Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:INSTEATRINDANN~~~~~≈¦¦¦¦¦¦¦++744

1

2

3

5

6

8

9

10

11

12

13

14

15

16

18

19

20

21

17 Year Payment Amount

22

23

24

25

26

27

28

29

30

31

32

33 14

36

34 15

37

35 16

38

39

40

A

41

42

~~~~~~ ON OG FW NOONGAWNIO

43

12

45

18

19

20

22

23

24

B

25

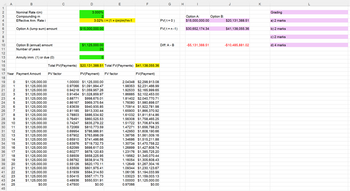

Nominal Rate r(m)

Compounding m

Effective Ann. Rate i

Option A (lump sum) amount

Option B (annual) amount

Number of years

Annuity imm. (1) or due (0)

$1,125,000.00

$1,125,000.00

$1,125,000.00

$1,125,000.00

$1,125,000.00

$1,125,000.00

$1,125,000.00

$1,125,000.00

$1,125,000.00

$1,125,000.00

$1,125,000.00

$1,125,000.00

$1,125,000.00

$1,125,000.00

$1,125,000.00

$1,125,000.00

$1,125,000.00

$1,125,000.00

$1,125,000.00

$1,125,000.00

$1,125,000.00

$1,125,000.00

$1,125,000.00

$1,125,000.00

$1,125,000.00

$0.00

C

PV factor

D

3.000%

2

3.02% i= (1 + i(m)/m)^m-1

$15,000,000.00

$1,125,000.00

25

0

E

1.00000 $1,125,000.00

0.97066 $1,091,994.47

0.94218 $1,059,957.26

0.91454 $1,028,859.97

0.88771 $998,675.01

0.86167 $969,375.64

0.83639 $940,935.85

0.81185 $913,330.44

0.78803 $886,534.92

0.76491 $860,525.53

0.74247 $835,279.22

0.72069 $810,773.59

0.69954 $786,986.91

0.67902 $763,898.09

0.65910 $741,486.66

0.63976 $719,732.73

0.62099 $698,617.03

0.60277 $678,120.83

0.58509 $658,225.95

0.56792 $638,914.75

0.55126 $620,170.11

0.53509 $601,975.41

0.51939 $584,314.50

0.50415 $567,171.73

0.48936 $550,531.91

0.47500

$0.00

LL

Total PV(Payments) $20,131,388.51 Total FV(Payments) $41,138,055.36

PV(Payment) FV factor

FV(Payment)

2.04348 $2,298,913.08

1.98353 $2,231,466.99

1.92533 $2,165,999.65

1.86885 $2,102,453.00

1.81402 $2,040,770.71

1.76080 $1,980,898.07

1.70914 $1,922,781.98

1.65900 $1,866,370.92

1.61032 $1,811,614.86

1.56308 $1,758,465.25

1.51722 $1,706,874.95

1.47271 $1,656,798.23

1.42950 $1,608,190.66

1.38756 $1,561,009.16

1.34686 $1,515,211.88

1.30734 $1,470,758.22

1.26899 $1,427,608.74

1.23176 $1,385,725.20

1.19562 $1,345,070.44

1.16054 $1,305,608.43

1.12649 $1,267,304.16

1.09344 $1,230,123.67

1.06136 $1,194,033.99

1.03023 $1,159,003.13

1.00000 $1,125,000.00

0.97066

$0.00

F

G

PV(t =0)

FV(t =n-1)

Diff: A - B

H

Option A:

$15,000,000.00

$30,652,174.34

-$5,131,388.51

Option B:

J

$20,131,388.51

$41,138,055.36

-$10,485,881.02

K

Grading

a) 2 marks

b) 2 marks

c) 2 marks

d) 4 marks

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- plan A plan B plan C Down payment 1,789.91 2,309.65 3,764.51 Annual payments 5,097.70 7,450.16 9,845.78 Years 20 20 20 Discount rate 12% 12% 12% What is the present value of plan B?arrow_forwardFast pls solve this question correctly in 5 min pls I will give u like for sure Surbharrow_forwardHw 2arrow_forward

- %24 What is the present value of a $1,000 payment made in five years when the discount rate is 10 percent? (Do not round Intermedlate calculatlons. Round your enswer to 2 declmal places.) Present value र् ( Prev 37 of 40 Next > ype here to search DELL F2 F4 F5 F7 F8 F11 F12 KA #3 V %arrow_forwardUse the NPV method to determine whether Root Products should invest in the following projects: • Project A: Costs $275,000 and offers eight annual net cash inflows of $53,000. Root Products requires an annual return of 12% on investments of this nature. Project B: Costs $380,000 and offers 9 annual net cash inflows of $74,000. Root Products demands an annual return of 10% on investments of this nature. E(Click the icon to view Present Value of $1 table.) E (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements. Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. (Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative net present value.) Caclulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A. Project A: Net Cash Annuity PV Factor Present Years Inflow (i=12%, n=8) Value 1-8 Present value of…arrow_forwardPlease don't provide answer in image format thank you.arrow_forward

- Pls solve this question correctly instantly in 5 min i will give u 3 like for surearrow_forwardVitalSource Account Center: Use X chapter05/4/2/28/6/40/2/2/4 G Sign in - Google Accounts Determine the future value of the following single amounts: 1234 Invested Amount $15.000 20,000 30,000 50,000 Interest Rate 6% 8 12 4 No. of Periods 12 ខសង 10 20 12 QA Aug 13, 2023, 12:15 PMarrow_forwardF16 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 1 2 Loan Amount 3 Annual Interest Rate 4 #times per year interest accrued 5 Periodic Rate 6 Term (years) 7 #payments per year 8 Number of payments 9 Balloon (balance after final payment) 10 Points paid at origination to get loan 11 12 32 33 34 35 36 37 38 39 40 DA Home Insert Cut Copy Format 41 42 Paste 43 44 ▾ Ready Sheet1 ✓ fx A Page Layout Calibri (Body) ▼ 11 BIU Sheet2 ▼ Formulas + B $1,000,000.00 7.66% 12 0.64% 30 12 360 Data A- A ▾ C Review View $0.00 AKA "Fully Amortizing" 1.50% t D 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 22 EE E Wrap Text + Merge & Center ▾ Balance in (t): B_(t) $1,000,000.00 F X Project Custom Interest in (t+1): (i/m)*B_t $6,383.33 % % > G +.0 .00 Payment in (t+1) $7,102.03 .00 ➡.0 Conditional Format Formatting as Table H Balance in (t+1): B_(t+1) $999,281.30 $0.00 I Cell Styles J H Insert X H Delete K Format Principal paid in (t+1)(=PMT-INT) 圓 Q Search…arrow_forward

- Allegience Insurance Company's management is considering an advertising program that would require an initial expenditure of $172,120 and bring in additional sales over the next five years. The projected additional sales revenue in year 1 is $79,000, with associated expenses of $27,000. The additional sales revenue and expenses from the advertising program are projected to increase by 10 percent each year. Allegience's tax rate is 30 percent. (Hint: The $172,120 advertising cost is an expense.) Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Required: 1. Compute the payback period for the advertising program. 2. Calculate the advertising program's net present value, assuming an after-tax hurdle rate of 10 percent. (Round your intermediate calculations and final answer to the nearest whole dollar.) 1. Payback period 2. Net present value yearsarrow_forwardHi, Can you please help with E21.10? Please show how to get the numbers , thank you.arrow_forwardP16-2 P16–2 Cost of giving up early payment discounts Determine the cost of giving up the dis-count under each of the following terms of sale. (Note: Assume a 365-day year.) a. 2/10 net 30?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education