FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Trio Company...Please refer to the pictures for parts one and two, and below for part three:

|

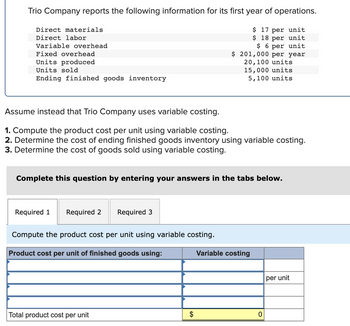

Transcribed Image Text:Trio Company reports the following information for its first year of operations.

$ 17 per unit

$ 18 per unit

$6 per unit

$ 201,000 per year

20,100 units

15,000 units

5,100 units

Direct materials

Direct labor

Variable overhead

Fixed overhead

Units produced

Units sold

Ending finished goods inventory

Assume instead that Trio Company uses variable costing.

1. Compute the product cost per unit using variable costing.

2. Determine the cost of ending finished goods inventory using variable costing.

3. Determine the cost of goods sold using variable costing.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Compute the product cost per unit using variable costing.

Product cost per unit of finished goods using:

Total product cost per unit

$

Variable costing

0

per unit

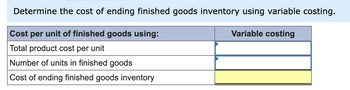

Transcribed Image Text:Determine the cost of ending finished goods inventory using variable costing.

Cost per unit of finished goods using:

Variable costing

Total product cost per unit

Number of units in finished goods

Cost of ending finished goods inventory

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- To find the weighted average contribution margin, a company adds up the individual unit contribution margins of the different products and then divides by the total number of different products True or falsearrow_forwardThe _________ is considered part of the cost of the product in absorption costing, but not in variable costing. Group of answer choices Variable Overhead Fixed Overhead Variable Selling & Administrative Fixed Selling and Administrative In the absorption income statement, Sales less Cost of Goods Sold is the calculation for: Group of answer choices Contribution margin Gross margin Net Income Operating Incomearrow_forwardThe inventory cost computed under absorption costing is ____ the inventory cost computed using variable costing. Group of answer choices half of thrice as much equal to greater thanarrow_forward

- The Dorilane Company produces a set of wood patio furniture consisting of a table and four chairs. The company has enough customer demand to justify producing its full capacity of 3,800 sets per year. Annual cost data at full capacity follow: Direct labor Advertising Factory supervision Property taxes, factory building Sales commissions Insurance, factory Depreciation, administrative office equipment Lease cost, factory equipment Indirect materials, factory Depreciation, factory building Administrative office supplies (billing) Administrative office salaries Direct materials used (wood, bolts, etc.) Utilities, factory $ 89,000 $ 103,000 $70,000 $ 23,000 $ 65,000 $ 6,000 $ 2,000 $ 17,000 $ 18,000 $ 106,000 $ 5,000 $ 111,000 $ 426,000 $ 46,000 Required: 1. Enter the dollar amount of each cost item under the appropriate headings. Note that each cost item is classified in two ways: first, as variable or fixed with respect to the number of units produced and sold; and second, as a selling…arrow_forwardAn analyst is constructing a simple model to determine the gross and net profit of a product, given its profit per unit, quantity sold, and the total costs assigned to the product. The calculation for gross profit is Profit per Unit times Quantity. The calculation for Net Profit is Gross Profit minus Total Costs. A B 1. 2 Profit per Unit 8 3 Quantity |10,100 4 Gross Profit 5 6 Total Costs 6,100 7 8 Net Profit With the values for Profit per Unit, Quantity, and Total Costs shown above, what should the model return for the following calculated cells? Cell Value Gross Profit Net Profitarrow_forwardPlease help me with all I will give upvotearrow_forward

- The cost of the ending inventory under absorption costing is higher than the cost of ending inventory under varibale costing by 1. an amount equal to the fixed overhead cost per unit. 2. an amount computed by multiplying the units in the ending inventory by the fixed costs per unit. 3. an amount equal to the difference in the income amounts under both costing methods. 4. the amount equal to the fixed overhead cost charged to expense during the period.arrow_forwardWhich of the following statements correctly complete the sentence:"Gross Margin equals":I. sales revenue less (minus) cost of goods sold.II. contribution margin less (minus) fixed costs.III. operating income plus all period costs.IV. sales revenue less (minus) cost of goods manufactured.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education