Concept explainers

Selected stock transactions

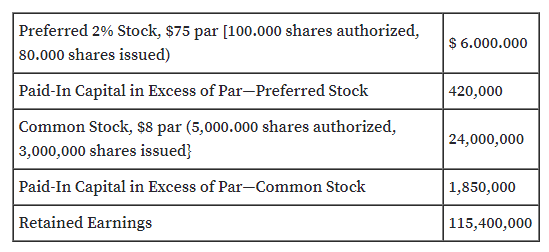

The following selected accounts appear in the ledger of Parks

Construction Inc. at the beginning of the current year:

During the year, the corporation completed a number of transactions

affecting the

a. Issued 400,000 shares of common stock at $11, receiving cash.

b. Issued 5,000 shares of preferred 2% stock at $90.

c. Purchased 150,000 shares of treasury common for $10 per share.

d. Sold 80,000 shares of treasury common for $13 per share.

e. Sold 20,000 shares of treasury common for $9 per share.

f. Declared cash dividends of $1.50 per share on

and $0.06 per share on common stock.

g. Paid the cash dividends.

Instructions

letter

Step by stepSolved in 2 steps

- Instructions Journalize the selected transactions. Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, Year 1, were as follows: a. Issued 15,000 shares of $20 par common stock at $30, receiving cash. b. Issued 4,000 shares of $80 par preferred 5% stock at $100, receiving cash. c. Issued $500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of $0.50 per share on common stock and $1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at $40 per share plus a $150 brokerage commission. The investment is classified as an available-forsale investment. g. Purchased 8,000 shares of treasury common stock at $33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock…arrow_forwardKohler Corporation reports the following components of stockholders' equity at December 31 of the prior year. Common stock-$15 par value, 100,000 shares authorized, 60,000 shares issued and outstanding Paid-in capital in excess of par value, cormon stock Retained earnings Total stockholders' equity During the current year, the following transactions affected its stockholders' equity accounts. January 2 Purchased 4,000 shares of its own stock at $20 cash per share. January 5 February 28 July 6 August 22 September 5 Directora declared a $2 per share cash dividend payable on February 28 to the February 5 stockholders of record. Paid the dividend declared on January 5. Sold 2,000 of its treasury shares at $24 cash per share. Sold 2,000 of its treasury shares at $16 cash per share. Directors declared a $2 per share cash dividend payable on October 28 to the September 25 stockholders of record. October 28 Paid the dividend declared on September 5. December 31 Closed the $408,000 credit…arrow_forwardThe annual report for Sneer Corporation disclosed that the company declared and paid preferred dividends in the amount of $170,000 in the current year. It also declared and paid dividends on common stock in the amount of $2.70 per share. During the current year, Sneer had 1 million common shares authorized; 370,000 shares had been issued; and 163,000 shares were in treasury stock. The opening balance in Retained Earnings was $870,000 and Net Income for the current year was $370,000. Required: 1. Prepare journal entries to record the declaration, and payment, of dividends on (a) preferred and (b) common stock. 2. Using the information given above, prepare a statement of retained earnings for the year ended December 31. 3. Prepare a journal entry to close the dividends account.arrow_forward

- darrow_forwardRequired information The following information applies to the questions displayed below] Incentive Corporation was authorized to issue 12,000 shares of common stock, each with a $1 par value. During its first year, the following selected transactions were completed: a. Issued 5,400 shares of common stock for cash at $24 per share. b. Issued 1,400 shares of common stock for cash at $27 per share. 3. Prepare the stockholders' equity section as it should be reported on the year-end balance sheet. At year-end, the accounts reflected net income of $200. INCENTIVE CORPORATION Balance Sheet (Partial) At December 31 Stockholders' Equity Contributed Capital: Total Contributed Capital Total Stockholders' Equityarrow_forwardKohler Corporation reports the following components of stockholders' equity at December 31 of the prior year. Common stock-$25 par value, 100,000 shares authorized, 60,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity During the current year, the following transactions affected its stockholders' equity accounts. January 2 Purchased 6,000 shares of its own stock at $20 cash per share. January 5 Directors declared a $6 per share cash dividend payable on February 28 to the February 5 stockholders of record. Paid the dividend declared on January 5. February 28 Sold 3,000 of its treasury shares at $24 cash per share. Sold 3,000 of its treasury shares at $16 cash per share. July 6 August 22 September 5 October 28 December 31 Directors declared a $6 per share cash dividend payable on October 28 to the September 25 stockholders of record. Paid the dividend declared on September 5. Closed the $408,000 credit…arrow_forward

- Prepare all journal entries and adjusting journal entries necessary to record all of Red Robin’s transactions related to its stockholders’ equity. See information below: Stockholders’ Equity On January 1 of the current year, Red Robin had 441,100 shares of $1 par value common stock issued (i.e., the shares had been issued prior to the current year). They have 1,245,000 shares authorized and 400,200 shares outstanding. Red Robin has had only one stock repurchase transaction in its history. On August 1 of the current year, Red Robin reissued 6,650 shares for$24 per share. On December 1 of the current year, Red Robin reissued 11,700 shares at $12 per share. Red Robin declared dividends of 18 cents per share on the last day of each calendar quarter and paid them on the 5th day of the 1st month of each calendar quarter. For the sake of simplicity, assume the date of record is also the last day of each calendar quarter. Red Robin did not declare any dividends in the prior year.arrow_forwardThe following information was extracted from the records of Cascade Company at the end of the fiscal yea were completed: Common stock ($0.01 par value; 230,000 shares authorized, 55,500 shares issued, 53,500 shares outstanding) Additional paid-in capital Dividends declared and paid during the year Retained earnings at the end of the year Treasury stock at cost (2,000 shares) Net income Current stock price Required: 1. Prepare the stockholders' equity section of the balance sheet at the end of the fiscal year. 2. Compute the dividend yield ratio. Determine the number of shares of stock that received dividends. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the dividend yield ratio. Determine the number of shares of stock that received dividends. Note: Do not round your intermediate calculations. Round Dividend yield ratio to 2 decimal places. Dividend yield ratio Number of shares % $ 555 459,000 23,500 315,000 (16;500) $ 96,500 $ 10 >arrow_forwardClothing Frontiers began operations on January 1 and engages in the following transactions during the year related to stockholders' equity. January 1 Issues 700 shares of common stock for $34 per share. April 1 Issues 110 additional shares of common stock for $38 per share. 2. Record the transactions, assuming Clothing Frontiers has either $1 par value or $1 stated value common stock. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 2 Record the issuance of 700 shares of common stock for $34 per share. Note: Enter debits before credits. Date General Journal Debit Credit January 01arrow_forward

- The annual report for Sneer Corporation disclosed that the company declared and paid preferred dividends in the amount of $300,000 in the current year. It also declared and paid dividends on common stock in the amount of $1.00 per share. During the current year, Sneer had 1 million common shares authorized; 500,000 shares had been issued; and 280,000 shares were in treasury stock. The opening balance in Retained Earnings was $700,000 and Net Income for the current year was $200,000. Required: 1. Prepare journal entries to record the declaration, and payment, of dividends on (a) preferred and (b) common stock. 2. Using the information given above, prepare a statement of retained earnings for the year ended December 31. 3. Prepare a journal entry to close the dividends account.arrow_forwardPart A During its first year of operations, the A. Clem Corporation entered into the following transactions relating to shareholders’ equity. The corporation was authorized to issue 103 million common shares, $1 par per share. Required: Prepare the appropriate journal entries to record each transaction. January 9 Issued 30 million common shares for $14 per share. March 11 Issued 4,200 shares in exchange for custom-made equipment. A. Clem shares have traded recently on the stock exchange at $14 per share. Part B A new staff accountant for the A. Clem Corporation recorded the following journal entries during the second year of operations. A. Clem retires shares that it reacquires (restores their status to that of authorized but unissued shares). Date General Journal ($ in millions) Debit Credit September 1 Common stock 4 Retained earnings 72 Cash 76 December 1 Cash 40 Common stock 2 Gain on sale of previously issued shares 38 Required:…arrow_forwardAlex Corporation reports the following components of stockholders' equity at December 31 of the prior year. Common stock-$25 par value, 60,000 shares authorized, 37,000 shares i issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity $ 925,000 74,000 364,000 $ 1,363,000 During the current year, the following transactions affected its stockholders' equity accounts. January 2 Purchased 3,700 shares of its own stock at $25 cash per share. January 7 February 28 July 9 August 27 September 9 October 22 December 31 Directors declared a $1.50 per share cash dividend payable on February 28 to the February 9 stockholders of record. Paid the dividend declared on January 7. Sold 1,480 of its treasury shares at $30 cash per share. Sold 1,850 of its treasury shares at $21 cash per share. Directors declared a $2 per share cash dividend payable on October 22 to the September 23 stockholders of record. Paid the dividend declared on…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education