Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Hello tutor please solve this question

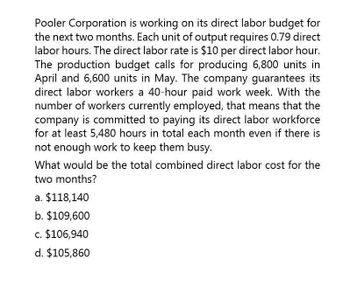

Transcribed Image Text:Pooler Corporation is working on its direct labor budget for

the next two months. Each unit of output requires 0.79 direct

labor hours. The direct labor rate is $10 per direct labor hour.

The production budget calls for producing 6,800 units in

April and 6,600 units in May. The company guarantees its

direct labor workers a 40-hour paid work week. With the

number of workers currently employed, that means that the

company is committed to paying its direct labor workforce

for at least 5,480 hours in total each month even if there is

not enough work to keep them busy.

What would be the total combined direct labor cost for the

two months?

a. $118,140

b. $109,600

c. $106,940

d. $105,860

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- Shalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted the follow sales: In Shalimars experience, 10 percent of sales are paid in cash. Of the sales on account, 65 percent are collected in the quarter of sale, 25 percent are collected in the quarter following the sale, and 7 percent are collected in the second quarter after the sale. The remaining 3 percent are never collected. Total sales for the third quarter of the current year are 4,900,000 and for the fourth quarter of the current year are 6,850,000. Required: 1. Calculate cash sales and credit sales expected in the last two quarters of the current year, and in each quarter of next year. 2. Construct a cash receipts budget for Shalimar Company for each quarter of the next year, showing the cash sales and the cash collections from credit sales. 3. What if the recession led Shalimars top management to assume that in the next year 10 percent of credit sales would never be collected? The expected payment percentages in the quarter of sale and the quarter after sale are assumed to be the same. How would that affect cash received in each quarter? Construct a revised cash budget using the new assumption.arrow_forwardEach unit requires direct labor of 2.2 hours. The labor rate is $11.50 per hour and next years direct labor budget totals $834.900. How many units are included in the production budget for next year?arrow_forwardLens Junction sells lenses for $45 each and is estimating sales of 15,000 units in January and 18,000 in February. Each lens consists of 2 pounds of silicon costing $2.50 per pound, 3 oz of solution costing $3 per ounce, and 30 minutes of direct labor at a labor rate of $18 per hour. Desired inventory levels are: Â Prepare a sales budget, production budget. direct materials budget for silicon and solution, and a direct labor budget.arrow_forward

- Palmgren Company produces consumer products. The sales budget for four months of the year is presented below. Company policy requires that ending inventories for each month be 25 percent of next months sales. At the beginning of July, the beginning inventory of consumer products met that policy. Required: Prepare a production budget for the third quarter of the year. Show the number of units that should be produced each month as well as for the quarter in total.arrow_forwardSunrise Poles manufactures hiking poles and is planning on producing 4,000 units in March and 3,700 in April. Each pole requires a half pound of material, which costs $1.20 per pound. The companys policy is to have enough material on hand to equal 10% of the next months production needs and to maintain a finished goods inventory equal to 25% of the next months production needs. What is the budgeted cost of purchases for March?arrow_forwardFoy Company has a welding activity and wants to develop a flexible budget formula for the activity. The following resources are used by the activity: Four welding units, with a lease cost of 12,000 per year per unit Six welding employees each paid a salary of 50,000 per year (A total of 9,000 welding hours are supplied by the six workers.) Welding supplies: 300 per job Welding hours: Three hours used per job During the year, the activity operated at 90 percent of capacity and incurred the actual activity and resource costs, shown on page 676. Lease cost: 48,000 Salaries: 315,000 Parts and supplies: 805,000 Required: 1. Prepare a flexible budget formula for the welding activity using welding hours as the driver. 2. Prepare a performance report for the welding activity. 3. What if welders were hired through outsourcing and paid 30 per hour (the welding equipment is provided by Foy)? Repeat Requirement 1 for the outsourcing case.arrow_forward

- Pilsner Inc. purchases raw materials on account for use in production. The direct materials purchases budget shows the following expected purchases on account: Pilsner typically pays 25% on account in the month of billing and 75% the next month. Required: 1. How much cash is required for payments on account in May? 2. How much cash is expected for payments on account in June?arrow_forwardNozama.com Inc. sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing activity is 250,000 and 50,000 sales orders are estimated to be processed. a. Determine the activity rate of the sales order processing activity. b. Determine the amount of sales order processing cost associated with 30,000 sales orders.arrow_forwardA companys sales for the coming months are as follows: About 20 percent of sales are cash sales, and the remainder are credit sales. The company finds that typically 10 percent of a months credit sales are paid in the month of sale, 70 percent are paid the next month, and 15 percent are paid in the second month after sale. Expected cash receipts in July are budgeted at what amount? a. 114,520 b. 143,150 c. 145,720 d. 156,000arrow_forward

- Cloud Shoes manufactures recovery sandals and is planning on producing 12.000 units in March and 11,500 in April. Each sandal requires 1.2 yards if material, which costs $3.00 per yard. The companys policy is to have enough material on hand to equal 15% of next months production needs and to maintain a finished goods inventory equal to 20% of the next months production needs. What is the budgeted cost of purchases for March?arrow_forwardGreiner Company makes and sells high-quality glare filters for microcomputer monitors. John Craven, controller, is responsible for preparing Greiners master budget and has assembled the following data for the coming year. The direct labor rate includes wages, all employee-related benefits, and the employers share of FICA. Labor saving machinery will be fully operational by March. Also, as of March 1, the companys union contract calls for an increase in direct labor wages that is included in the direct labor rate. Greiner expects to have 5,600 glare filters in inventory on December 31 of the current year, and has a policy of carrying 35 percent of the following month's projected sales in inventory. Information on the first four months of the coming year is as follows: Required: 1. Prepare the following monthly budgets for Greiner Company for the first quarter of the coming year. Be sure to show supporting calculations. a. Production budget in units b. Direct labor budget in hours c. Direct materials cost budget d. Sales budget 2. Calculate the total budgeted contribution margin for Greiner Company by month and in total for the first quarter of the coming year. Be sure to show supporting calculations. (CMA adapted)arrow_forwardAll Temps has a policy of always paying within the discount period, and each of its suppliers provides a discount of 2% if paid within 10 days of purchase. Because of the purchase policy, 80% of its payments are made in the month of purchase and 20% are made the following month. The direct materials budget provides for purchases of $23,812 in February, $23,127 in March, $21,836 in April, and $28,173 in May.What is the balance in accounts payable for April 30, and May 31?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning