FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Please list all of the journal entries for 2022 the ZARA

UNIVERSITY Contract. Your company name is PP. See below

information:

On December 1, PP signed a contract with ZARA University to

provide them with 905 scooters, at a price of $655 each. ZARA

University chose not to purchase the additional maintenance

service. Because PP had a great sales year, they did not have any

scooters in stock on December 1.

ZARA University offered a bonus plan for early delivery.

They will pay a 4% bonus if all scooters are delivered by the end

of January, 3% if all scooters are delivered by the end of February,

and 2% if all scooters are delivered by the end of March.

It believes that it is 45% likely that it can deliver the remaining

scooters in January, 40% likely that it will deliver them in

February, 10% likely that it will deliver them in March, and 5%

likely it will deliver them in April.

PP delivered and was paid for 195 scooters during the month of

December.

Hint: Consider using the “Estimated Bonus" account.

The analysis of the first four steps in the revenue recognition

process are below:

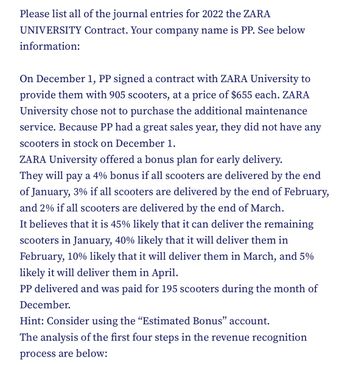

Transcribed Image Text:ZARA University contract:

Contract Price:

Units

Price

Contract Price

St 1:

Step 2:

Step 3:

Delivery date

January

February

March

Later

Transaction Price (constrained)

Transaction Price per scooter

Estimated Bonus per scooter

905

655

592,775

Step 4:

Contract exists

Only 1 performance obligation

Determine the transaction price - variable consideration

Bonus

4%

3%

2%

0%

It is 55% likely that the revenue will be reversed, so it is constrained.

Consideration Probability

610,558

674.65

19.65

616,486

610,558

604,631

592,775

45%

40%

10%

5%

100%

Only 1 performance obligation, so no allocation

277,419

244,223

60,463

29,639

611,744

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help mearrow_forwardTaylor Construction Inc. signed a contract with FSU to build a student residential building with two million dollars by 2021 August; FSU can only pay 1.8 million dollars if Taylor cannot complete the construction by September 1. According to the consideration of the four transaction price types, which type is for the following transaction?arrow_forwardPlease list all of the journal entries for 2022 the ZARA UNIVERSITY Contract. Your company name is PP. See below information: On December 1, PP signed a contract with ZARA University to provide them with 905 scooters, at a price of $655 each. ZARA University chose not to purchase the additional maintenance service. Because PP had a great sales year, they did not have any scooters in stock on December 1. ZARA University offered a bonus plan for early delivery. They will pay a 4% bonus if all scooters are delivered by the end of January, 3% if all scooters are delivered by the end of February, and 2% if all scooters are delivered by the end of March. It believes that it is 45% likely that it can deliver the remaining scooters in January, 40% likely that it will deliver them in February, 10% likely that it will deliver them in March, and 5% likely it will deliver them in April. PP delivered and was paid for 195 scooters during the month of December. Hint: Consider using the "Estimated…arrow_forward

- Complete Electronics Inc. sells a point - of -sale computer with a two- year service contract. Complete collects $3,500 cash for the selling price of the computer and $648 for the two - year service contract. How is revenue recognized? O A. Complete will record Sales Revenue of $3.500 when the computer delivered and will record revenue for the service contract as service calls are made. O B. Complete will record Sales Revenue of $2,074 per year for two years. O C. Complete will record Sales Revenue of $4,148 when the computer is delivered to the customer. O D. Complețe will record Sales Revenue of $3,500 when the computer is delivered and Service Revenue of $27 per month for 24 months.arrow_forwardOn February 1, 2019, the telecommunications company sold cellular phones and unlimited calls service to Customer #1 on a 24 month contract. Customer 1 pays CU30 per month for 'free' network and cell phone services. The Company sells Customer #2 the same cellular telephone for CU 150 and the same network services for CU 25 per month. The amount is also the price the company charges when the cellular phone or network service is sold separately. The time value effect of money is negligible in this case. Based on the above case, answer the following questions: How the company recognizes its revenue to Customer #1 and Customer #2? Keep a journal on February 1, 2019 and March 1, 2019arrow_forwardPlease list all of the journal entries for 2022 the OHIO Contract. Your company name is PP. See below information: Ohio Contract On September 7th of the current year (2022), PP signed a contract with Ohio Contract, a large city in the northeast. PP will provide Ohio with 2,470 scooters for $855 each. Each of the scooters is included in a service agreement, whereby PP will provide all maintenance on the scooters for 3 years. In addition, it will provide labor at no charge for these repairs. At the time of the repair, PP will bill Ohio for the parts needed to accomplish the repair. Ohio paid WTG on September 7th of the current year. PP will deliver 665 scooters on October 1 of the current year, 875 scooters on January 1 of next year, and 930 scooters on April 1 of the next year. Because of the size of Ohio, and its potential to buy many more scooters, PP offers them a volume discount, based on how many scooters they purchase between September 7th of the current year and December 31st of…arrow_forward

- You sell $5 million dollars' worth of delivery trucks to Walmart on account and offer them a 2% discount if they pay within 15 days, with the invoice due after 45 days (2/15, n/45). Unfortunately, Walmart returns all of the trucks after one week because they discover that the model you sold them is not approved for use in California. Which of the following is part of the correct journal entry to make at the time that Walmart returns the trucks? DEBIT to Sales Returns of $5 million CREDIT to Sales Discount of $100,000 CREDIT to Accounts Receivable of $4.9 million CREDIT to Sales Revenue of $5 millionarrow_forwardPresented below are two independent revenue arrangements for Pharoah Company. Respond to the requirements related to each revenue arrangement. Click here to view factor table. Pharoah sells 3D printer systems. Recently, Pharoah provided a special promotion of zero-interest financing for 2 years on any new 3D printer system. Assume that Pharoah sells University co-op a 3D system, receiving a $5,100 zero-interest-bearing note on March 1, 2020. The cost of the 3D printer system is $3,060. Pharoah imputes a 8% interest rate on this zero-interest note transaction. Prepare the journal entry to record the sale on March 1, 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places, eg. 58,971.) Account Titles and Explanation Debit Credit…arrow_forward* Your answer is incorrect. William Corp. enters into a contract with a customer to build an apartment building for $1,056,300. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $136,200 to be paid if the building is ready for rental beginning August 1, 2026. The bonus is reduced by $45,400 each week that completion is delayed. William commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by August 1, 2026 August 8, 2026 August 15, 2026 After August 15, 2026 Transaction price $ Probability Transaction price $ 70 % eTextbook and Media 20 (a) Determine the transaction price for the contract, assuming William is only able to estimate whether the building can be completed by August 1, 2026, or not (William estimates that there is a 70% chance that the building will be completed by August 1, 2026). 5 5 (b) Determine the transaction price…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education