FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

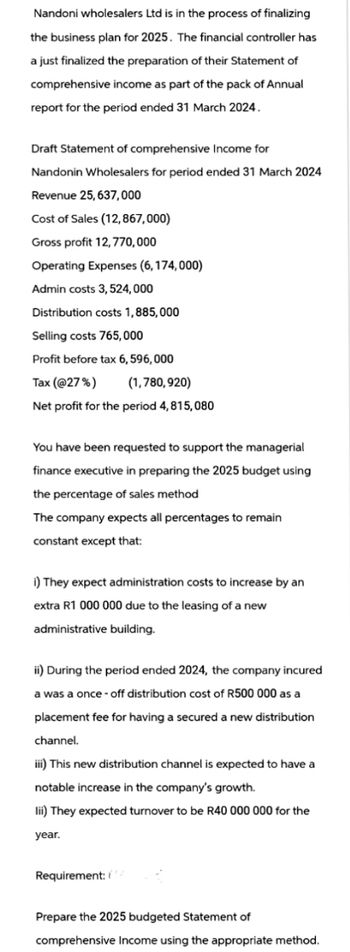

Transcribed Image Text:Nandoni wholesalers Ltd is in the process of finalizing

the business plan for 2025. The financial controller has

a just finalized the preparation of their Statement of

comprehensive income as part of the pack of Annual

report for the period ended 31 March 2024.

Draft Statement of comprehensive Income for

Nandonin Wholesalers for period ended 31 March 2024

Revenue 25,637,000

Cost of Sales (12,867,000)

Gross profit 12,770,000

Operating Expenses (6,174,000)

Admin costs 3,524,000

Distribution costs 1,885,000

Selling costs 765,000

Profit before tax 6,596,000

Tax (@27%)

(1,780,920)

Net profit for the period 4,815,080

You have been requested to support the managerial

finance executive in preparing the 2025 budget using

the percentage of sales method

The company expects all percentages to remain

constant except that:

i) They expect administration costs to increase by an

extra R1 000 000 due to the leasing of a new

administrative building.

ii) During the period ended 2024, the company incured

a was a once-off distribution cost of R500 000 as a

placement fee for having a secured a new distribution

channel.

iii) This new distribution channel is expected to have a

notable increase in the company's growth.

lii) They expected turnover to be R40 000 000 for the

year.

Requirement:

Prepare the 2025 budgeted Statement of

comprehensive Income using the appropriate method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- ) Cecil Inc. operates with three divisions: Naperville, Metropolitan and Urbana. Below areselected results for each division over the last two fiscal years.a. Calculate Return on Assets (ROA) for Cecil Inc. in 2021 and 2020 (report percentages rounded twodecimals).b. Calculate Return on Sales (ROS) for Cecil Inc. in 2021 and 2020 (report percentages rounded twodecimals).c. Industry Averages are 15% for ROA and 10% for ROS in 2021 and 2020. Discuss Cecil Inc.’sperformance trends and results compared to industry averages (discuss performance, do not repeatcalc’s from above).Revenues: 2021 2020 Naperville 22,500,000 19,600,000 Metropolitan 15,300,000 12,500,000 Urbana 9,500,000 8,700,000Operating Income: Naperville 1,900,000 1,800,000 Metropolitan 1,100,000 900,000 Urbana 1,100,000 1,050,000Average Total Assets: Naperville 10,000,000 9,500,000 Metropolitan 8,000,000 6,500,000 Urbana 4,500,000 4,300,000Number of Managers: Naperville 15 5 Metropolitan 9 10 Urbana 12arrow_forwardThe following data for the years ended December 31, 2019 and 2020 were presented to the management Zigzag Company: 2020 = Net sales: 1,363,000, Cost of Sales: 911,800, Gross Profit: 451,200; 2019 = Net Sales: 1,250,000, Cost of Sales: 776,000, Gross Profit: 474,000. The management requested you to determine the cause of the decline in gross profit on sales in spite of the favorable information given by the sales division that the quantity sold in 2020 was higher than in 2019 and that the production costs in 2020 were lower than that of 2019 by 6%. The percent change in volume is: 17.50% 14.00% 25.00% 20.00%arrow_forwardThe 2023 annual report for Pronghorn Industries Inc. contained the following information: Dec. 31, 2022 Dec. 31, 2023 Total assets 561,000 605,000Total liabilities 65,400 88,900Net revenue 410,000 530,000Net income 54,000 32,000 Calculate the rate of return on assets using profit margin for 2023arrow_forward

- Forecast Income Statement and Balance Sheet Following are the income statement and balance sheet for Medtronic PLC. Note: Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places. Medtronic PLC Consolidated Statement of Income $ millions, For Fiscal Year Ended April 26, 2019 Net sales $30,557 Costs and expenses Cost of products sold 9,155 Research and development expense 979 Selling, general, and administrative expense 10,418 Amortization of intangible assets 1,764 Restructuring charges, net 83 Certain litigation charges, net 166 Other operating expense, net 258 Operating profit 7,734 Other nonoperating income, net (157) Interest expense 1,444 Income before income taxes 6,447 Income tax provision 547 Net income 5,900 Net income loss attributable to noncontrolling interests (19) Net income attributable to Medtronic $5,881…arrow_forwardPrepare a projected statement of comprehensive income for the year ended 31 December 2021 to determine the sales needed to produce a profit after tax that is 25% more than that for the year ending 31 December 2020. (Where applicable round of amounts to the nearest rand) INFORMATION: Calder Enterprises Statement of Comprehensive Income for the year ended 31 December 2020 R Sales 5 445 000 Cost of sales (3 539 250) Gross profit Operating expenses Income from operations Interest expense 1905 750 (1 122 000) 783 750 (98 900) Profit before tax 684 850 Income tax (191 758) Profit after tax 493 092 Additional information: 1. Cost of sales is expected to be 60% of sales. 2. Operating expenses will increase by 4%. 3. Interest expense will increase to R120 000. 4. The tax rate will remain at 28% 3.2 Use the information from question 3.1 (not your solution) and calculate the following for the year ending 31 December 2020: 3.2.1 Gross margin 3.2.2 Net profit margin 3.2.3 Operating margin 3.2.4…arrow_forwardThe management of Zigby Manufacturing prepared the following estimated balance sheet for March 2019. ZIGBY MANUFACTURINGEstimated Balance SheetMarch 31, 2019 Assets Cash $ 80,000 Accounts receivable 364,000 Raw materials inventory 96,000 Finished goods inventory 364,800 Total current assets 904,800 Equipment 610,000 Accumulated depreciation (155,000 ) Equipment, net 455,000 Total assets $ 1,359,800 Liabilities and Equity Accounts payable $ 195,500 Short-term notes payable 17,000 Total current liabilities 212,500 Long-term note payable 510,000 Total liabilities 722,500 Common stock 340,000 Retained earnings 297,300 Total stockholders’ equity 637,300 Total liabilities and equity $ 1,359,800 To prepare a master budget for April, May, and June of 2019, management gathers the following information. Sales for March total…arrow_forward

- Vertical Balance Sheet for Isrceam factory on December 31,the end of the fiscal year, are shown below 2020 2021 Assets Cash 43500 55000 Inventory 22000 23500 Equipment and Fixtures 380000 255000 Supplies 3800 4100 Prepaid Expenses 9200 12500 Store Design/Buildout 27000 27000 Loan Fee 4000 5500 Advertising and Marketing 2500 3300 Liabilities Bank Loan 150000 170000 Owner Contribution 50000 45000 Prepare a comparative balance sheet for 2021 and 2022, stating each asset as a percent of total assests and each liability and stockholders' equity item as a…arrow_forwardFrom the trial balance, Prepare the statement of comprehensive income for the year ended 31 December 2020.arrow_forwardRefine Assumptions for PPE ForecastFollowing are the income statement and balance sheet for Medtronic PLC. Consolidated Statement of Income ($ millions) For Fiscal Year Ended April 26, 2019 Net sales $30,557 Costs and expenses Cost of products sold 9,155 Research and development expenses 2,330 Selling, general, and administrative expense 10,418 Amortization of intangible assets 1,764 Restructuring charges, net 198 Certain litigation charges, net 166 Other operating expense, net 258 Operating profit (loss) 6,268 Other nonoperating income, net (373) Interest expense 1,444 Income (loss) before income taxes 5,197 Income tax provision 547 Net income (loss) 4,650 Net (income) loss attributable to noncontrolling interests (19) Net income (loss) attributable to Medtronic $ 4,631 Consolidated Balance Sheet ($ millions) April 26, 2019 Current assets Cash and cash equivalents $ 4,393 Investments 5,455 Accounts receivable, less…arrow_forward

- Use the following selected data from Business Solutions's income statement for the three months ended March 31, 2022, and from its March 31, 2022, balance sheet to complete the requirements. Computer services revenue $ 25, 364 Net sales (of goods) 18, 138 Total sales and revenue 43, 502 Cost of goods sold 15, 644 Net income 19, 551 Quick assets 90, 356 Current assets 97, 288 Total assets 121, 816 Current liabilities 820 Total liabilities 820 Total equity 120, 996 Required: Compute the gross margin ratio (both with and without services revenue) and net profit margin ratio. Compute the current ratio and acid - test ratio. Compute the debt ratio and equity ratio. What percent of its assets are current? What percent are long term?arrow_forwardeon Jung Kook Corp. is preparing its year-end financial statements and has identified the following operating segments and their external revenues and intersegment revenues, respectively:· Begin- P4,800,000; P2,400,000· Euphoria- P1,600,000; P400,000· Decalcomania- P1,500,000; P0· My Time- P800,000; P0· Still with You- P600,000; P0· Paper Hearts- P400,000; P0Which of the following are reportable segments based on revenue test?arrow_forwardHow many reportable segments do FRUITAS have for year 2021 in accordance with IFRS 8, Operating Segments?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education