FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Please get the finished goods june 1 and june 30. disregard the other requirements (questions)

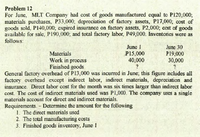

Transcribed Image Text:Problem 12

For June, MLT Company had cost of goods manufactured equal to Pi20,000;

materials purchases, P33,000; depreciation of factory assets, P17,000; cost of

goods sold, P140,000; expired insurance on factory assets, P2,000; cost of goods

available for sale, P190,000; and total factory labor, P49,000. Inventorics were as

follows:

Materials

Work in process

Finished goods

June I

P15,000

40,000

June 30

P19,000

30,000

General factory overhead of P13,000 was incurred in June; this figure includes all

factory overhead except indirect labor, indirect materials, depreciation and

insurance. Direct labor cost for the month was six times larger than indirect labor

cost. The cost of indirect materials used was P1,000. The company uses a single

materials account for direct and indirect materials.

Requirements. - Determine the amount for the following

1. The direct materials used

2. The total manufacturing costs

3. Finished goods inventory, June 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardTASKS Prepared supporting documents for Requested Materials to Purchase such as: (1) Purchase Request (PR), (2) Request for Quotation (RFQ), (3) Abstract for Quotation (AFQ), (4) Purchase Order (PO), & (5) Inspection and Acceptance Report (IAR). Prepared additional attachments such as: (1) Report of Waste Materials, (2) Request for pre-repair inspection and evaluation report. Issued Materials at the Warehouse (there are thousands of inventories) Posting of Purchase Requests to the Philippine Government Electronic Procurement System (PhilGEPS). (there are too many steps and details to keep in mind) Prepared Certificate of Creditable Tax Withheld at Source Updated the Summary of Withholding Taxes (SAWT) in the BIR System. Updated the Monthly Alphalist of Payees (MAP) and Quarterly Alphalist of Payees (QAP) in the BIR System. Remitted Creditable Withholding Tax (CWT) to the BIR via online.. Updated Bin Cards Updated Stock Cards. Reconciled the individual records of Inventories in the Bin…arrow_forwardHow do I calculate the finished goods in Part 2?arrow_forward

- Please do not give solution in image format thankuarrow_forwardExercise 16-44 (Algo) (Appendix used in requirement [b]) Variable Cost Variances (LO 16-5, 7) Rankin Fabrication reports the following information with respect to its direct materials: Actual quantities of direct materials used Actual costs of direct materials used. Standard price per unit of direct materials. Flexible budget for direct materials. Rankin Fabrication holds no materials inventories. 35,500 gallons $ 201,680 $ 5.79 $ 213,100 Required: a. Compute the direct material price and efficiency variances. b. (Appendix) Prepare the journal entries to record the purchase and use of the direct materials using standard costing. Direct materials price variance Direct materials efficiency variance Complete this question by entering your answers in the tabs below. Required A Required B Compute the direct material price and efficiency variances. Note: Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either…arrow_forwardHelp question 14arrow_forward

- K11.arrow_forwardp. What does Mazaya record as the cost of the new truck?arrow_forward3. it is a product costing system generally used in just-in-time inventory environment. This costing system delays the costing process until the production of goods is completed by eliminating the detailed tracking of cost throughout the production system and preparing journal entries only at trigger points. a.Backflush costing B.Standard costing C.Normal costing D.Traditional costing E.None of the abovearrow_forward

- View Policies Current Attempt in Progress In which of the following categories do indirect materials belong? Product Cost Manufacturing Overhead Period Cost No No Yes Yes No No Yes Yes No Yes Yes Yes eTextbook and Media Save for Later O Attempts: 0 of 3 used Submit Answerarrow_forwarda company is trying to decide whether to sell partially completed goods in their current state or incur additional costs to finish the goods and sell them as complete units. Which is NOT relevant to the decision? a- the costs incurred to process the units to this point b- the selling price of the partially completed units c- the costs that will be incurred to finish the units d- the costs that will be incurred to finisht the unitsarrow_forwardJust-in-time manufacturing is a system based on purchasing inventory and then producing finished products only when needed for an order. + TRUE FALSEarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education