Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

I want to this question answer general Accounting question

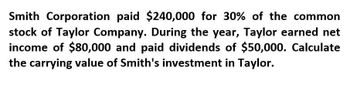

Transcribed Image Text:Smith Corporation paid $240,000 for 30% of the common

stock of Taylor Company. During the year, Taylor earned net

income of $80,000 and paid dividends of $50,000. Calculate

the carrying value of Smith's investment in Taylor.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Pronghorn Co. invested $920,000 in Stellar Co. for 25% of its outstanding stock. Stellar Co. pays out 30% of net income in dividends each year. Use the information in the following T-account for the investment in Stellar to answer the following questions. Investment in Stellar Co. 920,000 110,000 33,000 (a) How much was Pronghorn Co's share of Stellar Co's net income for the year? Net income $ (b) What was Stellar Co's total net income for the year? Total net income +A $ (c) What was Stellar Co's total dividends for the year? Total Dividends $ (d) How much was Pronghorn Co's share of Stellar Co's dividends for the year? Dividends $arrow_forward24 At the beginning of the year, Fairbridge, Inc. purchased an investment in Miller Milling Mills for $500,000, representing 10% of the book value of Miller. During the year, Miller reported net income of $800,000 and pays cash dividends of $92,000. At the end of the year, the fair value of Fairbridge’s investment is $525,000. Required At what amount is the investment reported on Fairbridge’s balance sheet at year-end? What amount of income from investments does Fairbridge report? Prepare journal entries to record the transactions for Fairbridge Company.arrow_forwardMadison Corporation purchases an investment in Lake Geneva, Inc. at a purchase price of $20 million cash, representing 40% of the book value of Lake Geneva, Inc. During the year, Lake Geneva reports net income of $3,400,000 and pays $838,000 of cash dividends. At the end of the year, the market value of Madison’s investment is $24 million. What is the year-end balance of the equity investment in Lake Geneva? Select one: a. $21,024,800 b. $24,000,000 c. $20,000,000 d. $22,562,000 e. $21,360,000arrow_forward

- Calculate the gross profit?arrow_forwardThe Pearson corporation reported an EBITDA of $7.5 million, net income of $1.8 million, $2 million of interest expense. The applicable corporate tax rate was 40%. Calculate the firm’s depreciation and amortization expense.arrow_forwardThe Rogers Corporation has a gross profit of $1,012,000 and $459,000 in amortization expense. The Evans Corporation has $1,012,000 in gross profit, with $170,000 in amortization expense. Selling and administrative expense is $131,000 for each company. a. Given that the tax rate is 40 percent, compute the cash flow for both companies. Cash flow Rogers $ Evans $ b. What is the difference in cash flow between the two firms? Difference in cash flowarrow_forward

- The Moore Enterprise has gross profit of $1,140,000 with amortization expense of $490,000. The Kipling Corporation has $1,140,000 in gross profits but only $73,000 in amortization expense. The selling and administration expenses are $133,000; the same for each company. If the tax rate is 40 percent, calculate the cash flow for each company. Moore Kipling Cash flow $ $ Calculate the difference in cash flow between the two firms? Difference in cash flow $arrow_forwardThe Moore Enterprise has gross profit of $1,180,000 with amortization expense of $510,000. The Kipling Corporation has $1,180,000 in gross profits but only $75,000 in amortization expense. The selling and administration expenses are $135,000; the same for each company. If the tax rate is 20 percent, calculate the cash flow for each company. Kipling Cash flow $ Difference in cash flow Moore $ Calculate the difference in cash flow between the two firms? $arrow_forwardPeter Inc. purchases 30% of Sam Ltd for $50,000 with significant influence. At year-end, Peter Inc. reports a net income of $100,000 and a dividend of $50,000 to its shareholders. Calculate the ending balance in Peter's investment account at year-end.arrow_forward

- What are the net income and the net cash flow ?arrow_forwardWillard Co. acquired a 30% interest in Diltronics for $420,000 and appropriately applied the equity method. During the first year, Diltronics reported net income of $250,000 and paid cash dividends totaling $50,000. What amount will Willard report as it relates to the investment at the end of the first year on its income statement? Show the calculation used to get the answer Investment earnings totaling $75,000 Investment earnings totaling $45,000 Net investment earnings totaling $150,000 Receipt of dividends totaling $15,000arrow_forwardKross Company purchases an equity investment in Penno Company at a purchase price of $2.5 million, representing 40% of the book value of Penno. During the current year, Penno reports net income of $300,000 and pays cash dividends of $100,000. At the end of the year, the fair value of Kross’s invest- ment is $2.65 million. What amount of income does Kross report relating to this investment in Penno for the year? Explain.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning