FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

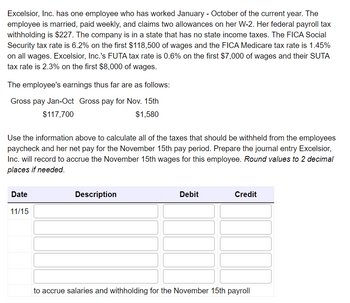

Transcribed Image Text:Excelsior, Inc. has one employee who has worked January - October of the current year. The

employee is married, paid weekly, and claims two allowances on her W-2. Her federal payroll tax

withholding is $227. The company is in a state that has no state income taxes. The FICA Social

Security tax rate is 6.2% on the first $118,500 of wages and the FICA Medicare tax rate is 1.45%

on all wages. Excelsior, Inc.'s FUTA tax rate is 0.6% on the first $7,000 of wages and their SUTA

tax rate is 2.3% on the first $8,000 of wages.

The employee's earnings thus far are as follows:

Gross pay Jan-Oct Gross pay for Nov. 15th

$117,700

$1,580

Use the information above to calculate all of the taxes that should be withheld from the employees

paycheck and her net pay for the November 15th pay period. Prepare the journal entry Excelsior,

Inc. will record to accrue the November 15th wages for this employee. Round values to 2 decimal

places if needed.

Date

11/15

Description

Debit

Credit

to accrue salaries and withholding for the November 15th payroll

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Old Town Entertainment has two employees in Year 1. Clay earns $3,500 per month, and Philip, the manager, earns $10,400 per month. Neither is paid extra for working overtime. Assume the Social Security tax rate is 6 percent on the first $130,000 of earnings and the Medicare tax rate is 1.5 percent on all earnings. The federal income tax withholding is 16 percent of gross earnings for Clay and 21 percent for Philip. Both Clay and Philip have been employed all year. Required a. Calculate the net pay for both Clay and Philip for March. b. Calculate the net pay for both Clay and Philip for December. c. Is the net pay the same in March and December for both employees? d. What amounts will Old Town report on the Year 1 W-2s for each employee? Complete this question by entering your answers in the tabs below. Reg A and B Req C a. Clay a Philip b. Clay b. Philip Reg D Calculate the net pay for both Clay and Philip for March. Calculate the net pay for both Clay and Philip for December. (Do not…arrow_forwardYoungston Company (a massachusetts employer) wants to give a holiday bonus check of $750 to each employee. Since it wants the check amount to be $750, it will need to gross-up the amount of the bonus. Calculate the withhholding taxes and the gross amount of the bonus to be made to Genna Fredrich if her earnings for the year are $55,920. Besides being subject to social security taxes and federal income tax (supplemental rate),a 5.1% Massachusetts income tax must be withheld on supplemental payments. (a)__ (b)_ (c).arrow_forwardDamerly Company (a Utah employer) wants to give a holiday bonus check of $325 to each employee. Since it wants the check amount to be $325, it will need to gross-up the amount of the bonus. Calculate the withholding taxes and the gross amount of the bonus to be made to John Rolen if his cumulative earnings for the year are $46,910. Besides being subject to social security taxes and federal income tax (supplemental rate), a 4.95% Utah income tax must be withheld on supplemental payments. Enter deductions beginning with a minus sign (-). You may need to adjust by a penny (subtract or add) to the gross amount to get net pay to calculate exactly to $325.00. Round your calculations and final answers to the nearest cent. As we go to press, the federal income tax rates for 2021 are being determined by budget talks in Washington and not available for publication. For this edition, the 2020 federal income tax tables for Manual Systems with Forms W-4 from 2020 or later with Standard Withholding…arrow_forward

- Armand Giroux (single; 0 federal withholding allowances) earned weekly gross pay of $1,445. For each period, he makes a 401(k) retirement plan contribution of 6.5% of gross pay. The city in which he works (he lives elsewhere) levies a tax of 1.15% of an employee's taxable pay (which is the same for federal and local income tax withholding) on residents and 0.75% of an employee's taxable pay on nonresidents.Federal income tax withholding = $ State income tax withholding = $arrow_forwardThe employees of Lillian's Interiors are paid on a semimonthly basis. All employees are single. Required: Compute the FICA taxes for the employees for December 31, 2021, pay period. All employees have been employed for the entire calendar year. (Round "Social Security Tax" and "Medicare Tax" to 2 decimal places.) Employee W. Babish G. Hanoush R. Fezzeti T. Gomez N. Bertraud R. LaPonte Semimonthly Pay $ $ $ $ 69 69 $ X Answer is complete but not entirely correct. Social Security Tax $ YTD Pay for 12-15- 2021 8,345 $191,935 $ 6,295 $ 144,785 $ 9,270 $ 213,210✔✔ $ $ 105,110 $ 4,570 5,725 $ 131,675$ 4,970 $ 114,310 $ Medicare Tax for 12- 31-2021 Pay for 12-31- 2021 Pay 0.00 $ 0.00 $ 0.00 $ 283.34 354.95 $ $ 308.14 $ 121.00 x 91.28 217.85✔ 66.27✔ 83.01✔ 72.07✔arrow_forwardAmy's gross pay for the week is $850. Her deduction for federal income tax is based on a rate of 25%. She has voluntary deductions of $255. Her year−to−date pay is under the limit for OASDI. What is her net pay? (Assume a FICA—OASDI Tax of 6.2% and FICA—Medicare Tax of 1.45%. Round all calculations to the nearest cent.)arrow_forward

- Youngston Company (a Massachusetts employer) wants to give a holiday bonus check of $750 to each employee. Since it wants the check amount to be $750, it will need to gross-up the amount of the bonus. Calculate the withholding taxes and the gross amount of the bonus to be made to Genna Fredrich if her earnings for the year are $55,920. Besides being subject to social security taxes and federal income tax (supplemental rate), a 5.00% Massachusetts income tax must be withheld on supplemental payments........? Compute the gross bonus amount and various amounts deducted to arrive at the net bonus check of $750. Present your computation vertically in a single column. Show supporting computations.arrow_forwardLucy Rose works at College of Fort Worth and is paid $12 per hour for a 40-hour workweek and time-and-a-half for hours above 40. A (Click the icon to view payroll tax rate information.) Read the requirements. Requirement 2. Rose is single, and her income tax withholding is 15% of total pay. Rose's only payroll deductions are payroll taxes. Compute Rose's net (take-home) pay for the week. Assume Rose's earnings to date are less than the OASDI limit. (Round all amounts to the nearest cent.) Withholding deductions: Net (take-home) pay Requirement 3. Journalize the accrual of wages expense and the payments related to the employment of Lucy Rose. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Begin with the entry to accrue wages expense and payroll withholdings for Lucy Rose. (Round all amounts to the nearest cent.) Date Accounts and Explanation Debit Creditarrow_forwardAZT Company has one employee who has worked January - March 15 of the current year. The employee is single, paid semi-monthly, and claims two allowances on his W-2. The federal withholding is $143. The company is in a state that has no state income taxes. The FICA Social Security tax rate is 6.2% on the first $118,500 of wages and the FICA Medicare tax rate is 1.45% on all wages. AZT Company's FUTA tax rate is 0.6% on the first $7,000 of wages and their SUTA tax rate is 1.95% on the first $8,000 of wages. The employee's earnings thus far are as follows: Gross pay Jan - Mar 15th Gross pay for March 31st $6,200 $1,280 Use the information above to calculate the employer's payroll taxes and prepare the journal entry AZT Company will use to record the employer's portion of the payroll taxes for the pay period ended March 31st. Date 03/31 Description Debit Credit to record employer's portion of payroll taxes for the pay period ending March 31starrow_forward

- Julie Whiteweiler made $930 this week. Only social security (fully taxable) and federal income taxes attach to her pay. Whiteweiler contributes $100 each week to her company's 401(k) plan and has $30 put into her health savings account (nonqualified) each week. Her employer matches this $30 each week. Determine Whiteweiler's take-home pay if she is head of household. Enter deductions beginning with a minus sign (-). Round your calculations and final answers to the nearest cent. As we go to press, the federal income tax rates for 2021 are being determined by budget talks in Washington and not available for publication. For this edition, the 2020 federal income tax tables for Manual Systems with Forms W-4 from 2020 or later with Standard Withholding and 2020 FICA rates have been used. Click here to access the Wage-Bracket Method Tables. Gross pay $930 HSA contributions -30 401(k) deductions -100 OASDI tax -57.66 HI tax -13.49 FIT Net pay $arrow_forwardDuring the first week of February, Gabe Hopen earned $300. Assume that FICA taxes are 7.65 percent of wages up to $106,800, state unemployment tax is 5.0 percent of wages up to $13,000, and federal unemployment tax is 0.8 percent of wages up to $13,000. Assume that Gabe has voluntary withholdings of $10 (in addition to taxes) and that federal and state income tax withholdings are $18 and $6, respectively. Using the information above, what is the employer's payroll tax expense for the week, assuming that Gabe Hopen is the only employee? Group of answer choices $24.00 $17.40 $28.00 $40.35arrow_forwardOld Town Entertainment has two employees in Year 1. Clay earns $4,500 per month, and Philip, the manager, earns $10,700 per month. Neither is paid extra for working overtime. Assume the Social Security tax rate is 6 percent on the first $110,000 of earnings and the Medicare tax rate is 1.5 percent on all earnings. The federal income tax withholding is 15 percent of gross earnings for Clay and 22 percent for Philip. Both Clay and Philip have been employed all year. Required a. Calculate the net pay for both Clay and Philip for March. b. Calculate the net pay for both Clay and Philip for December. c. Is the net pay the same in March and December for both employees? d. What amounts will Old Town report on the Year 1 W-2s for each employee? Complete this question by entering your answers in the tabs below. Req A and B a. Clay Calculate the net pay for both Clay and Philip for March. Calculate the net pay for both Clay and Philip for December. (Do not round intermediate calculations and…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education