FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

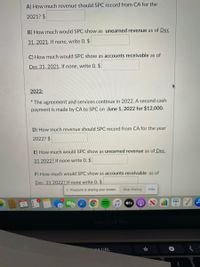

Transcribed Image Text:A) How much revenue should SPC record from CA for the

2021? $

B) How much would SPC show as unearned revenue as of Dec

31, 2021. If none, write 0. $

C) How much would SPC show as accounts receivable as of

Dec 31, 2021. If none, write 0. $

2022:

* The agreement and services continue in 2022. A second cash

payment is made by CA to SPC on June 1, 2022 for $12,000.

D) How much revenue should SPC record from CA for the year

2022? $

E) How much would SPC show as unearned revenue as of_Dec,

31 2022? If none write 0. $

F) How much would SPC show as accounts receivable as of

Dec, 31 2022? If none write 0. $

I| Proctorio is sharing your screen.

Stop sharing

Hide

stv

MacBook Pro

ne URL

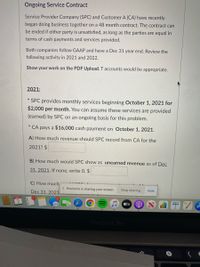

Transcribed Image Text:Ongoing Service Contract

Service Provider Company (SPC) and Customer A (CA) have recently

began doing business together on a 48 month contract. The contract can

be ended if either party is unsatisfied, as long as the parties are equal in

terms of cash payments and services provided.

Both companies follow GAAP and have a Dec 31 year end. Review the

following activity in 2021 and 2022.

Show your work on the PDF Upload. T accounts would be appropriate.

2021:

SPC provides monthly services beginning October 1,

$2,000 per month. You can assume these services are provided

021 for

(earned) by SPC on an ongoing basis for this problem.

* CA pays a $16,000 cash payment on October 1, 2021.

A) How much revenue should SPC record from CA for the

2021? $

B) How much would SPC show as unearned revenue as of Dec

31, 2021. If none, write 0. $

C) How much

I| Proctorio is sharing your screen.

Dec 31, 2021

Stop sharing

Hide

tv

MacBook Pro

Expert Solution

arrow_forward

Step 1

"Since you have posted a question with multiple sub parts, we will solve first three sub parts for you. To get remaining sub parts solved, please repost the complete question and mention the sub parts to be solved."

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- 1. What amount of warranty expense should be shown on Crassula's income statement for the year ended December 31, 2021? 2. What amount of warranty liability should be shown on Crassula's statement of financial position as of December 31, 2021?arrow_forwardOn the attached problem. Calculate the 2021 year-end adjusted balances of Interest Payable and Interest Expense (assuming the balance of interest Payable at the beginning of the year is $0). Are these numbers the $990 for both and if so is one of the numbers negative?arrow_forwardPLEASE FASTarrow_forward

- Company A provides a bundled service offering to Customer B. It charges Customer B $800,000 for initial connection to its network and two ongoing services - access to the network for 1 year and 'on-call troubleshooting' advice for that year. Customer B pays the $800,000 upfront, on 1 July 2020. Company A determines that, if it were to charge a separate fee for each service if sold separately, the fee would be: Connection fee Access fee Troubleshooting Paragraph $400,000 Lato (Recomm... v $500,000 The end of Company A's reporting period is 30 June 2021. Required Prepare the journal entries to record this transaction in accordance with AASB 15 for 1 July 2020 and the year ended 30 June 2021, assuming Company A applies the relative fair value approach. (Show all workings). $400,000 BI U A/ 19px (... ✓ EQ DC X Marrow_forwardOn June 1, 2021, Demer Consulting provides services to a customer for $150,000. To pay for the services, the customer signs a three-year, 12% note. The face amount is due at the end of the third year, while annual interest is due each June 1. Required: 1. Record the acceptance of the note on June 1, 2021.2. Record the interest collected on June 1 for 2022 and 2023, and the adjustment for interest revenue on December 31, 2021, 2022, and 2023.3. Record the cash collection on June 1, 2023. Record the acceptance of the note. please do a journal entry for each date. listed below. There should be 7 in total Date Jun 01, 2021 dec 31,2021 jan 01,2022 dec 31,2022 jun 01,2023 dec 31,2023 jun 01,2023arrow_forwardOn February 1, 2021, Miter Corp. lends cash and accepts a $1,000 note receivable that offers 12% interest and is due in six months. How much interest revenue will Miter Corp. report during 2021? Multiple Choice O O O O $120. $240. $100. $60.arrow_forward

- Problems 1). Record the journal entries for the following current liabilities for Company Z A). Company Z is required by law to collect and remit sales taxes to the state. If $78,000 of cash sales are subject to a 6% sales tax B). Company Z faces a probalble loss on a pending lawsuit where the amount of the loss is estimated to be $500,000. C). Employees earn vacation pay at the rate of one day per month. During the month, 25 employees quality for one vacation day each. Their average daily wage is $100 per day. D). Z company estimates thatt warranty expense will be 4% of sales. The company's sales for the current period are $185,000.. E). Z Company receives $48, 000 cash in advance ticket sales for 12 home games. Record the advance ticket sales on April :30. Record the revenue earned for the first home game played on August 14. "V B. C. D. E.arrow_forwardHelp me selecting the right answer. Thank youarrow_forwardM Corp. receives advance payments with special orders for containers constructed to customer specifications. Related information for 2022 is as follows ($ in millions): Customer advances balance, Dec. 31, 2021 $ 100 Advances received with 2022 orders 204 Advances applicable to orders shipped in 2022 189 Advances from orders canceled in 2022 53 What amount should M Corp. report as a current liability for advances from customers in its December 31, 2022, balance sheet? Multiple Choice $62 million. $0. $304 million. $115 million.arrow_forward

- Please answer practice problemarrow_forwardOn September 1, 2021, Daylight Donuts signed a $112,000, 9%, six-month note payable with the amount borrowed plus accrued interest due six months later on March 1, 2022.Daylight Donuts should report interest payable at December 31, 2021, in the amount of: (Do not round your intermediate calculations.) Multiple Choice $0. $5,040. $3,360. $1,680.arrow_forwardOn September 1, 2021, Daylight Donuts signed a $110,000, 10%, six-month note payable with the amount borrowed plus accrued interest due six months later on March 1, 2022.Daylight Donuts should report interest payable at December 31, 2021, in the amount of: (Do not round your intermediate calculations.) Multiple Choice $5,500. $3,667. $1,833. $0.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education