FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Portia Grant is an employee who is paid monthly. For the month of January of the current year, she earned a total of $8,260

The Federal Insurance Contributions Act (FICA) tax for social security is 6.2% of the first $137700 earned each calendar year

and the Federal Insurance Contributions Act (FICA) tax rate for Medicare is 145% of all earnings. The Federal

Unemployment Taxes (FUTA) tax rate of 06% and the State Unemployment Taxes (SUTA) tax rate of 5.4% are applied to the

first $7,000 of an employee's pay. The amount of federal income tax withheld from her earnings was $1,32517 What is the

total amount of taxes withheld from the Portia's earnings? (Round your intermediate calculetions to two decimal places.)

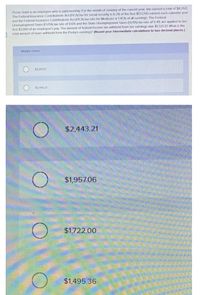

Multiple Choice

$3,09717

$2,443 21

$2,443.21

$1,957.06

$1,722.00

$1,495.36

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Employee AA is paid monthly. For the month of January, she earned a total of $8,260. The tax for social security is 6.2% of the first $128,400 of employee earnings each calendar year and the tax rate for Medicare is 1.45% of all earnings. The FUTA tax rate of .6% and the SUTA tax rate of 5.4% are applied to the first $7,000 of an employee's pay. The amount of federal income tax withheld from Employee AA’s earnings was $1,325.17. Employee AA’s net pay for the month is:arrow_forwardAZT Company has one employee who has worked January - March 15 of the current year. The employee is single, paid semi-monthly, and claims two allowances on his W-2. The federal withholding is $143. The company is in a state that has no state income taxes. The FICA Social Security tax rate is 6.2% on the first $118,500 of wages and the FICA Medicare tax rate is 1.45% on all wages. AZT Company's FUTA tax rate is 0.6% on the first $7,000 of wages and their SUTA tax rate is 1.95% on the first $8,000 of wages. The employee's earnings thus far are as follows: Gross pay Jan - Mar 15th Gross pay for March 31st $6,200 $1,280 Use the information above to calculate the employer's payroll taxes and prepare the journal entry AZT Company will use to record the employer's portion of the payroll taxes for the pay period ended March 31st. Date 03/31 Description Debit Credit to record employer's portion of payroll taxes for the pay period ending March 31starrow_forwardDomesticarrow_forward

- Thomas Martin receives an hourly wage rate of $15, with time-and-a-half pay for all hours worked in excess of 40 hours during a week. Payroll data for the current week are as follows: hours worked, 48; federal income tax withheld, $370; social security tax rate, 6.0%; and Medicare tax rate, 1.5%. What is the gross pay for Martin? Round your answer to the nearest whole dollar. Oa. $720 Ob. $780 Oc. $1,080 Od. $1,440arrow_forwardJohn Moyer (married; 6 federal withholding allowances) earned monthly gross pay of $3,150. He participates in a flexible spending account, to which he contributes $265 during the period.Using wage-bracket method: Federal income tax withholding = $Using percentage method: Federal income tax withholding = $arrow_forwardDr. Josef Young earns an adjusted gross weekly income of $2,472. How much Social Security tax should be withheld the first week of the year? How much Medicare tax should be withheld? The Social Security tax rate is 6.2% from earnings to be taxed to a maximum annual wage of $118,500. The Medicare tax rate is 1.45% from all earnings to a maximum annual wage of $200,000. The Social Security tax is $??? (Type an integer or a decimal. Round to the nearest cent as needed.) The Medicare tax is $??? (Type an integer or a decimal. Round to the nearest cent as needed.)arrow_forward

- An employee earned $62,500 during the year working for an employer. The FICA tax rate for Social Security is 6.2% of the first $128,400 of employer earnings per calendar year and the FICA tax rate Medicare is 1.45% of all earnings. The current FUTA tax rate is 0.6%, and the SUTA tax rate is 5.4%. Both unemployment taxes are applied to the first $7,000 of an employee's pay. What is the amount of total unemployment taxes the employee must pay?arrow_forwardMartin Jackson receives an hourly wage rate of $25, with time and a half for all hours worked in excess of 40 hours during a week. Payroll data for the current week are as follows: hours worked, 46; federal income tax withheld, $362; social security tax rate, 6.0%; and Medicare tax rate, 1.5%. What is the net amount to be paid to Jackson? Oa. $1,225.00 Ob. $1,846.13 Oc. $771.13 Od. $1,633.13arrow_forwardAn employee earned $46,800 during the year working for an employer when the maximum limit for Social Security was $128,400. The FICA tax rate for Social Security is 6.2% and the FICA tax rate for Medicare is 1.45%. The employee's annual FICA taxes amount is: Multiple Choice $2,789.20. $6,489.70. $7,160.40. $3,580.20. $670.70.arrow_forward

- Thomas Martin receives an hourly wage rate of $22, with time and a half for all hours worked in excess of 40 hours during a week. Payroll data for the current week are as follows: hours worked, 44; federal income tax withheld, $329; social security tax rate, 6.0%; and Medicare tax rate, 1.5%. What is the gross pay for Martin? a.$968 b.$1,012 c.$1,452 d.$1,936arrow_forwardPat Maninen earns a gross salary of $4,600 each week. Assume a rate of 6.2% on $128,400 for Social Security and 1.45% for Medicare.a. What are Pat’s first week’s deductions for Social Security and Medicare? Will any of Pat’s wages be exempt from Social Security and Medicare for the calendar year?arrow_forwardSky Company employed Tom Mills in Year 1. Tom earned $5,900 per month and worked the entire year. Assume the Social Security tax rate is 6 percent for the first $130,000 of earnings, and the Medicare tax rate is 1.5 percent. Tom's federal income tax withholding amount is $870 per month. Use 5.4 percent for the state unemployment tax rate and 0.6 percent for the federal unemployment tax rate on the first $7,000 of earnings per employeearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education