FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

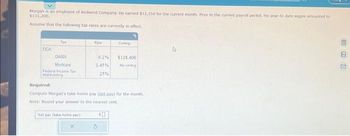

Morgan is an employee of Redwind Company. He earned $12,350 for the current month. Prior to the current payroll period, his year-to-date wages amounted to $131,200. Assume that the following tax rates are currently in effect. 7 FICA Tax OASDI Medicare Federal Income Tax Withholding Net pay (take-home pay): Rate X 6.2% 1.45% 25% Required: Compute Morgan's take-home pay (net pay) for the month. Note: Round your answer to the nearest cent. Ceiling $0 $128,400 No ceiling BEE K

Transcribed Image Text:Morgan is an employee of Redwind Company. He earned $12,350 for the current month. Prior to the current payroll period, his year-to-date wages amounted to

$131,200.

Assume that the following tax rates are currently in effect.

7

EICA

Tax

DASDI

Medicare

Federal Income Tax

Withholding

Net pay (take-home pay)

6,2%

1.45%

25%

x

Celing

Required:

Compute Morgan's take-home pay (net pay) for the month.

Note: Round your answer to the nearest cent

$0

$128,400

No celing

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sky Company employed Tom Mills in Year 1. Tom earned $5,900 per month and worked the entire year. Assume the Social Security tax rate is 6 percent for the first $130,000 of earnings, and the Medicare tax rate is 1.5 percent. Tom's federal income tax withholding amount is $870 per month. Use 5.4 percent for the state unemployment tax rate and 0.6 percent for the federal unemployment tax rate on the first $7,000 of earnings per employeearrow_forwardAssume a tax rate of 6.2% on $142,800 for Social Security and 1.45% for Medicare. No one will reach the maximum for FICA. Complete the following payroll register. (Use the percentage method to calculate FIT for this weekly period.) (Use Table 9.1). Note: Do not round intermediate calculations and round your final answers to the nearest cent. Employee Pat Brown Marital status S Gross pay $ 1,900 FIT Social Security FICA Medicare Net payarrow_forwardJason's gross pay for the week is $1,900. His yearly pay is under the limit for OASDI. Assume that the rate for state and federal unemployment compensation taxes is 6% and that Jason's year-to-date pay has not yet exceeded the $7,000 cap. His yearly pay is under the limit for OASDI. What is the total amount of payroll taxes that his employer must record as payroll tax expenses?arrow_forward

- Kip Bowman is owner and sole employee of KB Corporation. He pays himself a salary of $1,500 each week. Additional tax information includes: FICA tax—OASDI 6.2% on first $132,900 FICA tax—HI 1.45% on total pay Federal income tax $232.00 per pay State income tax 22% of the federal income tax withholding Federal unemployment tax 0.6% on first $7,000 State unemployment tax 0.05% on first $14,000 Additional payroll deductions include: 401(k) plan 3% per pay Child support garnishment $100 per pay Health insurance premium $95 per payarrow_forwardLemur Corp. is going to pay three employees a year-end bonus. The amount of the year-end bonus and the amount of federal income tax withholding are as follows. Federal Gross Income Employee Filing Status Allowances Income Withholding Sarah $10,000 $962 $1,362 Joe $8,000 $7,000 Kevin $357 Lemur's payroll deductions include FICA Social Security at 6.2%, FICA Medicare at 1.45%, FUTA at 0.6%, SUTA at 5.4%, federal income tax as previously shown, state income tax at 5% of gross pay, and 401(k) employee contributions at 2% of gross pay. Record the entry for the employee payroll on December 31. If required, round your answers to the nearest whole dollar. If an amount box does not require an entry, leave it blank. Dec. 31 Married Single Single 4 1arrow_forwardA married employee who earns $17/hour, works 38 hours during a recent week, is paid weekly, and claims 6 federal withholding allowances has $_____ in federal income tax withholding under the wage-bracket method.arrow_forward

- Portia Grant is an employee who is paid monthly. For the month of January of the current year, she earned a total of 9,038. The FICA tax for social security is 6.2% of the first $132,900 of employee earnings each calendar year and the FICA tax rate for Medicare is 1.45% of all earnings. The FUTA tax rate of 0.6% and the SUTA tax rate of 5.4% are applied to the first $7,000 of an employee's pay. The amount of federal income tax withheld from her earnings was $1,499.67. Her net pay for the month is: (Round your intermediate calculations to two decimal places.)arrow_forwardAssume that the MUST Co. pays a weekly payroll. Using the portion of the Wage Bracket Withholding Table given, what would be the amount of federal income tax to withhold for this pay period for a single employee whose gross earning is $2,250 and who counted 2 withholding allowance? Table for Percentage Method of Withholding WEEKLY Payroll Period SINGLE person(including head of household)-- Assume the deduction for each withholding allowance is $75. If the amount of wages (after subtracting withholding allowances) is: The amount of income tax to withhold is $0 Not over $43. . . ver--- But not over-- of excess over-- $43 --$222 | $ 0.00 plus 10% ---$43 $222 ---$767 $17.90 plus 15% --$222 $767 --$1,796| $99.65 plus 25% ---$767 $1,796 --$3,700 $356.90 plus 28% ---$1,796 $3,700 ---87,992 | $890.12 plus 33% --S3,700 $7,992 ---$8,025 | $2,306.38 plus 35% ---$7,992 $8,025 $2,317.93 plus 39.6% ---$8,025 $356.90 $442.02 $484.02 $630.00arrow_forwardDee is paid $2,345 on November 8, 20--. Dee had cumulative gross earnings, including overtime pay, of $131,600 prior to this pay. Round your answers to the nearest cent. a. The amount of OASDI taxes to withhold from Dee's pay is $ b. The amount of HI taxes to withhold from Dee's pay is $arrow_forward

- Sky Company employed Tom Mills in Year 1. Tom earned $5,300 per month and worked the entire year. Assume the Social Security tax rate is 6 percent for the first $110,000 of earnings, and the Medicare tax rate is 1.5 percent. Tom's federal income tax withholding amount is $940 per month. Use 5.4 percent for the state unemployment tax rate and 0.6 percent for the federal unemployment tax rate on the first $7,000 of earnings per employee. Required a. Answer the following questions. (1) What is Tom's net pay per month? (2) What amount does Tom pay monthly in FICA payroll taxes? (3) What is the total payroll tax expense for Sky Company for January Year 1? February Year 1? March Year 1? December Year 1? b. Assume that instead of $5,300 per month Tom earned $9,700 per month. Answer the following questions. (1) What is Tom's net pay per month? (2) What amount does Tom pay monthly in FICA payroll taxes? (3) What is the total payroll tax expense for Sky Company for January Year 1? February Year…arrow_forwardQ) Find the federal withholding tax using the wage bracket method for each of the following employees. Kerry Cook: 1 withholding allowance, single, $2165.17 monthly earnings Mary Jackson: 2 withholding allowances, married, $639.80 weekly earnings Julie Pendleton: 0 withholding allowances, single, $1843.19 monthly earnings L. Sanchez: 3 withholding allowances, married, $521.10 weekly earnings B. Maynard: 4 withholding allowance, married, $2484.97 monthly earningsarrow_forward3. Jordan Peters (single; 3 federal withholding allowances) earned monthly gross pay of $2,300. He contributes $150 to a flexible spending account during the period. Using wage-bracket method: Federal income tax withholding=$ Using percentage method: Federal income tax withholding=$arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education