FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

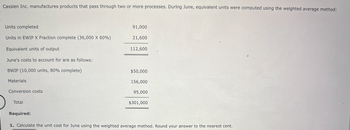

Question

Transcribed Image Text:Cassien Inc. manufactures products that pass through two or more processes. During June, equivalent units were computed using the weighted average method:

Units completed

Units in EWIP X Fraction complete (36,000 X 60%)

Equivalent units of output

June's costs to account for are as follows:

BWIP (10,000 units, 80% complete)

Materials

Conversion costs

Total

Required:

91,000

21,600

112,600

$50,000

156,000

95,000

$301,000

1. Calculate the unit cost for June using the weighted average method. Round your answer to the nearest cent.

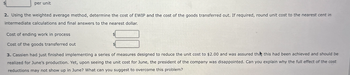

Transcribed Image Text:per unit

2. Using the weighted average method, determine the cost of EWIP and the cost of the goods transferred out. If required, round unit cost to the nearest cent in

intermediate calculations and final answers to the nearest dollar.

Cost of ending work in process

Cost of the goods transferred out

3. Cassien had just finished implementing a series of measures designed to reduce the unit cost to $2.00 and was assured that this had been achieved and should be

realized for June's production. Yet, upon seeing the unit cost for June, the president of the company was disappointed. Can you explain why the full effect of the cost

reductions may not show up in June? What can you suggest to overcome this problem?

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Spartans Inc. has the following Standard Cost Card: per unit per year Price $21.00 Direct Materials $6.00 Direct Labor $1.80 Var. MOH $0.80 Fixed MOH $36,000 Selling $2.00 Administrative $60,000 1. What is the contribution margin per unit? $8.60, $2.99, $7.59, $10.60, or $4.99 2. What is the contribution margin ratio? 0.3672, 0.6328, 0.7800, 0.2200, or 0.4415 3. Based on your answer from (b), how much of every $1.00 of sales represents variable costs? 4. If direct labor costs increase by $1.00, how will that affect the contribution margin?arrow_forwardPrearcan CVBA's income statement shows the following: Sales Revenue: $9,121,000 Variable Costs: 4,797,000 Fixed Costs: 3,946,000 If unit sales were 5,000, the contribution margin per unit to the nearest cent is : $arrow_forwardNeed all answeredarrow_forward

- Hanshabenarrow_forwardRequired: 1. A partially completed schedule of the company's total and per unit costs over the relevant range of 51,000 to 91,000 units produced and sold annually is given below: Complete the schedule of the company's total and unit costs. Round the variable cost and fixed cost to 2 decimal places.) Units Produced and Sold 51,000 71,000 91,000 Total costs: Variable costs $ 168,300 Fixed costs 400,000 Total costs $ 568,300 Cost per unit: Variable cost Fixed cost Total cost per unitarrow_forwardGiven the cost formula, Y = $16,000+ $3.40x, total cost for an activity level of 4,000 units would be: A. $13,600 OB. $3,600 C. $29,600 O D. $16,000arrow_forward

- hrd.2arrow_forwardOslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales $ 50,000 Variable expenses 27,500 Contribution margin 22,500 Fixed expenses 14,850 Net operating income $ 7,650 Required: 1. What is the contribution margin per unit? (Round your answer to 2 decimal places.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education