Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

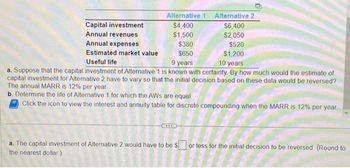

Transcribed Image Text:Alternative 2

$6,400

$2,050

$520

$1,200

Useful life

9 years

10 years

a. Suppose that the capital investment of Alternative 1 is known with certainty. By how much would the estimate of

capital investment for Alternative 2 have to vary so that the initial decision based on these data would be reversed?

The annual MARR is 12% per year.

b. Determine the life of Alternative 1 for which the AWS are equal.

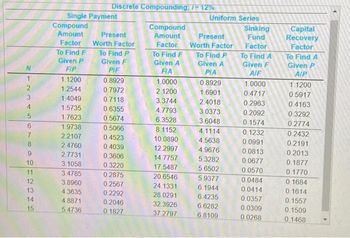

Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year

Capital investment

Annual revenues

Annual expenses

Estimated market value

Alternative 1

$4,400

$1,500

$380

$650

a. The capital investment of Alternative 2 would have to be $ or less for the initial decision to be reversed (Round to

the nearest dollar)

Transcribed Image Text:1

2

3

4

5

7

8

9

10

11

12

13

14

15

Single Payment

Compound

Amount

Factor

To Find F

Given P

FIP

1.1200

1.2544

1.4049

1.5735

1.7623

1.9738

2.2107

2.4760

2.7731

3.1058

3.4785

3.8960

Discrete Compounding; /= 12%

4.3635

4.8871

5 4736

Present

Worth Factor

To Find P

Given F

PIF

0.8929

0.7972

0.7118

0.6355

0.5674

0.5066

0.4523

0.4039

0.3606

0.3220

0.2875

0.2567

0.2292

0.2046

0 1827

Uniform Series

Compound

Amount Present

Factor

To Find F

Given A

FIA

1.0000

2.1200

3.3744

4.7793

6.3528

8.1152

10.0890

12.2997

14.7757

17.5487

20.6546

24.1331

28.0291

32.3926

37 2797

Worth Factor

To Find P

Given A

ΡΙΑ

0.8929

1.6901

2.4018

3.0373

3.6048

4.1114

4.5638

4.9676

5.3282

5.6502

5.9377

6.1944

6.4235

6.6282

6.8109

Sinking

Fund

Factor

To Find A

Given F

AIF

1.0000

0.4717

0.2963

0.2092

0.1574

0.1232

0.0991

0.0813

0.0677

0.0570

0.0484

0.0414

0.0357

0.0309

0.0268

Capital

Recovery

Factor

To Find A

Given P

AIP

1.1200

0.5917

0.4163

0.3292

0.2774

0.2432

0.2191

0.2013

0.1877

0.1770

0.1684

0.1614

0.1557

0.1509

0 1468

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Exercise 1arrow_forward6 Project A requires a $375,000 initial investment for new machinery with a five-year life and a salvage value of $43,000. Project A is expected to yield annual income of $22,700 per year and net cash flow of $93,750 per year for the next five years. Compute Project A's accounting rate of return. 04:19:42 Numerator: Accounting Rate of Return Denominator: Accounting Rate of Return Accounting rate of returnarrow_forwardQUESTION 5 GoGo Inc. is considering a new project that requires an initial investment of $36140 and will generate a net income of $5518 per year, if the project's profitability index is 2.8, the present value of the project's future cash flows is $ Round to the nearest dollar.arrow_forward

- question 11 What is the present value of investment A, B, and C at an annual discount rate of 24 percent?arrow_forwardQUESTION 7 A project has a 0.8 chance of quintupling your investment in a year and a 0.2 chance of halving your investment in a year. What is the standard deviation of the rate of return on this investment? O 100.00% O 140.00% 180.00% O 220.00% 260.00% None of the abovearrow_forwardQuestion 1 Davidsons Incorporated is using Payback Period and Net Present Value (NPV) methods for investment decision making for small projects. The cut-off period will remain at 3 years. The net after tax cash flows of the projects are as follows: Cash Flows Initial Cost Year 1 Year 2 Year 3 Required: Project 1 £11,000 £5,000 £5,000 £5,000 Project 2 £20,000 £7,000 £5,500 £4,000 Project 3 £8,000 b) Explain the uses, limitations, and merits of the Payback Period compared to Net Present Value in investment appraisal. £3,000 £3,500 £4,000 a) Calculate the NPV of each project at 9% discount rate. Given the above four projects' cash flows and using a 9% discount rate, which projects that would have been accepted under Payback Period will now be rejected under Net Present Value? Project 4 £19,000 £11,000 £12,000 £0arrow_forward

- Question A22 A project initially costs £297,000 and is expected to have a useful life of five years at which point its scrap value will be £32,000. The project is expected to yield operating profits of £94,000 per year over its useful life. What is the accounting rate of return? (2d.p.)arrow_forwardQuestion 6 Year a. DORIAN Enterprise has developed a four-year investment plan which is expected to generate the following cash flows: 1 2 3 4 Cash flow GH¢ 30,000 45,000 48,000 50,000 The opportunity cost of capital is 18%. How much is this investment worth today? b. The financial data of DORIAN Enterprise is given as follows: Details Operating income Amount GH¢ Financial expense 275,000 47,000 Net impairment loss, gross loan portfolio 53,000 Operating expense 122,000 Gross loan portfolio 125,000 Delinquency + 1 month or more 14,000 Net subsidy 26,000 Interest rate charged on loans = 18% i. Compute the Subsidy Dependence Index (SDI) ii. Compute the Operational Self Sufficiency (OSS) iii. Compute the Portfolio at Risk (PAR) of DORIAN Ltd. iv. What do the values computed in (a), (b) and (c) represent? c. Below are the details of Accounts Receivable of DORIAN Ltd. Customer Outstanding Balance GH¢ Days outstanding 1 5,000 28 2 8,000 42 3 15,000 30 4 8,500 65 5 6,000 120 6 14,000 73 7…arrow_forwardFast pls solve this question correctly in 5 min pls I will give u like for sure Surbh Question 2 Three part question Project L requires an initial outlay at t = 0 of $35,000, its expected cash inflows are $10,000 per year for 9 years, and its WACC is 12%. What is the project's NPV? Do not round intermediate calculations. Round your answer to the nearest cent. $ Project L requires an initial outlay at t = 0 of $61,639, its expected cash inflows are $12,000 per year for 9 years, and its WACC is 9%. What is the project's IRR? Round your answer to two decimal places. % Project L requires an initial outlay at t = 0 of $71,000, its expected cash inflows are $9,000 per year for 9 years, and its WACC is 14%. What is the project's payback? Round your answer to two decimal places. yearsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education