ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

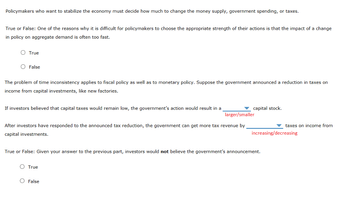

Transcribed Image Text:Policymakers who want to stabilize the economy must decide how much to change the money supply, government spending, or taxes.

True or False: One of the reasons why it is difficult for policymakers to choose the appropriate strength of their actions is that the impact of a change

in policy on aggregate demand is often too fast.

O True

O False

The problem of time inconsistency applies to fiscal policy as well as to monetary policy. Suppose the government announced a reduction in taxes on

income from capital investments, like new factories.

If investors believed that capital taxes would remain low, the government's action would result in a

larger/smaller

After investors have responded to the announced tax reduction, the government can get more tax revenue by

capital investments.

capital stock.

O True

True or False: Given your answer to the previous part, investors would not believe the government's announcement.

O False

taxes on income from

increasing/decreasing

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 50 ts 00:30:41 Print During the Great Depression, Keynes advocated the use of Multiple Choice O monetary; aggregate demand for fiscal; aggregate demand for monetary, aggregate supply of fiscal; aggregate supply of policy to increase the goods and services.arrow_forwardThis exercise points to a clear policy dilemma. A fiscal contraction may have desirable long-run effect on output and living standards, but the short-run effects are output and gap.arrow_forwardOn the following graph, AD1 represents the initial aggregate demand curve in a hypothetical economy, and AS represents the initial aggregate supply curve. The economy's full-employment output is $12 trillion. On the following graph, use the grey point (star symbol) to mark the equilibrium. (Note: You will not be graded on any adjustments made to the graph.) PRICE LEVEL (CPI) AS 106 105 104 103 63 102 101 100 99 98 AD AD 吕 1 97 96 Full Employment 96 6 7 8 9 10 11 12 13 14 15 16 REAL GDP (Trillions of dollars) AD 2 Equilibrium The initial short-run equilibrium level of real GDP is $ trillion, and the initial short-run equilibrium price level is Suppose the government, seeking full employment, borrows money and increases its expenditures by the amount it believes necessary to close thearrow_forward

- 1. Use of discretionary policy to stabilize the economy In an effort to stabilize the economy, is it best for policymarkers to use monetary policy, fiscal policy, or a combination of both? The following questions address the ways monetary and fiscal policies impact the economy and the pros and cons associated with using these tools to ease economic fluctuations. The following graph shows a hypothetical aggregate demand curve (AD), short-run aggregate supply curve (AS), and long-run aggregate supply curve (LRAS) for the economy in January 2025. According to the graph, this economy is in .To bring the economy back to the natural level of output, the government could use monetary or fiscal policy such as Shift the appropriate curve on the following graph to illustrate the effects of the policy you chose. 150 LRAS AS 110 X AD 70 24 26 OUTPUT (Trillions of dollars) PRICE LEVEL 130 85 50 20 22 28 30 AD ロー AS ? Suppose that in January 2025, policymakers undertake the type of policy that is…arrow_forwardDiscuss three reasons why the use of fiscal policy to stabilize the economy is more complicated than suggested by the basic Keynesian model.arrow_forwardConsider a potential fiscal policy used to curb a recession. How could a consumer and business expectations about the future economy could hamper those plans?arrow_forward

- If a recession persists due to nominal wage and price stickiness (i.e., slow adjustment of nominal wages downward), what kind of fiscal policy can bring us out of this recession? decreased government expenditures and increased taxes increased government expenditures and decreased taxes decreased government expenditures contractionary fiscal policyarrow_forwardFiscal Policy: Recessionary vs Expansionary Policy Complete the following exercises. 1. Describe a policy measure the government can use to close a recessionary gap. 2. Illustrate your response to question 1 in a graph. 3. Describe a policy measure the government can use to close an inflationary gap. 4. Please Illustrate Graphically in response to question (question 3: Describe a policy measure the government can use to close an inflationary gap.)arrow_forwardOn the following graph, AD1 represents the initial aggregate demand curve in a hypothetical economy, and AS represents the initial aggregate supply curve. The economy's full-employment output is $12 billion. On the following graph, use the grey point (star symbol) to mark the equilibrium. (Note: You will not be graded on any adjustments made to the graph.) PRICE LEVEL (CPI) 106 105 104 103 102 H AS 1ŏ1 101 ADA 100 AD 3 99 AD 2 98 AD1 97 Full Employment 96 6 7 8 9 10 11 12 13 14 15 16 REAL GDP (Billions of dollars) Equilibrium (?)arrow_forward

- From the perspective of someone using aggregate-demand and aggregate supplyanalysis, what is the impact of a tax cut when the economy is operating above fullemployment. Is this a wise policy? Why or why not?arrow_forwardThe graph below depicts an economy where a decline in aggregate demand has caused a recession. Assume the government decides to conduct fiscal policy by increasing government purchases to reduce the burden of this recession. Fiscal Policy Price Level 160 LRAS AS 140 120 100 80 60 40 20 0 AD 1 AD 80 160 240 320 400 480 560 640 720 800 Real GDP (billions of dollars) Instructions: Enter your answers as a whole number. a. How much does aggregate demand need to change to restore the economy to its long-run equilibrium? $ billion b. If the MPC is 0.6, how much does government purchases need to change to shift aggregate demand by the amount you found in part a? EA billion Suppose instead that the MPC is 0.75. c. How much does aggregate demand and government purchases need to change to restore the economy to its long-run equilibrium? Aggregate demand needs to change by $ billion and government purchases need to change by $ billion.arrow_forwardThe text book describes various types of lags that may slow the response of Congress when the economy enters a recession. Which of the following describes the time required for Congress to recgonize that the economy is experiencing a recession? Recognition lag Legislative lag Presidential lag Implementation lagarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education