FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

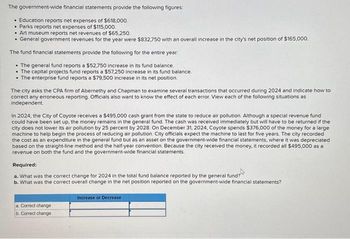

Transcribed Image Text:The government-wide financial statements provide the following figures:

• Education reports net expenses of $618,000.

• Parks reports net expenses of $115,000.

. Art museum reports net revenues of $65,250.

• General government revenues for the year were $832,750 with an overall increase in the city's net position of $165,000.

The fund financial statements provide the following for the entire year:

• The general fund reports a $52,750 increase in its fund balance.

The capital projects fund reports a $57,250 increase in its fund balance.

• The enterprise fund reports a $79,500 increase in its net position.

The city asks the CPA firm of Abernethy and Chapman to examine several transactions that occurred during 2024 and indicate how to

correct any erroneous reporting. Officials also want to know the effect of each error. View each of the following situations as

Independent.

In 2024, the City of Coyote receives a $495,000 cash grant from the state to reduce air pollution. Although a special revenue fund

could have been set up, the money remains in the general fund. The cash was received immediately but will have to be returned if the

city does not lower its air pollution by 25 percent by 2028. On December 31, 2024, Coyote spends $376,000 of the money for a large

machine to help begin the process of reducing air pollution City officials expect the machine to last for five years. The city recorded

the cost as an expenditure in the general fund but as an asset on the government-wide financial statements, where it was depreciated

based on the straight-line method and the half-year convention. Because the city received the money, it recorded all $495,000 as a

revenue on both the fund and the government-wide financial statements.

Required:

a. What was the correct change for 2024 in the total fund balance reported by the general fund?

b. What was the correct overall change in the net position reported on the government-wide financial statements?

a. Correct change

b. Correct change

Increase or Decrease

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Changes in mix of revenues and expenditures must be interpreted with care. The data that follow were drawn from the city of Boulder, Colorado’s CAFR. Dates have been changed. They are from two statistical-section schedules showing the mix of revenue and expenditures for a 10-year period. They include amounts only from the general fund, special revenue funds, and debt service funds. 2020 2021 (amounts in thousands) Revenues Sales and use taxes $ 97,397 $104,136 General property taxes 29,474 29,434 Other taxes 20,278 21,184 Charges for services 27,030 22,670 Intergovernmental 16,420 13,348 Proceeds from bonds and notes 54,830 Other 20,660 21,473 Total revenues $266,089 $212,245 Expenditures General government and administration $ 27,717 $ 30,185 Public safety 47,825 48,202 Public works 22,178 27,896 Housing and human services 13,384 20,226 Culture and recreation 25,677 28,089 Capital outlay 29,111 19,218 Debt service 13,574 16,375…arrow_forwardThe governmental funds of the City of Westchester report $601,500 in assets and $214,000 in liabilities. The following are some of the assets that the government reports. • Prepaid items-$16,900. • Cash from a bond issuance that must be spent within the school system according to the bond indenture-$120,000. • Supplies-$5,750. • Investments given by a citizen that will be sold soon with the proceeds used to beautify a public park-$34,500. • Cash that the assistant director of finance designated for use in upgrading the local roads-$43,750. • Cash from a state grant that must be spent to supplement the pay of local kindergarten teachers-$59,000. • Cash that the city council (the highest level of decision-making authority in the government) voted to use in renovating a school gymnasium-$80,750. On a balance sheet for the governmental funds, what fund balance amounts should the City of Westchester report? Answer is complete but not entirely correct. Fund balance-nonspendable Fund…arrow_forwardThe City of Wolfe issues its financial statements for Year 4 (assume that the city uses a calendar year). The city's general fund is composed of two functions: (1) education and (2) parks. The city also utilizes capital projects funds for ongoing construction and an enterprise fund to account for an art museum. The city also has one discretely presented component unit. The government-wide financial statements indicate the following Year 4 totals. Education had net expenses of $668,000. Parks had net expenses of $147,000. Art museum had net revenues of $59,500. General revenues were $972,500. The overall increase in net position for the city was $217,000. The fund financial statements for Year 4 indicate the following: The general fund had an increase of $32,500 in its fund balance. The capital projects fund had an increase of $62,250 in its fund balance. The enterprise fund had an increase of $63,250 in its net position balance. Officials for the City of Wolfe define "available" as…arrow_forward

- The City of Upper Falls accounts for its inventory using the purchases method. During the year the City bought $400,000 of supplies, for which it owed $100,000 at year-end. The City will pay for the supplies from available expendable financial resources. The entry that should be recorded in the City s General Fund is a. Debit Expenditures $400,000; Credit Cash $300,000 and Accounts Payable $100,000. b. Debit Expenditures $300,000; Credit Cash $300,000. c. Debit Supplies Inventory $400,000; Credit Cash $300,000 and Accounts Payable $100,000. d. Debit Supplies Inventory $300,000; Credit Cash $300,000.arrow_forwardAccountingarrow_forwardNeed Help with this Questionarrow_forward

- i need the answer quicklyarrow_forwardFollowing is the information concerning operating activity for Annette County. For the year ended June 30, the net change in total governmental fund balances was $(289,200), and the change in net position of governmental activities was $(376,600). During the year, Annette issued $2,000,000 in general obligation bonds at a premium of 101. The bonds are to be used for a construction project. The county acquired $2,750,000 in capital assets and sold capital assets with a book value of $563,000 for $570,900. At the beginning of the period, accrued liabilities were $470,000 and at the end of the period, they totaled $494,000. Depreciation on capital assets totaled $595,000. Revenue accrued for the period but not available for use totaled $364,600. Required Prepare a reconciliation of the change in governmental fund balance to the change in net position of governmental activities. (Decreases should be indicated with a minus sign.) ANNETTE COUNTY Reconciliation of the Statement of Revenues,…arrow_forward-The City of Havisham has a fiscal year ending December 31, Year 5. If the city were to produce financial statements right now, the following figures would be included: -Governmental activities: Assets = $800,000, Liabilities = $300,000, and Change in Net Position for the period = increase of $100,000 - Business-type activities: Assets = $500,000, Liabilities = $200,000, and Change in Net Position for the period = increase of $60,000 - Governmental funds: Assets = $300,000, Liabilities = $100,000, and Change in Fund Balances = increase of $40,000 -Proprietary funds: Assets = $700,000, Liabilities = $300,000, and Change in Net Assets for the period = increase of $70,000 Other information: The city council is considered the highest level of decision-making authority for the government. Where applicable, current financial resources are viewed by the government as available if collected within 75 days of the end of a fiscal year. For each of the following, indicate whether the overall…arrow_forward

- General City's general fund reported a supplies inventory costing $200,000 at the beginning of the fiscal year. During the year, General City purchased materials and supplies on account for $15,000,000; $900,000 remains unpaid at year-end. Materials and supplies costing $125,000 are on hand at the end of the fiscal year. Prepare the journal entries made this year using the consumption method and purchases method.arrow_forwardChesterfield County had the following transactions. A budget is passed for all ongoing activities. Revenue is anticipated to be $939,750, with approved spending of $594,000 and operating transfers out of $275,000. A contract is signed with a construction company to build a new central office building for the government at a cost of $6,000,000. The county previously recorded the budget for this project. Bonds are issued for $6,000,000 (face value) to finance construction of the new office building. The new building is completed. An invoice for $6,000,000 is received by the county and paid. Previously unrestricted cash of $1,350,000 is set aside by county officials to begin paying the bonds issued in (c). A portion of the bonds comes due, and $1,350,000 is paid. Of this total, $235,000 represents interest. The interest had not been previously accrued. Property tax levies are assessed. Total billing for this tax is $885,000. On this date, the assessment is a legally enforceable claim…arrow_forwardAt the beginning of the year, the Baker Fund,a nongovernmental not-for-profit corporation,received a $125,000 contribution restrictedto youth activity programs. During the year,youth activities generated revenues of$89,000 and had program expenses of$95,000. What amount should Baker reportas net assets released from restrictions forthe current year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education