FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need help with question B sales vale at split off point. Please show how you got the numbers. I really need help calculating cost per liter for each product. Thanks

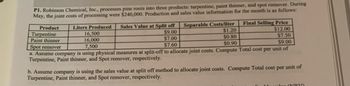

Transcribed Image Text:P1. Robinson Chemical, Inc., processes pine rosin into three products: turpentine, paint thinner, and spot remover. During

May, the joint costs of processing were $240,000. Production and sales value information for the month is as follows:

Liters Produced

16,500

16,000

7,500

Product

Turpentine

Paint thinner

Spot remover

Separable Costs/liter

$1.20

$0.80

$0.90

Final Selling Price

Sales Value at Split off

$9.00

$12.00

$7.50

$7.00

$9.00

$7.60

a. Assume company is using physical measures at split-off to allocate joint costs. Compute Total cost per unit of

Turpentine, Paint thinner, and Spot remover, respectively.

b. Assume company is using the sales value at split off method to allocate joint costs. Compute Total cost per unit of

Turpentine, Paint thinner, and Spot remover, respectively.

Jue ORYA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardRequirements Dialog content starts 1. Allocate revenue from the sale of each unit of Dynamic Duo to Smarty and Sublime using the following: a. The stand-alone revenue-allocation method based on selling price of each product b. The incremental revenue-allocation method, with Smarty ranked as the primary product c. The incremental revenue-allocation method, with Sublime ranked as the primary product d. The Shapley value method 2. Of the four methods in requirement 1, which one would you recommend for allocating Paris's revenues to Smarty and Sublime? Explain.arrow_forwardContribution Margin, Break-Even Sales, Cost-Volume-Profit Chart, Margin of Safety, and Operating Leverage Belmain Co. expects to maintain the same inventories at the end of 20Y7 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows: Estimated Estimated Variable Cost Fixed Cost (per unit sold) Production costs: Direct materials $50.00 Direct labor 30.00 Factory overhead $350,000 6.00 Selling expenses: Sales salaries and commissions 340,000 4.00 Advertising 116,000 Travel 4,000 Miscellaneous selling expense 2,300 1.00 Administrative expenses: Office and officers' salaries 325,000 Supplies 6,000 4.00 Miscellaneous administrative expense 8,700 1.00 Total $1,152,000 $96.00 It is expected that 12,000 units will be sold at a price…arrow_forward

- Scatter Diagrams and High-Low Cost Estimation Assume the local Pearle Vision has the following information on the number of sales orders received and order-processing costs. Month Sales Orders Order Processing Costs 1 3,000 $49,620 2 1,500 30,225 4,400 72,420 2.800 49,140 2.300 41,865 25,860 37,500 3 4 S 6 7 1,200 2,000 NOTE: Round variable cost per unit answers to two decimal places, if appropriate. (a.) Use information from the high- and low-volume months to develop a cost-estimating equation for monthly order-processing costs. $ 15:400 +5 24.26 * 8400 + M.SS* Correct (b.) Plot the data on a scatter diagram. Using the information from representative high-and low-volume months, develop a cost estimating equation for monthly production costs. If needed, an Excel worksheet is provided in the following link in order to create the scatter diagram: Scatter Diagram $ 15,622 X+$ 23.93 XXarrow_forwardHt.9.arrow_forwardCassien Inc. manufactures products that pass through two or more processes. During June, equivalent units were computed using the weighted average method: Units completed Units in EWIP X Fraction complete (36,000 X 60%) Equivalent units of output June's costs to account for are as follows: BWIP (10,000 units, 80% complete) Materials Conversion costs Total Required: 91,000 21,600 112,600 $50,000 156,000 95,000 $301,000 1. Calculate the unit cost for June using the weighted average method. Round your answer to the nearest cent.arrow_forward

- need last three requirement , answer in text form please (without image)arrow_forwardFill in the missing amounts in each of the eight cases below. Each case is independent of the others. (Hint: One way to find the missing amounts would be to prepare a contribution format income statement for each case, enter the known data, and then compute the missing items.) Required: a. Assume that only one product is being sold in each of the four following case situations: b. Assume that more than one product is being sold in each of the four following case situations: Complete this question by entering your answers in the tabs below. Required A Required B Assume that only one product is being sold in each of the four following case situations: Units sold Sales Variable expenses Fixed expenses Net operating income (loss) Contribution margin per unit Case 1 Case 2 Case 3 Case 4 9,100 20,800 5,800 $ 254,800 $ 296,100 $ 191,400 163,800 291,200 87,000 175,000 75,000 $ S (62,200) $ 8 $ 54,600 $ 17,800 7arrow_forwardPlease help with the income statement based on info below: Pricing Actual # Revenue Grooming 25 4 3,000 Daycare 18 22 11,880 Boarding 25 12 9,000 Total January Revenue 23,880arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education