500 $ 12,100 If sales increase by 10% in 2023 and the company uses a strict percentage of sales planning model (meaning that all items on the income and balance sheet also increase by 10%), what must be the balancing item? What will be the value of this balancing item?arrow_forward

- Use 2018 Form 990 and the 2019 audited financial statements for Feeding America. Although Form 990 indicates it is for 2018, it is actually for the period July 1, 2018, to June 30, 2019, the same time period as the 2019 audited financial statements. Required Compute the following performance measures using the Form 990. Using the annual financial statements, calculate the following performance measures. Compute the following performance measures using the Form 990. (Round your answers to two decimal places and the Going Concern ratio to three decimal places.) This is what I had come up with but they are all incorrect amounts. Let me know how I can sent the Form 990 to give you the figures. Liquidity Choose Numerator ÷ Choose Denominator = Ratio Current Assets Current Liabilities $106,955,173 ÷ $15,171,035 = 7.05 Going Concern Choose Numerator ÷ Choose Denominator = Ratio Revenue over expenses Total Expenses…arrow_forwardPlease helparrow_forwardForecast Income Statement and Balance Sheet Following are the income statement and balance sheet for Medtronic PLC. Note: Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places. Medtronic PLC Consolidated Statement of Income $ millions, For Fiscal Year Ended April 26, 2019 Net sales $30,557 Costs and expenses Cost of products sold 9,155 Research and development expense 979 Selling, general, and administrative expense 10,418 Amortization of intangible assets 1,764 Restructuring charges, net 83 Certain litigation charges, net 166 Other operating expense, net 258 Operating profit 7,734 Other nonoperating income, net (157) Interest expense 1,444 Income before income taxes 6,447 Income tax provision 547 Net income 5,900 Net income loss attributable to noncontrolling interests (19) Net income attributable to Medtronic $5,881…arrow_forward

- Perform the Reperformance or Recalculation procedures to check the mathematical accuracy ofthe Income Statement. What issue did you find? What is the next step? Create a Correctedversion of the Income Statement. Income Statement For the Year Ended For the Year Ended Revenue 3/31/2021 3/31/2022 Sales Revenue: Corporate Accounts $ 353,739.57 $ 343,050.56 Sales Revenues: Storefront $ 80,649.00 $ 91,411.50 Total Sales Revenue $ 434,388.57 $ 434,462.06 Cost of Goods Sold: Ingredients $ 69,736.39 $ 64,645.64 Cost of Goods Sold: Boxes and Cupcake Cups $ 3,875.55 $ 3,755.55 Cost of Goods Sold: Beverages $ 5,466.50 $ 5,681.50 Total COGS $ 76,078.44 $ 74,082.69 Gross Profit $ 358,310.13 $ 360,379.37 Interest Revenue $…arrow_forwardOn the attached page prepare a well-formatted multi-section income statement for the Fiona Company for the fiscal year ending December 31, 2020 from the data below. Use the entire figures as shown on your income statement.Note: For items in section 2 (Other Items) and section 4 (Below-the-line Items) use brackets if an item will have a negative impact on earnings. In section 1 individual items are not generally shown in brackets except for calculated margins or totals if negative. Cost of Goods Sold amounted to $20,000. Sale of equipment that had a historical cost of $1,400 had accumulated depreciation of $910 and was sold for $890. The tax rate related to such a transaction is 25%. Non-taxable interest income on municipal bonds of $300 Sales revenue totaled $35,000. Interest expense totaled $500 for the period. Selling and Administrative Expenses amounted to $6,000 The company discontinued operations during the year that will result in total losses before taxes of $2,000. This…arrow_forward1.32. Creating Balance Sheets and Income Statements. Using the information in the below table, prepare a classified balance sheet for Erie Company as of December 31, 2019 and December 31, 2020, along with multi-step income statements for the years then endedarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education