FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

What is the firm's weighted average cost of capital?

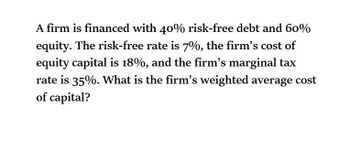

Transcribed Image Text:A firm is financed with 40% risk-free debt and 60%

equity. The risk-free rate is 7%, the firm's cost of

equity capital is 18%, and the firm's marginal tax

rate is 35%. What is the firm's weighted average cost

of capital?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- What is the firm's weighted average cost of capital? General accountingarrow_forwardWhat is a firm's weighted average cost of capital for a firm that is financed 45% by debt? The debt has a 10% required return and the equity has a 17% required return. Thetax rate is 30%arrow_forwardA firm has a capital structure with $75 million in equity and $75 million in debt. The cost of equity capital is 10% and the pretax cost of debt is 7%. If the marginal tax rate of the firm is 35%, compute the weighted average cost of capital of the firm. A. 7.6% B. 7.3% C. 8.4% D. 8.0%arrow_forward

- A company is estimating its optimal capital structure. Now the company has a capital structure that consists of 20% debt and 80% equity, based on market values (debt to equity D/S ratio is 0.25). The risk-free rate (rRF) is 5% and the market risk premium (rM – rRF) is 6%. Currently the company’s cost of equity, which is based on the CAPM, is 14% and its tax rate is 20%. Find the firm’s current leveraged beta using the CAPM 1.0 1.5 1.6 1.7arrow_forwardYou are analyzing the cost of capital for a firm that is financed with 65 percent equity and 35 percent debt.The cost of debt capital is 8 percent, while the cost of equity capital is 20 percent for the firm. What is the overall cost of capital for the firm? Select one: a. 20.2 % b. 15.8 % c. 12.2 % d. None of thesearrow_forwardA firm has EBIT of $30 million. It has debt of $100 million and the cost of debt is 7%. Its unlevered cost of capital is 10% and tax rate at 35%. a) What’s its unlevered firm value? b) What’s its levered firm value? c) What’s its equity value?arrow_forward

- You are analyzing the cost of capital for a firm that is financed with $300 million of equity and $200 million of debt. The before-tax cost of debt capital for the firm is 4 percent. The beta of the company's stock is 1.5. The risk-free rate is 2%, and the market risk premium is 6%. Assume the firm's marginal tax rate is 30%, the company's weighted average cost of capital (WACC) is closest to O 7.7% O 5.9% O 8.2% O 6.4%arrow_forwardAbcarrow_forwardPhil's Carvings Inc wants to have a weighted average cost of capital of 9.8 percent. The firm has an after- tax cost of debt of 6.6 percent and a cost of equity of 13.2 percent. What debt-equity ratio is needed for the firm to achieve their targeted weighted average cost of capital?arrow_forward

- A company has determined that its optimal capital structure consists of 34 percent debt and the rest is equity. Given the following information, calculate the firm's weighted average cost of capital. Rd = 7.8%; Tax rate = 28 %: Po = $ 39.01; Growth = 5.1%; and D1 = $ 1.02. Show your answer to the nearest .1% Your Answer: Answerarrow_forwardThe Beta Corporation has an optimal debt ratio of 40 percent. Its cost of equity capital is 10 percent, and its before-tax borrowing rate is 7 percent. Given a marginal tax rate of 35 percent. Required: A. Calculate the weighted-average cost of capital. B. Calculate the cost of equity for an equivalent all-equity financed firm.arrow_forwardA firm has two components in its capital structure, debt and equity. The after-tax cost of debt is 3% and the cost of equity is 11%. The proportion of equity in the capital structure is 75%. What is the firm's Weighted Average Cost of Capital? Select one: a. 9.47% b. 8.78% c. 9.00% d. 8.37%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education